| Symbol | Last | Change | % | High | Low |

|---|---|---|---|---|---|

| CAC 40 – FRANCE | 7,822.67 | +0.67 | +0.01% | 7,873.05 | 7,815.30 |

| Close | France Time : Mon Jul 21 2025 04:57 | ||||

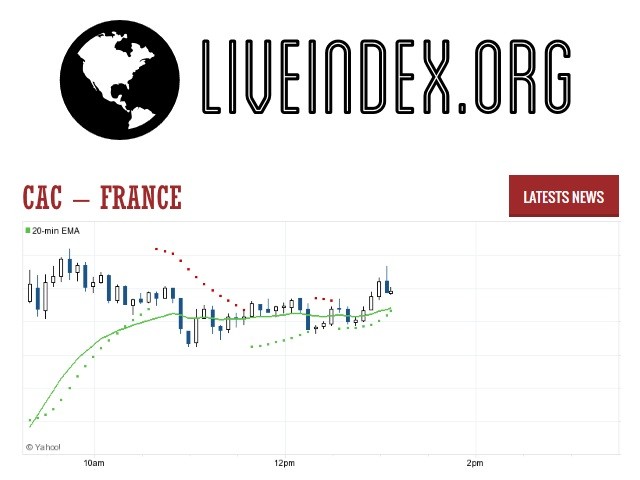

CAC 40 : Intraday Live Chart

CAC 40 : Technical Signal Buy & Sell

| 5 Min Signal | 1 Hour Signal | 1 Day Signal |

|---|---|---|

| Sell | Buy | Buy |

CAC 40 : Moving Averages

| Period | MA 20 | MA 50 | MA 100 |

|---|---|---|---|

| 5 Minutes | 7822.67 | 7824.60 | 7831.20 |

| 1 Hour | 7830.84 | 7826.04 | 7806.00 |

| 1 Day | 7774.07 | 7729.59 | 7675.95 |

| 1 Week | 7729.18 | 7615.12 | 7604.50 |

CAC 40 : Technical Resistance Level

| Resistance 1 - R1 | Resistance 2 - R2 | Resistance 3 - r3 |

|---|---|---|

| 7,882.25 | 7,915.76 | 7,940.32 |

CAC 40 : Technical Support Level

| Support 1 - S1 | Support 2 - S2 | Support 3 - S3 |

|---|---|---|

| 7,824.18 | 7,799.62 | 7,766.11 |

CAC 40 : Periodical High, Low & Average

| Period | High Change from Last | Low Change from Last | Average Change from Last |

|---|---|---|---|

| 1 Week | 7,873.30 -50.63 | 7,722.09 +100.58 | 7,798.07 +24.60 |

| 1 Month | 7,940.62 -117.95 | 7,505.27 +317.40 | 7,725.95 +96.72 |

| 3 Month | 7,955.53 -132.86 | 7,218.30 +604.37 | 7,723.90 +98.77 |

| 6 Month | 8,257.88 -435.21 | 6,763.76 +1,058.91 | 7,793.52 +29.15 |

| 1 Year | 8,257.88 -435.21 | 6,763.76 +1,058.91 | 7,612.57 +210.10 |

CAC 40 : Historical Chart

CAC or CAC 40

CAC 40 is also called Citation Assistee Continu. This is a large benchmark French Stock Market Index. This index represents data which is based on capitalization-weighted method. Among the 100 highest market caps on the Euronext Paris this method measure 40 most significant values. The index represents a capitalization-weighted measure of the 40 most significant values among the 100 highest market caps on the Paris Bourse (now Euronext Paris). This index is used as a benchmark for the investor who wants to invest in the Paris Bourse and also used for the purpose of benchmarking France economy. CAC 40 is similar to Dow Jones Industrial Average which is another index working in the United States. But one of its features is different from Dow Jones Industrial Average which is it only contains 40 top listed companies whereas Dow Jones Industrial Average contains 100 top rated companies. This is one of the main national indices Pan-European stock exchange group. The name of this index is derived from Paris Bourse. On 31, December 1987 its base value is set as 1000 which is at that time equivalent to the market capitalization of 470,433,957 French francs. In 2000 during dot-com bubble this index reached the peak value of 6923 which is high from the creation of this index to till now.

After all on 1, December 2003 the index weight-capitalization system is switched to total market capitalization to free float market cap only. This index is also in line with other leading and related indices. Also, there is another index available which is called CAC Small. Actually, CAC small is a stock market index which is used by Paris Bourse. So if any company is included in the CAC Index . The main benefit is that this will improve the profile of the company and also improves the visibility of company against international investors. In other words, this also increases demand for a stock because the manager of large companies or investors adjusts their portfolios for the purpose of reflecting index new composition.

History of CAC 40

CAC 40 Index was created on 31, December 1987 and when it begins to start working the base value was set to 1000.In September 2000, CAC 40 Index reached his highest ever value which is 6822.This value is all-time high value and this company never got this value before 2000 or after 2000.In whole 2015 the closing stock is about 4000 and in this whole years closing value never reached 5000 and also never decline to a range of 3000.But 2016 is not a good year for the index the closing value is decline to 3898.This is something about closing stock of the index but on the other hand, on 1, December 2003 the index weight-capitalization system is switched to total market capitalization system.

Selection by CAC 40

Index Steering Committee is working independently which is use to review CAC 40 Index composition. After the review meeting if any changes are made they are affected in minimum 2 or 3 weeks. Companies listed on Euronext Paris are ranked on the basis of free float market capitalization at each review date. When companies are ranked according to free float market capitalization then these companies share turn over the prior 12 months. After the ranking of companies from top 100 companies 40, best companies are included in CAC 40 because it is the relevant benchmarking for the purpose of portfolio management. If a company has more than one type of shares traded in the exchange then in this case only the most actively traded shares are added to the index. Generally, the shares added to the index are Ordinary Shares.

Weighting in CAC 40

The index of CAC 40 is based on Capitalization-Weighted index. This index is different from Dow Jones Industrial Average because Dow Jones Industrial Average based on Price weighted index whereas on the other hand CAC 40 based on other method which is Capitalization-Weighted Index. The Number of shares which are issued by the company is reviewed on the quarterly bases such as on the first Friday of March, June, September and December. Since December 2003 at each index review, the index weighting of companies which are listed in the index capped at 15%.The one and only purpose of a capping factor are to limit the weights to 15% and this will review annually by the committee which is called index steering committee.

Share Holders in CAC 40

Although CAC 40 is exclusively composed of companies which were based on French-Domiciled. But more than 45% shared are purchased by foreign investors. The shares purchased by foreign investors are more than any other main European Index. Significant shareholders of CAC 40 are investors from Germany, Japan and other European Countries. First of all 100 high standing companies are selected by the index and after all from these 100 these only select and include 40 companies in his index. So due to these reasons, there are more chances for the international or multinational companies to be included in CAC 40 index and that’s why many foreign companies are also included in this index. The companies which are included in the index of CAC 40 conduct two-third of their business outside France.

Composition in CAC 40

This index is consists of only 40 companies. The last effective update is recorded on 19, December 2011.Here is the list of 5 companies which are on the top of this index.

- Accor – This company is also known as Accor S.A and it is a French hotel group. This company is also a part of CAC 40 index. Accor belongs to Hotel sectors having the ticker symbol of AC.

- Air Liquide – Air Liquide is another company which is also a part of CAC 40 index, belongs to Commodity Chemicals sector having the ticker symbol of AL.

- Alcatel-Lucent – This company is placed at the 3rd number of CAC 40 index. This is a telecommunication company having the Ticker symbol of ALU.

- Airbus Group – Airbus group is also a part of CAC 40 index and placed at 4th number in the index. This is an aerospace company having the ticker symbol of AIR.

- Alstom – Alstom is also a part of CAC 40 index, placed at 5th number in the index. Alstom is industrial machinery company having the ticker symbol of ALO.

CAC - CAC 40 Index | CAC 40 Live Quotes | France Index

Live Price of CAC. CAC Live Chart, CAC Intraday & Historical Live Chart. CAC Buy Sell Signal, CAC News, CAC Videos, CAC Averages, Returns & Historical Data

» CAC

» CAC Real Time Quotes

» CAC Live Chart

» CAC Intraday Chart

» CAC Historical Chart

» CAC Buy Sell Signal

» CAC News

» CAC Videos

» CAC Averages

» CAC Returns

» CAC Historical Data