Groundhog Day All Over Again: Futures Surge On “Greek Hope”, China Stock Manipulation

It’s officially Groundhog day… and month… and year… and so on.

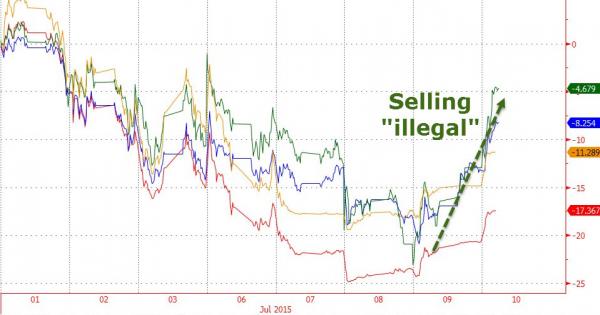

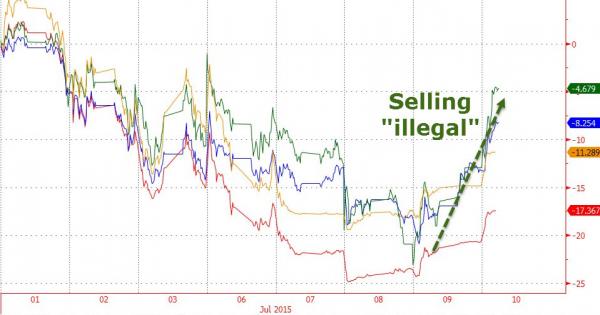

After futures soared yesterday morning following the Chinese government’s halt of the local stock bloodbath, only to fade the euphoria late in the day on Greek concerns and the realization that threatening Chinese sellers with arrest…

… outlawing short selling, while keeping half your stocks frozen (those which would be otherwise sold) and implementing nearly 20 different official measures to halt the market plunge…

… is hardly a basis for bullish sentiment, this morning we again wake up to futures surging about 1% higher, with HFTs taking out all the stops overnight, and with even more Chinese intervention as the local police instead of just threatening have actually started cracking down on sellers and “rumor spreaders.”

As a result, after brief early weakness, the Chinese market soared out of the gate rising above 5% before seeing some late session selling to close up 4.5%, up 10% in the past two days, the biggest 2-day surge in Chinese stocks since 2008.

Still, even as half the Chinese stock market has rebounded strongly the other half remains stuck in time at days-old prices, leading some to invoke jokes about a Schrodingerian market: is China up or frozen? It depends which half you look at. Of the roughly 2,800 stocks listed on the Shanghai and Shenzhen markets, half were suspended from trading as of Friday morning. On the ChiNext, a Nasdaq-like board of small-cap stocks, the count was 205 trading, 279 suspended.

Of course, what the suspended companies are waiting for is simple: a return of the market euphoria – with the market rising, more than 60 companies said their trading would resume Friday. As the WSJ reports, they may have been hoping to replicate the experience of the likes of Hangzhou Iron & Steel Co., Zhejiang Huahai Pharmaceutical Co. and Leshi Internet Information & Technology Corp. Beijing, all of which resumed trading on Thursday – and all of which saw their shares rise by the daily maximum 10% within 30 minutes. Because when it comes to making the same mistake over and over again, the Chinese have zero learning capacity.

But the key catalyst so far for US equity futures appears to be Greece, which as we reported last night submitted a proposal to the Eurogroup, one which is virtually a replica of the European proposal from June 26, subsequently rejected by over 60% of the Greek population on July 5. Now, 5 days later, the Greek parliament will vote on this proposal (which has no request for a debt haircut, and which makes a lot of promises and no actual spending cuts) even as the “Oxi” vote supporters meet in front of parliament for a previously scheduled demonstration.

One wonders what the mood will be among the nearly two-thirds of the Greek population once it realizes it has been sold down the river by its government once again, and this time with a referendum vote to back it. Surely the release of some €120 billion in deposits, if only briefly, from the hostage clutches of the ECB will ease the pain, although don’t hope the Greek bank run will go away even if the ECB boosts Greek ELA. Having seen what happens to their deposits in the worst case, no Greek in their right mind will keep their money in the bank ever again.

Another problem for Tsipras will be his own party: he appealed to his party’s lawmakers on Friday to back a tough reforms package after abruptly offering last-minute concessions to try to save the country from financial meltdown. After walking into a party meeting to applause, Tsipras rallied his Syriza lawmakers to throw their weight behind the new proposals ahead of a snap vote in parliament on the negotiations, urging them to help keep Greece in the euro. Cited by Reuters, Tsipras said that “we are confronted with crucial decisions.” Which was also the case two weeks ago when Tsipras called the referendum he had hoped to lose.

“We got a mandate to bring a better deal than the ultimatum that the Eurogroup gave us, but certainly not given a mandate to take Greece out of the eurozone, he said. “We are all in this together.”

As of this moment it is unclear whether all the creditors would back the latest reforms package, which was “strikingly similar” to the terms Greece had rejected in a referendum that Tsipras had called in June. Finance ministers of the 19-nation euro area will meet on Saturday to decide whether to recommend opening negotiations on a third bailout program for Athens despite widespread exasperation at the five-year-old Greek debt crisis. Worse, any new deal would also have to be endorsed by national parliaments including in Germany.

Has Germany finally had enough may be the question. For now the market’s answer is no, judging by the surge, but this won’t be the first (or second, or hundredth) time that the algos have been fooled by the endless game between Greece and Germany, now in its fifth year, that the former is solvent, and that the letter still has a European monetary union to look for in the future. Both have now been revealed as utter shams.

So expect many more “Greek hope” headlines, rumors, and denials all day as is now the norm, and into the weekend, another weekend ruined by the Greek fiasco, with the Eurogroup meeting at 9am Eastern followed by the Summit of 28 European Union nations on Sunday.

* * *

A closer look at stock markets reveals that Asian equities rose as sentiment was bolstered after Greece submitted proposals similar to reforms sent by its EU creditors last month . Chinese stocks continued their recovery with the Shanghai Comp (+4.5%) sees its largest 2-day gaining streak since 2008 as aggressive measures supported the nations markets . Nikkei 225 (-0.4% ) was weighed on by weakness in index giant Fast Retailing, however the index pared losses amid an optimistic tone in Asia and continued recovery in Chinese stocks. Finally, JGBs fell amid spill over selling in USTs, although pulled off worse levels BoJ conducted its large bond purchase program.

In Europe, equities (Euro Stoxx: +2.9%) have spent the morning firmly in the green amid hope of a Greek deal, seeing financials outperform. Elsewhere, energy names have underperformed their counterparts, which comes in tandem with a move lower in the energy complex this morning after the !EA forecast that oil may see a further drop in price prior to a slowdown in supply growth forecast for 2016.

Fixed income markets have taken a leg lower this morning amid the aforementioned hope of a Greek proposal, with Bund Sep’15 futures lower by over 90 ticks. Today has been touted as an opportune time to come to market for US corporate issuance as T-Notes trend lower and with the key Greek risk event occuring over the weekend, Fed’s Yellen due to speak later in the day and Chinese equities ending their session in positive territory. Fixed income markets have recently seen a backlog in corporate issuance as many choose to hold off due to risk-off sentiment amid the current spate of risk events.

After a couple of days out of the limelight while Chinese equities took center stage, Greece as now back firmly in focus this morning after submitting their written proposals to creditors overnight. The Greek proposals are reportedly very similar to the offer they received on June 26th, which was later voted on and rejected by the public, with this suggesting that the offer may be seen as more acceptable to creditors than previous negotiations from Greece as France’s EU Affairs Minister stated that the newly submitted proposals from Greece are ‘credible and serious.’

Of note EU’s Dijsselbloem has said that an outcome of the Greek proposal may be presented today and EU sources have said that IMF’s Lafarge, EU’s Juncker, ECB’s Draghi and Eurogroup Dijsselbloem are to have a meeting on Greece at 1200BST/0600CDT

This has seen sentiment bolstered, with EUR/USD retaking the 1.1100 handle to the upside to reside firmly in the green (+122 pips), while JPY has continued to weak today as risk-on sentiment returns to the market . As such, USD/JPY is now firmly above the 6 week lows seen earlier in the week as the pair resides above the 122.00 handle (+83 pips). Despite USD/JPY strength, the USD index resides in negative territory (-0.6%) weighed on by the aforementioned EUR strength. Meanwhile, GBP/USD (+116 pips) is also stronger in tandem with the EUR as large hedge funds are said to be on the bid in the pair.

The metals complex sees gold head into the weekend firmly above its 4 month lows after the greenback weakened overnight as the continued recovery of Chinese stocks lift sentiment in the Asia-Pacific region.

Elsewhere, copper trades higher amid a softer USD and mainland China posting its largest 2 day intraday climb since 2008, while Dalian iron ore futures trades higher but is on course for the largest weekly drop since 2013 of 11%, following the oversupply of the industrial mineral. In the energy complex, the aforementioned IEA forecast has seen both WTI and Brent crude futures come off their earlier highs, to trade in modest positive territory after bolstered Chinese sentiment saw strength in the commodities overnight.

Looking ahead, this afternoon sees Canadian unemployment rate, US crop report and comments from Fed’s Rosengren and Yellen.

Bulletin Headline Summary From Bloomberg and RanSquawk

- Greece hand over proposals to creditors, leading to positive sentiment and gains across the board in European equities as well as strength in EUR.

- Shanghai Comp sees its largest 2-day gaining streak since 2008 as aggressive measures supported the index.

- Looking ahead, this afternoon sees Canadian unemployment rate, US crop report and comments from Fed’s Rosengren and Yellen, with further developments in the Greek saga also a possibility.

- Treasuries fall, paring weekly gains, after

Greece late yesterday proposed measures in return for a EU53.5b

bailout; France praised the package while Germany reserved

judgement. - Reforms will be presented in Greek Parliament today, euro region officials will meet Sunday to discuss

- Package almost mirrored that from creditors on June 26, which was rejected by Greek voters in a July 5 referendum

- As program request would last a number of years, it would have to go beyond what was discussed two weeks ago with tougher conditions, a German government official said

- While Greek proposals should be enough to start conversation, they are generally no tougher than what was on table in June, Teneo Intelligence says; “given respective comments from German Chancellor Angela Merkel this week, hardliners will likely demand additional measures”

- Chinese stocks rose, with the Shanghai Composite gaining 4.5%, adding to Thursday’s 5.8% surge; with more than 1,300 companies still halted on mainland exchanges, trading was limited to 53% of the market

- Official measures to support shares this week include a ban on stockholders and executives from selling stakes in listed companies for six months, an order for companies to buy equities and an investigation by the nation’s public security bureau into short-selling

- Some of the chief beneficiaries of Obama’s proposed trade deal may be big drug companies like Novartis AG, Roche Holding AG, and Pfizer Inc. while the losers could be consumers in both the U.S. and the region

- Sovereign 10Y bond yields lower; Greek 10Y yield -471bp to 14.085%. Asian and European stocks, U.S. equity-index futures fall. Crude oil and gold higher, copper falls

US Event Calendar

- 10:00am: Wholesale Inventories, May, est. 0.3% (prior 0.4%); Wholesale Sales, May, est. 0.9% (prior 1.6%)

- 11:35am: Fed’s Rosengren speaks at Lake Victor, Idaho

- 12:30pm: Fed’s Yellen speaks in Cleveland

DB’s Jim Reid completes the overnight recap

Hope has broken out overnight. Although the midnight deadline was tested, the Greek proposals are in, with the Creditors and show some meaningful concessions. The ball now flips back into the European’s court and we await their feedback. In the meantime, a Greek parliamentary meeting is underway now with a vote seeking to authorise a negotiation with the Creditors. DB’s George Saravelos notes that this is an interesting political move given the parliament meeting is not being called upon to vote on the actual measures, rather just the mandate for negotiations.

In the meantime all the focus overnight has been on the actual substance of the proposals and whether or not we were going to see additional concessions made from the Greek side. The overall feeling on the wires appears to be one of Greece offering a package similar to the one offered by the Creditors on June 26th and one which does make additional significant concessions. George Saravelos echoes this view saying that the first read is that they are constructive and indicative of the government willingness to reach an agreement. George notes that the fiscal targets are the same as those published by the EC before talks broke down, while the proposed mix of fiscal consolidation has shifted away from tax increases to spending cuts as required by the Creditors. Pension cuts go deeper and VAT reform proposals are now very similar. There are still some important differences however, including delays to cuts in certain pension subsidies and weak language around labour market reforms.

So a tentative step in the right direction but given the back and forth nature of this saga the next 48 hours will be crucial ahead of Sunday’s summit. As well as the Greek parliament meeting this morning (which started at 6am BST), Greek finance minister Tsakalotos is due to fly to Brussels today to resume negotiations. A positive commitment at parliament clearly commits Greece ahead of time although if the Europeans demand additional changes it also gives Tsipras the option to reject. The timeline beyond today remains the same with a Eurogroup meeting scheduled for tomorrow before the summit on Sunday (due to start around 3pm BST). As we highlighted previously any deal still needs Bundestag ratification and will likely be time consuming (in which case some sort of short-term financing will be needed) so the calendar beyond Sunday is ultimately still to be decided by how this weekend plays out.

Elsewhere it was interesting to see some of the rhetoric out of European officials yesterday prior to the news of the proposals being handed in. In particular it was the chatter around debt sustainability which appeared to be more hotly debated and which echoed previous comments from the IMF’s Lagarde. In particular, EU President Tusk said that ‘the realistic proposal from Greece will have to be matched by an equally realistic proposal on debt sustainability from the creditors’. EC Vice-President Dombrovskis also said that debt relief would be needed, although there were slightly more mixed comments from German Finance Minister Schaeuble who said that ‘debt sustainability is not feasible without a haircut and I think the IMF is correct in saying that’, but also saying that there was limited scope for ‘re-profiling’ Greek debt. So all eyes again turn to the European response in what’s set to be another very busy and crucial weekend.

The Greece proposals and another decent rebound in Chinese equity markets have lifted sentiment across Asia this morning. With over 1300 companies still suspended from trading, the Shanghai Comp (+5.16%), Shenzhen (+4.00%) and CSI 300 (+5.79%) have all seen the rally extend for another day with the Shanghai Comp currently on course for its biggest two-day gains since 2008. There are also gains elsewhere for the Nikkei (+0.69%), Hang Seng (+2.12%) and ASX (+0.44%) with the generally better tone. Sovereign bond yields have moved wider in the region while 10y Treasuries are 2.2bps higher at 2.343%. S&P 500 futures are pointing towards a 1% gain while the Euro is nearly a percent off the lows of last night’s session at $ 1.109. Credit markets in Asia (-3bps), Australia (-3.5bps) and Japan (-2bps) are also closing out the week on a more positive note.

Yesterday’s rebound in China lent itself to a better tone in markets generally yesterday. European equities rose for the second consecutive session with the Stoxx 600 (+2.19%), DAX (+2.32%) and CAC (+2.55%) all marching higher, while in the periphery the IBEX (+2.65%) and FTSE MIB (+3.51%) again led the gains. There was a better tone at the start of the US open too with the S&P 500 initially rising 1.4%, only to then trade with more caution as the session went on to finish +0.23% at the closing bell as utility stocks in particular dragged the index down. The risk-off tone saw 10y Treasury yields bounce off their recent lows to end +12.9bps higher at 2.322%, only the second session that yields have closed higher in July. 10y Bund yields also marched higher, ending +4.8bps at 0.717%. Meanwhile with Greek 10y (-125bps) yields taking a steep leg lower, yields in Italy (-4.4bps), Spain (-5.1bps) and Portugal (-11.1bps) all marched lower. In the commodity complex, oil markets had a better day with WTI (+2.19%) in particular bringing to an end 5 consecutive down days.

Away from Greece and China there was some focus on Fedspeak yesterday. The Kansas City Fed’s George reiterated her view that the Fed should raise rates ‘sooner rather than later’ and that keeping rates near zero is ‘risky in my view’. George also suggested that recent data is pointing to the economy generally moving in the right direction and that ‘waiting for more data before acting can be a trap’. This was in stark contrast to the more dovish Chicago Fed President Evans who said ‘I still have the first funds rate increase not taking place until 2016’ before then clarifying that that would be more sometime around mid next year. Evans, unlike Williams earlier this week also highlighted his concerns around Greece and China. Away from the Fedspeak, it was a quiet day data wise. Initial jobless claims printed weaker having rose 15k to 297k (vs. 275k expected) and to the highest level in four months, although remaining below 300k for the 18th consecutive week. There was some chatter about Independence Day distortions so we’ll see if the move is reversed next week. In the European timezone we saw the BoE keep rates on hold while in Germany the May trade balance saw a slight fall in the surplus to €19.5bn (vs. €20.5bn expected) from €21.8bn, although our colleagues in Europe noted that strong export numbers continue to point towards a positive net-export contribution to GDP growth after two previous negative prints.

Wrapping up yesterday’s events, with concerns around the weak start to the year in the US, the IMF cut their global growth forecast for 2015 to 3.3% (from the initial 3.5% forecast made in April). At the same time the fund left its forecast for 2016 unchanged at 3.8%. Despite much of the downward revision being driven by the US, the fund did also acknowledged the recent turmoil in Chinese stocks and ongoing tensions with regards to Greece as causes for concern.

The obvious focus in the day ahead will be on Greece, starting with the Greek parliament meeting this morning. Away from those events, French industrial and manufacturing production is due this morning along with UK trade data and construction output. With just wholesale inventories and trade sales due in the US this afternoon, there’s likely to be plenty of focus on the Fed’s Yellen who is due to speak on the US economic outlook in Cleveland, while the Fed’s Rosengren is also due to speak today. Then as we move into the weekend Sunday sees the historic EU summit that has been billed as the make or break moment for Greece’s Euro membership.