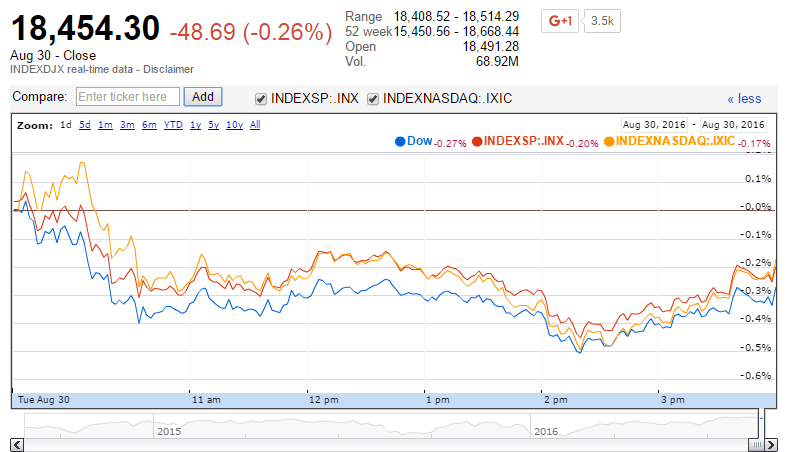

U.S. Market Indexes Lower as Investors Await Rate Increase

U.S. market indexes were lower Tuesday. For the day the Dow Jones Industrial Average closed at 18454.30 for a loss of -48.69 points or -0.26 percent. The S&P 500 was also lower, closing at 2176.12 for a loss of -4.26 points or -0.20 percent. The Nasdaq Composite closed lower at 5222.99 for a loss of -9.34 points or -0.18 percent. The VIX Volatility Index was higher at 13.06 for a gain of 0.12 points or 0.93 percent.

Tuesday’s Market Movers

Leading reports on the economic calendar Tuesday included the S&P Case-Shiller Home Price Index and Consumer Confidence. The S&P Case-Shiller Home Price Index was down -0.1 percent from the previous month and up 5.1 percent from a year ago. Consumer confidence was improved. The Conference Board’s Consumer Confidence Index increased from 96. 7 to 101.1.

Stocks were lower for the day with less favor for equities as investors began to prepare for more aggressive U.S. rate increases in the credit market. The Fed signaled last week that economic conditions were improving and that they could likely raise rates twice before the end of the year if economic data continued to be favorable.

Stocks trading actively for the day included the following:

Bank of America

EMC

Chesapeake Energy

Ford

Apple

Wells Fargo

Mosaic

General Electric

In the Dow Jones Industrial Average, the following stocks led losses:

Boeing Co -1.57

Nike Inc -1.07

Procter & Gamble Co -0.86

Apple Inc -0.77

Caterpillar Inc -0.75

Coca-Cola Co -0.69

In the broad market all sectors were lower except financial which continued to gain on the prospects of more aggressive rate increases. Technology stocks in the S&P 500 were down -0.34 percent. The Nasdaq Composite closed lower at 5222.99 for a loss of -0.18 percent and the Nasdaq 100 was lower at 4775.99 for a loss of -0.31 percent. Stocks leading losses in the technology sector included the following:

Discovery Communications Inc -3.15

Tesla Motors Inc -1.79

Skyworks Solutions Inc -1.36

T-Mobile US Inc -1.35

In commodities, gold traded lower as evidenced by the SPDR Gold Trust which reported a loss of -1.27 points or -1.01 percent. The dollar was lower for the day as the U.S. Dollar Index was down 0.51 points or 0.53 percent to 96.07.

Small-Cap Stocks

In small-caps, the Russell 2000 Index was higher at 1246.03 for a gain of 1.09 points or 0.09 percent. The S&P 600 Small-Cap Index was higher at 756.46 for a gain of 0.28 points or 0.04 percent. The Dow Jones Small-Cap Growth TSM Index was lower at 7581.56 for a loss of -3.21 points or -0.04 percent. The Dow Jones Small-Cap Value TSM Index was higher at 8800.37 for a gain of 4.94 points or 0.06 percent.

Other Notable Indexes

Other notable index closes included the S&P 400 Mid-Cap Index at 1570.06 for a loss of -0.73 points or -0.05 percent; the S&P 100 Index at 961.78 for a loss of -1.77 points or -0.18 percent; the Russell 3000 Index at 1287.78 for a loss of -2.07 points or -0.16 percent. The Russell 1000 Index at 1205.91 for a loss of -2.19 points or -0.18 percent; and the Dow Jones U.S. Select Dividend Index at 615.43 for a loss of -3.18 points or -0.51 percent.