| Symbol | Last | Change | % | High | Low |

|---|---|---|---|---|---|

| USD / HKD | 7.8063 | -0.0146 | -0.19% | 7.8221 | 7.7994 |

| Open Last Trade : 18:51 | GMT Time : Tue Mar 03 2026 18:51 | ||||

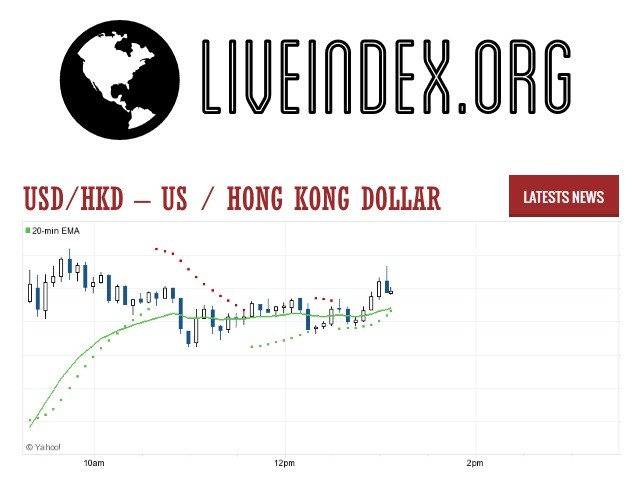

USD/HKD : Intraday Live Chart

USD/HKD : Technical Signal Buy & Sell

| 5 Min Signal | 1 Hour Signal | 1 Day Signal |

|---|---|---|

| Buy | Sell | Buy |

USD/HKD : Moving Averages

| Period | MA 20 | MA 50 | MA 100 |

|---|---|---|---|

| 5 Minutes | 7.80 | 7.80 | 7.80 |

| 1 Hour | 7.81 | 7.82 | 7.82 |

| 1 Day | 7.82 | 7.81 | 7.80 |

| 1 Week | 7.79 | 7.80 | 7.80 |

USD/HKD : Technical Resistance Level

| Resistance 1 - R1 | Resistance 2 - R2 | Resistance 3 - r3 |

|---|---|---|

| 7.8220 | 7.8225 | 7.8230 |

USD/HKD : Technical Support Level

| Support 1 - S1 | Support 2 - S2 | Support 3 - S3 |

|---|---|---|

| 7.8210 | 7.8205 | 7.8200 |

USD/HKD : Periodical High, Low & Average

| Period | High Change from Last | Low Change from Last | Average Change from Last |

|---|---|---|---|

| 1 Week | 7.8238 -0.0175 | 0.0000 +7.8063 | 7.8218 -0.0155 |

| 1 Month | 7.8238 -0.0175 | 0.0000 +7.8063 | 7.8167 -0.0104 |

| 3 Month | 7.8238 -0.0175 | 0.0000 +7.8063 | 7.7977 +0.0086 |

| 6 Month | 7.8238 -0.0175 | 0.0000 +7.8063 | 7.7880 +0.0183 |

| 1 Year | 7.8502 -0.0439 | 0.0000 +7.8063 | 7.8003 +0.0060 |

USD/HKD : Historical Chart

USD to HKD Exchange Rate History: Pegged Stability, Monetary Policy, and Global Influences

The USD to HKD exchange rate is one of the most stable and tightly regulated currency pairs globally, thanks to Hong Kong’s linked exchange rate system. Since 1983, the Hong Kong dollar (HKD) has been pegged to the U.S. dollar (USD) within a narrow band, creating a uniquely predictable market environment for traders, investors, and businesses operating in Asia.

Despite global market volatility, regional instability, and U.S. monetary policy changes, the USD/HKD pair has shown minimal fluctuation compared to other currency pairs. The fixed rate regime has shielded Hong Kong from excessive inflation and exchange rate risk but has also raised debates about monetary independence and alignment with the U.S. Federal Reserve.

1940s–1970s: Floating Beginnings and British Oversight

Before the formal peg, the HKD/USD rate was influenced heavily by colonial policy under British rule. In the 1940s, Hong Kong’s currency was initially tied to the pound sterling, not the U.S. dollar. However, the Bretton Woods system and Hong Kong’s increasing trade with the United States began to shift monetary attention toward the greenback.

During the 1950s and 1960s, the exchange rate floated based on market supply and demand. By 1972, the USD/HKD traded around 5.65, fluctuating due to political uncertainties in China and evolving trade dynamics.

The U.S. moved off the gold standard in 1971, and the Bretton Woods system collapsed. By the end of the 1970s, the HKD was significantly weaker, touching around 4.75–5.10/USD, due to inflation and currency speculation pressures.

1980s: The Birth of the Pegged Exchange Rate

A turning point came in October 1983, when Hong Kong’s currency peg to the U.S. dollar was introduced after a period of financial turmoil and speculative attacks. The political uncertainty following the Sino-British Joint Declaration triggered capital flight, pushing the USD/HKD rate to 9.60 at its worst.

To stabilize the economy, the Hong Kong Monetary Authority (HKMA) implemented the Linked Exchange Rate System (LERS), pegging the HKD at 7.80 per USD. The system allows for convertibility within a narrow band of 7.75 to 7.85, with HKMA intervening when the rate approaches either extreme.

This peg ushered in an era of monetary credibility, policy discipline, and low inflation. By the end of the 1980s, confidence returned, and the rate hovered steadily around 7.80/USD.

1990s: Asian Financial Crisis and Currency Defense

The 1990s were relatively stable until the 1997 Asian financial crisis. While many Asian currencies were devalued, HKD withstood massive speculative pressure, thanks to robust reserves and determined intervention by the HKMA.

At the height of the crisis, short-sellers targeted the peg, betting on devaluation. In response, the HKMA raised interest rates sharply, at times exceeding 300% overnight, and directly intervened in the stock market to restore stability.

Despite severe economic contraction, the USD/HKD exchange rate held firm at 7.80, reinforcing investor confidence in the peg’s durability. By 1999, Hong Kong was on a recovery path, maintaining currency stability even amidst regional disarray.

2000s: Resilience Amid Dot-com Bust and Globalization

The early 2000s tested the peg again as global markets reeled from the dot-com bubble burst and 9/11. But the USD/HKD rate remained firmly within the 7.75–7.85 range. The currency board system’s credibility, transparency, and automation attracted growing capital inflows and positioned Hong Kong as a global financial center.

In 2005, the HKMA introduced greater flexibility by creating a Convertibility Undertaking band — committing to buy or sell HKD at 7.75 and 7.85, respectively, rather than sticking to a single fixed rate. This tweak maintained discipline while allowing slight rate movement within the corridor.

Despite global challenges, including the 2008 financial crisis, the peg endured. Massive U.S. dollar inflows during periods of quantitative easing occasionally pushed the HKD to the strong side (7.75), prompting HKMA to intervene and maintain balance.

2010s: Fed Tapering and Policy Alignment

During the 2010s, the USD to HKD exchange rate remained well-managed, even during episodes of high volatility such as the 2013 taper tantrum or geopolitical unrest in Hong Kong.

The HKMA closely mirrored U.S. interest rate policy due to the peg, sometimes tightening or loosening even when local economic conditions differed from the U.S. For example, while Hong Kong faced sluggish growth or protests, it still raised rates in step with the U.S. Federal Reserve during 2016–2018.

Even when tensions around China’s National Security Law in 2020 raised concerns globally, the HKD peg held steady, with the rate never breaching the 7.75–7.85 band. The linked exchange system remained a key pillar of stability amidst political uncertainty.

2020s: Global Inflation, Rate Hikes, and FX Interventions

In the 2020s, Hong Kong faced challenges from the COVID-19 pandemic, U.S.-China tensions, and global inflation. Despite massive interest rate hikes by the Federal Reserve in 2022 and 2023, the HKMA followed suit, raising local interest rates to defend the peg.

Frequent interventions became necessary as investors sought carry trades, borrowing in HKD at low rates to invest in higher-yielding assets. HKMA was forced to buy HKD and sell USD repeatedly to prevent the rate from drifting above 7.85.

As of April 2025, the USD/HKD rate stands around 7.83, safely within the peg band. While analysts debate whether Hong Kong might eventually shift to a yuan peg, the current policy framework remains unchanged and fully supported by deep FX reserves and institutional credibility.

USD to HKD: Decade-Wise Exchange Rate Table

| Decade | Avg. Exchange Rate (Approx) | Change from Previous Decade |

|---|---|---|

| 1940s | Pegged to GBP | 🟡 Transition to USD begins |

| 1950s | Floating (5.70–5.90) | ❌ -Depreciation |

| 1960s | Floating (5.70–6.00) | 🟢 Stable |

| 1970s | 4.75–5.10 (volatility) | ❌ -HKD weakened |

| 1980s | Peg introduced @ 7.80 (1983) | ❌ -Pegging to USD |

| 1990s | Peg maintained @ 7.80 | 🟢 Stable |

| 2000s | Peg widened to 7.75–7.85 | 🟢 Controlled flexibility |

| 2010s | 7.75–7.85 | 🟢 Stable |

| 2020s (till 2025) | ~7.83 average | 🟡 Slight depreciation |

✅ Key:

🟢 = Stable

❌ = HKD depreciation vs. USD

🟡 = Transitional or volatile phase

USD/HKD - US Dollar / Hong Kong Dollar Currency Rate

Live Price of USD/HKD. USD/HKD Live Chart, Intraday & Historical Live Chart, Buy Sell Signal, USD/HKD News, USD/HKD Averages, Returns & Historical Data

» USD/HKD

» USD/HKD Real Time Quotes

» USD/HKD Live Chart

» USD/HKD Intraday Chart

» USD/HKD Historical Chart

» USD/HKD Buy Sell Signal

» USD/HKD News

» USD/HKD Videos

» USD/HKD Averages

» USD/HKD Currency Pair

» USD/HKD Historical Data