Ignore These 7 Questions If You Want to Lose Money

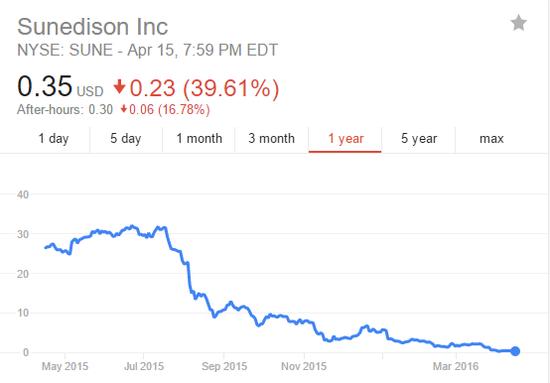

SunEdison (NYSE:SUNE) is down 92% year-to-date.

But what the heck happened? Isn’t clean energy the future?

Why would “investors” continue throwing money into a bonfire?

This is how shareholders have been rewarded.

The thing is, SunEdison doesn’t come close to passing the sniff test. You have to hold your nose from a mile away.

Look at these numbers for a sec.

Revenue vs Cash from Ops vs FCF | Source: Old School Value Online

Some immediate “house is burning down” signs that I see from the financials:

- From 2009 to 2014, revenues only increased a little more than 100%.

- Capex continued to escalate at a rate faster than it was generating sales.

- At the same time, cash from operations went for a dive.

- FCF took it one step further and went exponentially down.

- Warning! GuruFocus has detected 7 Warning Signs with SUNE. Click here to check it out.

- SUNE 15-Year Financial Data

- The intrinsic value of SUNE

- Peter Lynch Chart of SUNE

Just based on this simple data, it’s enough to run away.

But why did so many investors continue to throw their hard earned money into the fire? If the same investors used Warren Buffett’s advice to analyze the business as if they were buying the entire company or joining as partners, the final decision would be vastly different.

Basic checks further emphasize the need to run for your life.

SunEdison has no quality | Source: Old School Value Online

For every dollar of sales, SunEdison uses up $ 1.47 of FCF. For every dollar invested, it loses 24 cents.

Accounting quality is also poor.

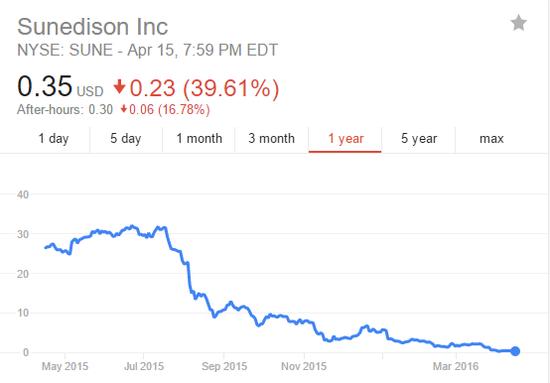

SunEdison has no value | Source: Old School Value Online

Constantly losing money makes it look cheap if you just look at Price to Book, but even the book value is sinking.

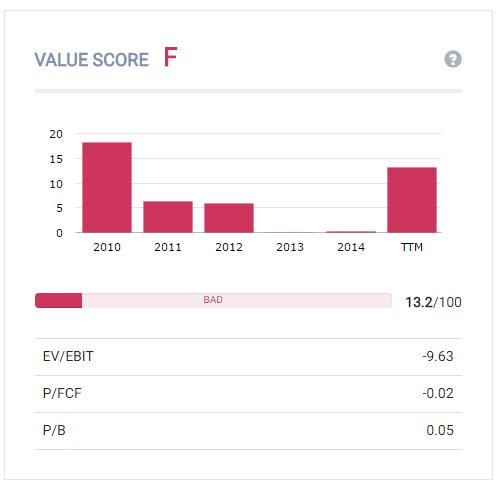

SunEdison has poor growth | Source: Old School Value Online

For an industry fueled by government subsidies and claims of world changing technology and the tailwinds of the green revolution, sales is ridiculously slow. The five-year CAGR is 16.5%. Tesla’s (NASDAQ:TSLA) five-year CAGR is 103%.

SunEdison also has an appalling 2% GPA. In simple terms, this means that only 2% of their assets are profitable.

Seven questions that will determine whether the business is a hero or a zero

But the point of this article isn’t to rehash what a horrible investment SunEdison is. It’s easy to point out what I’m seeing based on hindsight. But one man who knew this years before it happened is Peter Thiel (PayPal’s founder).

I finished his book the other day, “Zero to One,” and he specifically shows why industries like renewable energy and companies like SunEdison are horrible investments.

The book is based on Thiel’s experience as a tech VC, businessman and advice for startups, but it is eerily similar to reading a Buffett letter about making big bold concentrated bets and how to find one.

With this background, Thiel then provides seven qualitative questions that businesses (or investors in our case) must be able to answer before starting a business or investing in one.

Using some of this thoughts, here’s a look at why Peter Thiel believed that companies like SunEdison are inevitably bound to fail.

Be warned. Ignore these seven questions and you will lose money, just like investors in SunEdison.

I’ve adapted the seven questions to be investment related and included examples from the book where it made sense.

1. The engineering question: Does this company create breakthrough technology?

Thiel says that in order for a company to truly succeed, it has to produce something that is 10x better than its nearest competitor. It’s only when the product or technology is 10x better that the company will be able to extract huge value and all those future cash flows.

Companies must strive for the 10x better because merely incremental improvements often end up meaning no improvement at all for the end user.

Google’s (NASDAQ:GOOGL) search algorithm was 10x better than Yahoo (NASDAQ:YHOO) or Microsoft (NASDAQ:MSFT) in the late 1990s, which enabled them to leave the competition in the dust. Google did not invent the search engine, they just did it 10x better than anyone else and so all the others died.

Before Google dominated, I used AltaVista. One day they disappeared.

Apple’s (NASDAQ:AAPL) iPod, iPhone and iPad were 10x better than the products that came before it.

PayPal (NASDAQ:PYPL) was 10x better than sending checks to pay for eBay (NASDAQ:EBAY) items.

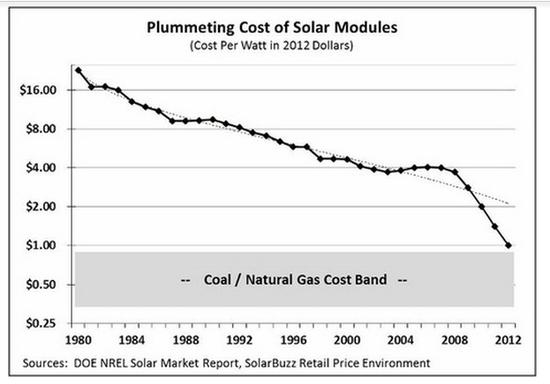

For solar and renewable energy, the question was whether it was going to be 10x better or cheaper than fossil fuels. Fracking and oversupply of oil has made this even more difficult.

Even if a new solar energy company came along and claimed that their technology was tested to be 30% more efficient than other renewable energy sources, does that make it an instant hit?

What about all the costs and real world issues that will eat away that 30% efficiency claim?

Although the cost of solar is going down and there are social benefits to using clean energy, will businesses and the average person want to spend an extra $ 1,000 to use solar energy when they can get the same much cheaper?

What type of breakthrough technology did SunEdison bring to the table?

None.

2. The timing question: Is now the right time for this business?

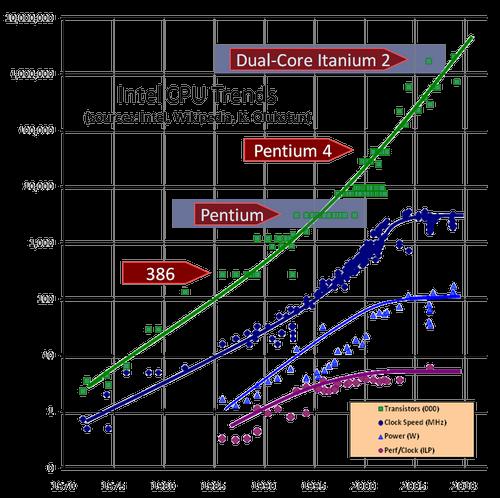

One of the legs that fueled the clean tech “bubble” was that companies like SunEdison compared itself to the boom of the silicon chip industry of the 1970s.

The problem was that it wasn’t anywhere close.

In the 70’s when Intel (NASDAQ:INTL) was pushing out exponential improvements in their processors and computing power was growing quicker year over year, solar wafer improvements crawled along in comparison.

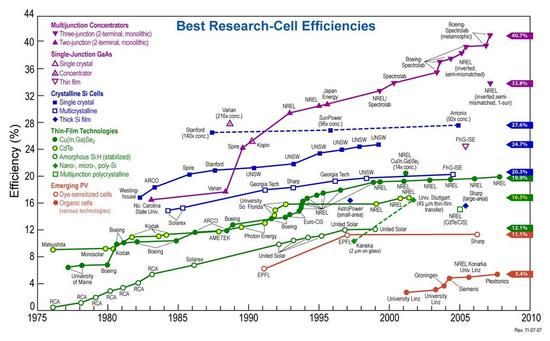

Even today, the highest efficiency percentage is 46% in a lab setting. In the real world, the best ones are in the 20s. The chart below is based on “research” inefficiencies. Not real world usage.

In over 30 years, it’s gone from 0% to 40%.

Infrastructure readiness, social norms, government regulations, established platforms and ecosystems all play a role in the timing question.

3. The monopoly question: Is the company a monopoly in a smaller market?

Like value investors, Thiel believes monopolies are a good thing and competition is bad.

The reason to search for monopolies is that it allows them to innovate and to continue growing. By conquering a small market to begin with, companies build cash flow and can therefore try radical things. It’s the same thing that Jeff Bezos said in his latest letter.

In business, every once in a while, when you step up to the plate, you can score 1,000 runs.

This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.

Our scale enables us to build services for customers that we could otherwise never even contemplate.

Amazon (NASDAQ:AMZN) didn’t become the powerhouse it is today by trying to do everything at once. They started by dominating the book market. Then they expanded horizontally, vertically and everywhere else. (Amazon Web Service, Lending, etc.).

Google owns the search space, but they don’t admit to being a monopoly. They are quick to point out that their business is also in the global advertising space, consume tech and online software business. While it may be true, it was dominance in search and online advertising that allowed them to move to Android, Google Glass, Google cars, Google Fiber and beyond.

Another interesting point is that monopolies don’t want to bring attention to their monopoly, while non-monopolistic businesses are quick to point out that they own the majority of their market by overly narrowing their market.

SunEdison’s CEO said that by 2020, the renewable-energy startup would be worth more than $ 350 billion. Some day it would be as big as Apple or Google.

But what if the CEO took a step back and looked at the competition and realized that it was just the renewable energy industry he was competing in, but against the global energy business.

In 2009, the global energy business was worth $ 5 trillion where $ 4.4 trillion came from coal, oil and natural gas. SunEdison’s ridiculous claim to be worth $ 350 billion is still a sliver of the market when you look at what it has to compete with.

4. The people question: Does the company have the right team?

With clean energy, you would expect to find engineers running the place. You would think engineers and nerds are pioneering new technology or working on being truly innovative.

When it came to clean tech companies, what Thiel saw was that many of the companies that pitched to him were led by people wearing suits.

Suits in a tech world meant bad sales people who weren’t engineers and it wasn’t a priority to create breakthrough technology (see #1).

The most obvious clue [to determine if you have the right people] was sartorial: clean-tech executives were running around wearing suits and ties. This was a huge red flag, because real technologists wear T-shirts and jeans. So we instituted a blanket rule: pass on any company whose founders dressed up for pitch meetings. There’s nothing wrong with a CEO who can sell, but if he actually looks like a salesman, he’s probably bad at sales and worse at tech.

Most investment books talk about investing alongside a shareholder friendly management. But the angle that Thiel brings to the table is that they also need to be experts in their field and addicted and infatuated with what they do.

In SunEdison’s case, the team was a mess.

Some acquisitions proceeded over objections from the senior executives who would manage them, said current and former employees. Managers in SunEdison’s international division last year lobbied against buying Mark Group, a small British home-rooftop solar company. The U.K. had too little sun and depended heavily on government subsidies, they argued.

Mr. Chatila didn’t budge. The deal was completed in July 2015, just before U.K. officials announced plans to slash solar subsidies. In October, SunEdison sold the insolvent business back to Mark’s management for an “immaterial” price. – source

5. The distribution question: Does the business execute on selling the product?

Cleantech companies effectively courted government and investors, but they often forgot about customers. They learned the hard way that the world is not a laboratory.

You see the same problem with SunEdison. Instead of knocking down doors or coming up with a distribution strategy, they were busy engaged in financial engineering to give off the perception of fast growth and moving horizontally before it even dominated its own market.

Tesla (NASDAQ:TSLA) is the total opposite as they place huge emphasis on marketing their products. They also own their entire distribution channel. By skipping dealerships and using a retail strategy, Tesla controls the message they want to send and they easily measure the pulse of the customer experience.

Nerds might wish that distribution could be ignored and salesmen banished to another planet. All of us want to believe that we make up our own minds, that sales doesn’t work on us. But it’s not true. Everybody has a product to sell— no matter whether you’re an employee, a founder, or an investor.

6. The durability question: Will the market position be defensible 10 and 20 years later?

Will this business still be around a decade from now? Numbers alone won’t tell you the answer; instead you must think critically about the qualitative characteristics of your business.

The numbers are clear about the condition of the company today, but will it be around in a decade?

I thought I was going through a value investing book because Thiel states that there are four main factors that need to be considered:

- Proprietary technology.

- Network effects.

- Economies of scale.

- Strong branding.

Companies like Google, Facebook, Twitter have these elements. Zynga and Groupon don’t.

With value investing you don’t bother trying to find the next Facebook, Microsoft of Apple. “Leave that to the growth investors,” I tell myself. “It’s better to focus on the stable proven companies.”

But Thiel makes an insightful point.

Every startup is small at the start. Every monopoly dominates a large share of its market. Therefore, every startup should start with a very small market. Always err on the side of starting too small. The reason is simple: it’s easier to dominate a small market than a large one… Being the first mover doesn’t do you any good if someone else comes along and unseats you. It’s much better to be the last mover—that is, to make the last great development in a specific market and enjoy years or even decades of monopoly profits. The way to do that is to dominate a small niche and scale up from there, toward your ambitious long-term vision…. ‘you must study the endgame before everything else.’

Renewable energy relies on government subsidies and backing, which is not a reliable business plan.

The industry also believed too much that fossil fuels were peaking and ignored the rise of fracking. China also came along and ruined the party by competing with U.S. companies at a fraction of the cost.

Does SunEdison own any of the four durability points?

No.

7. The secret question: Is there a unique opportunity that others don’t see?

Great companies have secrets: specific reasons for success that other people don’t see.

This last question is hard to apply to an investment because public companies are not startups.

Instead, ask whether the product or service the company offers is innovative and solves a problem or whether it is another commodity. Companies that are monopolies or own strong competitive advantages don’t compete for commodity products or services.

The common phrase from economics and capitalism is that “competition is good.” But in reality, “under perfect competition, in the long run no company makes an economic profit.”

Airline competition is great for consumers, but until the airline industry started consolidating and they came up with creative ways to charge the consumer for everything, profits didn’t exist.

Because of all the competition, making money was brutal.

In solar, there is no unique opportunity, just the creation of businesses based on the dogmatic idea that solar will work one day.

Summary

If you want to find and invest in stocks that have the potential to go up 10x or 100x, ask these qualitative questions while doing your due diligence.

I’ve gone through many checklists before, but this is a good and easy to understand all-in-one version.

Without it, you could end up like SunEdison investors.

The original seven questions from Zero to One.

- The Engineering Question: Can you create breakthrough technology instead of incremental improvements?

- The Timing Question: Is now the right time to start your particular business?

- The Monopoly Question: Are you starting with a big share of a small market?

- The People Question: Do you have the right team?

- The Distribution Question: Do you have a way to not just create but deliver your product?

- The Durability Question: Will your market position be defensible 10 and 20 years into the future?

- The Secret Question: Have you identified a unique opportunity that others don’t see?

The adapted investment versions:

- The Engineering Question: Does this company create breakthrough technology?

- The Timing Question: Is now the right time for this business?

- The Monopoly Question: Is the company a monopoly in a smaller market?

- The People Question: Does the company have the right team?

- The Distribution Question: Does the business execute on selling the product?

- The Durability Question: Will the market position be defensible 10 and 20 years later?

- The Secret Question: Is there a unique opportunity that others don’t see?