Trump Hits China Harder While Pausing “Reciprocal” Tariffs

In a surprising turn of events, President Trump has rescinded his significant tariffs on nearly 100 countries, which had been implemented mere hours prior. This unexpected decision led to a surge in stock prices, even as the President concurrently declared an increase in tariffs on Chinese imports to 125%. On Wednesday, Trump announced that his baseline tariff of 10% on nearly all imports will remain in place. He has instituted a 90-day suspension for the elevated reciprocal rates previously announced for countries deemed “bad actors” in trade, with the exception of China. In a midday update on social media, Trump announced a significant increase in the tariff on China, raising it to 125%, with the new rate taking effect immediately.

A government representative announced that Canada and Mexico will continue to be exempt, at least for the time being, from the 10% baseline global tariff. As discussions continue regarding the potential implementation of 25% tariffs on a majority of imports from neighboring countries, the rationale provided by Trump centers on their alleged contribution to the fentanyl crisis. Notably, an exemption remains for automobiles and various other products that adhere to the stipulations of the U.S.-Mexico-Canada trade agreement.Trump announced a decision to suspend the majority of his reciprocal-tariff program, citing increasing worries regarding the economic landscape. “They were getting yippy,” Trump stated in response to inquiries regarding his decision to implement the temporary rollback. “There was a noticeable increase in anxiety and apprehension among them.”

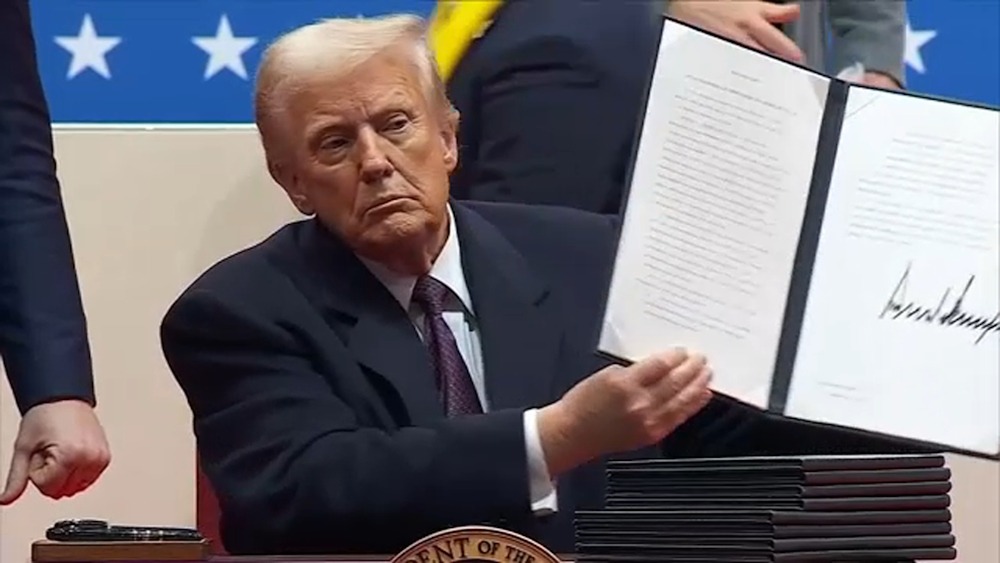

The recent development initiates a 90-day period during which trading partners can propose agreements to President Trump aimed at lowering their tariffs. President Trump executed a series of executive orders in the Oval Office, accompanied by a number of officials. “Nothing is over yet,” Trump stated, emphasizing the necessity for someone to undertake the actions he implemented to realign global trade to benefit the United States. Numerous countries have stepped up to engage in agreements with the United States, with China being among them. “China is eager to negotiate,” stated Trump, noting that the Chinese are a proud nation and are currently assessing ways to reach an agreement with the United States.

The unexpected decision to reverse tariffs has taken even some of Trump’s closest allies by surprise. “It was a significant surprise to many,” remarked Sen. Jim Justice (R., W. Va.), a longtime ally of Trump, further stating, “I appreciate the impact it has had on Wall Street.” Several members of the Democratic Party have expressed concerns regarding the swift changes in U.S. policy. Senator Adam Schiff (D., Calif.) commented on X that President Trump is inducing significant market volatility through his inconsistent approach to tariffs. “The ongoing fluctuations in policy create significant risks for insider trading activities.” Questions arise regarding which members of the administration were informed about Trump’s recent tariff reversal prior to its announcement. Were there any transactions involving stock purchases or sales that resulted in profits at the expense of the public?

President Trump, known for his keen interest in cable news, informed reporters that he tuned in to JPMorgan Chase CEO Jamie Dimon’s interview on Fox Business earlier this Wednesday morning. In a recent interview, Dimon indicated that a recession could be a “likely outcome” of the newly implemented tariffs, while also advocating for tariffs as a mechanism to enhance trade. He called on Trump to allow Treasury Secretary Scott Bessent the necessary time to negotiate deals. “I’m adopting a measured perspective, although the situation has the potential to deteriorate,” Dimon stated.On Wednesday morning, Trump took to Truth Social to declare, “THIS IS A GREAT TIME TO BUY!!!”

The sudden shift was met with enthusiasm by a majority of Senate Republicans, many of whom were attending a caucus luncheon at the time Trump revealed the pause. Senator James Lankford (R., Okla.) reported a favorable response in the room, stating that the pause “sounds like good news to me.” Following the recent decision, several Republican senators indicated that the initial strategy involved imposing tariffs only to subsequently retract them. Senator Bernie Moreno (R., Ohio) praised the president, stating, “The president is a master negotiator.”

However, certain prominent critics of Trump’s tariffs expressed skepticism. “I’m not certain this was thoroughly planned,” remarked Senator Thom Tillis, a Republican from North Carolina. “It remains unclear whether this was a strategic decision outlined in the playbook or a spontaneous reaction.” The unexpected tariff shift caught the attention of U.S. Trade Representative Jamieson Greer, who was providing testimony before the House Ways and Means Committee at the time President Trump made the announcement via social media. Members of the committee representing the Democratic Party pressed Greer on whether he had prior knowledge of the shift and, if that was the case, why he failed to disclose this information during his extensive testimony.

Greer acknowledged being informed about ongoing discussions regarding a potential tariff pause but refrained from providing further details about his conversations with the president or other cabinet members. Senator Bill Hagerty, a Republican from Tennessee and a staunch ally of former President Trump, reported that he met with trade official Greer on Wednesday morning. Notably, Greer did not discuss any intentions regarding a pause on tariffs. Hagerty emphasized that he viewed this as commendable, indicating that Greer was prudent in not wanting to preempt the president’s decisions.

At the market’s close, the Nasdaq surged by 12%, while the S&P 500 gained 9.5%. The Dow Jones Industrial Average also saw a significant increase, rising by 7.9%, which translates to an impressive 2,962 points. On Wednesday, Trump indicated that he is closely monitoring the bond market while deliberating on the decision to pause the reciprocal tariffs. “The bond market is currently performing exceptionally well,” Trump stated during a press briefing at the White House. “Reports indicate that individuals experienced some discomfort last night.”

The announcement by Trump regarding the delay of tariffs has significantly disrupted the bond market. Longer-term yields, previously on the rise due to widespread concerns regarding the implications of tariffs, experienced a decline following his announcement. Yields on short-term notes, previously stable, surged significantly, indicating a notable drop in bond prices. Lawmakers, including Tillis, received the announcement with optimism. “An examination of Treasury yields reveals…”Tillis remarked that the situation was not progressing positively, indicating that various factors could have converged to result in a notably unfavorable outcome.

Hagerty, who played a pivotal role in negotiating a trade deal for Trump during his first term as ambassador to Japan, reported that numerous governments have expressed interest in establishing economic agreements with the president. According to Hagerty, Trump is expected to set a demanding standard for any potential agreements. He emphasized that foreign nations must be prepared to not only lower their tariffs but also eliminate non-tariff barriers to American products, commit to purchasing U.S. exports, and present strategies for investing in U.S. manufacturing.

Critics of Trump’s tariffs assert that U.S. businesses continue to face ongoing challenges. Experts indicate that ongoing uncertainty surrounding the tariff agenda is likely to hinder businesses from committing to long-term investments in new manufacturing facilities. “You’re certainly not in an environment where capital is going to be moving until this is settled,” stated Tillis, who emphasized that “smaller retailers are going to face significant stress until the situation with China is resolved.”