Trump’s $2,000 tariff ‘dividend’ resembles Covid stimulus payments

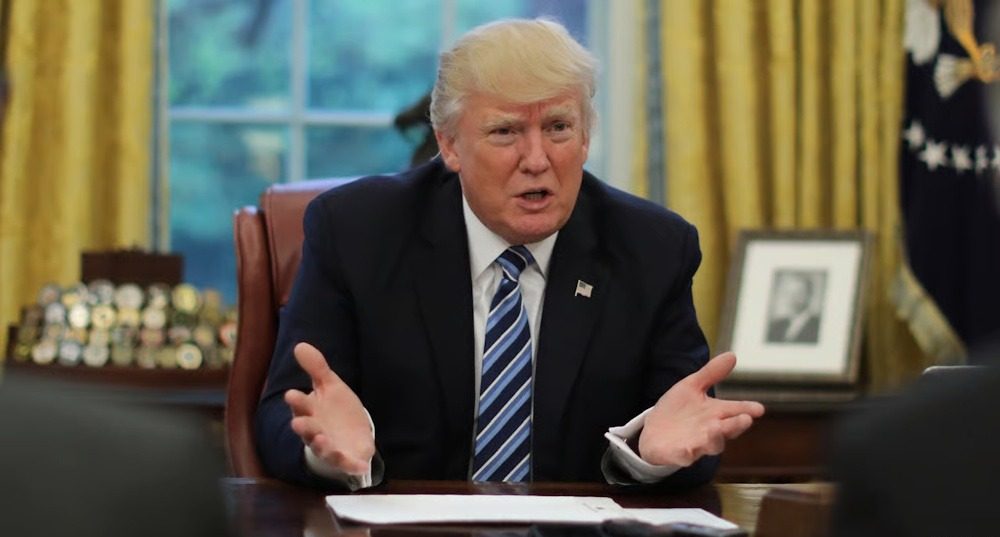

President Donald Trump’s proposal to send $2,000 “dividend” payments from tariffs to US citizens recalls the stimulus checks issued during the Covid crisis, presenting comparable economic risks. After discussing the concept of tariff dividend payouts for several months, Trump on Sunday specified the amount of “at least $2,000 a person.” He stated that the recipients would not encompass high-income individuals, though he did not specify a threshold. Despite the president’s repeated claims about the billions raised in tariff revenue this year, an analysis suggests that such a plan — which would likely necessitate congressional approval — could result in costs for the US government that are double the projected revenue for 2025. It would also undermine Trump’s assertion that such revenue will contribute to reducing federal debt — a claim that economists suggest is improbable in the near future, given the government is facing budget deficits close to $2 trillion. In December 2020, Trump was urging US lawmakers to increase pandemic-aid checks to $2,000, a significant rise from the $600 that they ultimately approved. His successor Joe Biden addressed the $1,400 shortfall in his American Rescue Plan in March 2021.

Some economists now attribute the 2021-22 inflation surge — the most severe since the early 1980s — to excessive federal payouts. More than four years later, consumer-price increases have yet to revert to pre-Covid levels, heightening the risk that a new influx of cash into US households could reignite inflation. Trump has not clarified the mechanics behind a $2,000 payout, nor has he indicated whether he is pursuing legislation to authorize the “dividends.” However, Kevin Hassett stated that Congress would indeed need to approve the payout. “It’s a terrible idea,” Paul Krugman stated during an appearance. “The notion that we will take a single source of revenue and distribute funds while simultaneously increasing federal debt — that’s profoundly irresponsible.”

The Committee for a Responsible Federal Budget, a centrist watchdog group, has provided a preliminary calculation estimating the proposal’s cost at $600 billion, assuming the dividends are structured similarly to Covid payments. Net US tariff revenue for the fiscal year through September reached $195 billion, with numerous economists estimating approximately $300 billion for the calendar year 2025. Another complication arises as the Supreme Court deliberates on the legality of Trump’s import duties, which were imposed under the International Emergency Economic Powers Act. “If those go on to be invalidated, it would take seven years before the government raised enough tariff revenue to cover the full cost of the dividend checks,” the CRFB said. Treasury Secretary Scott Bessent indicated that the $2,000 might not be a check at all, but rather could be considered as tariff-funded tax relief incorporated within Trump’s signature tax legislation enacted in July. “It could be just the tax decreases that we are seeing on the president’s agenda — no tax on tips, no tax on overtime, no tax on Social Security – deductibility on auto loans,” Bessent stated. In other words, there will be no net new “dividend” payout; however, Bessent also mentioned that he hadn’t discussed the matter with Trump.

On Monday, Trump reiterated his stance on the payout concept via Truth Social, stating that the tariff revenue funds “left over from the $2,000 payments” would be utilized to “substantially pay down national debt.” Currently, the unprecedented surge in customs revenue is being directed towards reducing fiscal deficits. For federal debt to be diminished in nominal terms, a transition to outright surpluses would be necessary. The government last experienced an annual surplus over twenty years ago, while current deficits are, in comparison, historically significant. If the Supreme Court determines that Trump’s tariffs invoked under the IEEPA are unlawful and mandates refund payments, this could lead to an increase in federal borrowing needs for a period as the process takes place. “If it was illegally collected, there is supposed to be a remedy for that,” stated Lawrence Friedman.