Stock-Market Rally Costs Bears $120 Billion

Investors have been ramping up bets against stocks—and they are getting burned. Total short interest in the U.S. market topped $1 trillion this month, hitting the highest level since April 2022, according to data from S3 Partners. That is up from $863 billion at the start of the year and represents about 5% of all shares that are available to trade.

Short sellers borrow shares and then sell them, hoping to buy them back at a lower price later and pocket the difference. They have added to their bearish wagers in recent weeks, while the S&P 500 climbed to a 14-month high. The index is up 14% in 2023 and 5% in June alone. That rally has been punishing: Short sellers have incurred roughly $120 billion in mark-to-market losses this year, including $72 billion in the first half of June, according to S3. The bearish bets, the most of which are made by hedge funds and other institutional investors, reflect their unease about the market rally. A lack of breadth, stretched valuations and the potential for further interest-rate increases from the Federal Reserve are among their chief concerns.

“There are still many investors and hedge funds who think that this rally is ready for a pullback,” said Ihor Dusaniwsky, managing director of predictive analytics at S3. “Or at least that several of the highflying stocks will lose steam and revert back to the mean.”

Another driver of the increased short selling: hedge funds that are adding leverage after coming into the year positioned defensively. “Hedge funds are increasing their market exposure, adding to both their long and short holdings, looking to play catch-up after missing some of the early year rally,” said Dusaniwsky.

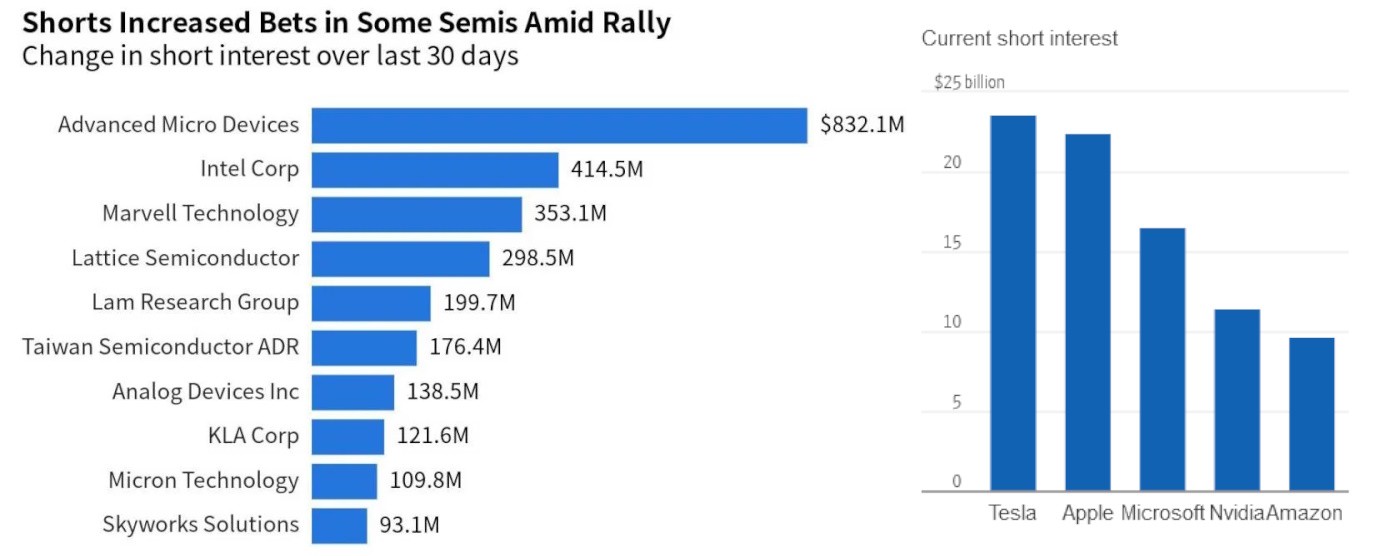

The list of companies with the biggest short positions is a who’s who of the market’s hottest stocks this year: Tesla, Apple, Microsoft, Nvidia and Amazon.com. Tesla overtook Apple for the top spot on June 8. Of the five, it has by far the highest short interest as a percentage of available shares, at 3.3%. Tesla shares have more than doubled in 2023, while Nvidia’s have nearly tripled. The other three stocks are up at least 40%. Together, big-tech stocks are responsible for almost all of the S&P 500’s gains.

Investors shorting Elon Musk’s electric-vehicle maker are down about 78%, or $12.4 billion, this year, according to S3. Those betting against Nvidia shares are down 105%. The potential loss on a short sale is unlimited, since the shares need to be repurchased and returned eventually. The most popular short trades have inflicted outsize losses on investors: A Goldman Sachs Group index tracking the 50 most-shorted stocks in the Russell 2000 has advanced 20% this year, outpacing the S&P 500.

More pain could be on the way. Analysts note that many institutions are boosting their stock-market exposure, propelling a hot stretch for equities in which the S&P 500 has advanced in nine of the past 13 sessions. “Investors have been cautiously positioned really since last summer, in anticipation of this recession that has yet to materialize,” said Jason Draho, head of asset allocation Americas at UBS Global Wealth Management. “The more the market goes up, the more I think those who are on the sidelines have to figure out how to get back in.”

Increasingly, investors are using exchange-traded funds to bet against the market. Because it is easy to create new shares in ETFs to meet demand, the shares are typically easy to source, making the fee to borrow them low. Investors were shorting about $235 billion worth of ETFs at the end of May, according to S3. Not all shorts are outright bearish plays. Investors are often shorting ETFs to hedge their exposure to a sector that has several individual stocks they might like, said Rich Lee, head of program and ETF trading at Robert W. Baird.

And some of the popular ETF short trades have looked more like long positions in practice. Two of the three most profitable on a percentage-gain basis in May were investors shorting inverse ETFs, or those that seek to provide the opposite return of their underlying assets. An investor can theoretically outperform a benchmark by shorting an inverse ETF that tracks it, taking advantage of the tracking error that causes an inverse ETF to drop by more than the percentage that the asset it tracks rises.

Betting against the ProShares Ultrapro Short QQQ ETF, which aims to provide three times the opposite return of the Nasdaq-100 Index, has grown in popularity. The inverse ETF amassed $609 million of short interest as of the end of May, per S3. Similar wagers against the smaller Direxion Daily Semiconductor Bear 3X ETF are also prevalent.

As U.S. stocks keep rallying and losses among short sellers grow, professional investors have been left increasingly perplexed. “The stock market, frankly, is exhibiting signs of a mania,” DoubleLine Capital founder and CEO Jeffrey Gundlach said on CNBC Wednesday. “This is feeling a lot like the lead-up to January 4, 2022. There were a lot of shorts, there was a lot of pessimism, and then you had the kind of retracement that one would expect.”