U.S. Market Indexes Lower as Fed Holds Rate Unchanged

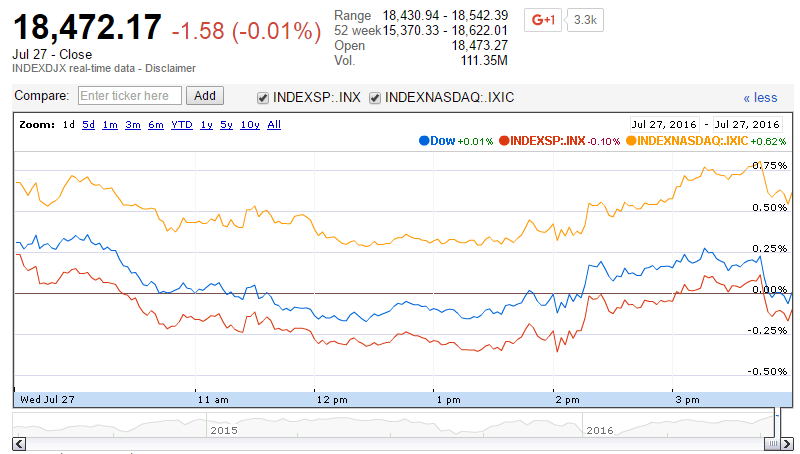

U.S. market indexes were mostly lower on Wednesday after the Fed reported it would keep its federal funds rate unchanged at 0.25 percent to 0.50 percent. For the day the Dow Jones Industrial Average closed at 18472.17 for a loss of -1.58 points or -0.01 percent. The S&P 500 was also down, closing at 2166.58 for a loss of -2.60 points or -0.12 percent. Technology stocks and the Nasdaq Composite gained for the day. The Nasdaq Composite was higher at 5139.81 for a gain of 29.76 points or 0.58 percent. The VIX Volatility Index was lower at 12.79 for a loss of -0.26 points or -1.99 percent.

Wednesday’s Market Movers

The main focus of the day’s trading was on the Federal Open Market Committee’s meeting report on Wednesday afternoon. The FOMC kept rates unchanged at 0.25 percent to 0.50 percent. The FOMC’s report indicated that the economic outlook was improving and a rate increase is likely to occur this year. Economic data and the outlook for the economy could cause a rate increase as soon as September.

On the economic calendar, mortgage applications reported by the Mortgage Bankers Association were lower by 11.2 percent for the week. Pending home sales were below consensus. The Pending Home Sales Index increased 0.2 percent from the previous month, below consensus of 1.3 percent but above the previous month’s change of -3.7 percent. Wednesday’s Durable Goods Report showed a decrease in new orders of durable goods of 4 percent. Durable goods were below consensus and the month’s report was the lowest in almost two years. Wednesday’s EIA Petroleum Status Report showed oil inventories increasing by 1.7 million.

For the day, stocks trading actively included: Bank of America, Apple, Chesapeake Energy, Facebook, General Electric, Coca-Cola, Ford and Microsoft.

In the Dow Jones Industrial Average, stocks leading losses for the day included the following:

Losses (percent)

Coca-Cola Co -3.30

McDonald’s Corp -1.83

The Travelers Companies Inc -1.04

Nike Inc B -1.03

Microsoft Corp -1.00

Top sectors for the broad market included technology, healthcare and materials.

In technology, the following stocks led gains:

Gains (percent)

Illumina Inc 8.09

Biomarin Pharmaceutical Inc 6.6

Apple Inc 6.53

In commodities, gold traded higher as evidenced by the SPDR Gold Trust which reported a gain of 2.03 points or 1.61 percent. The dollar was lower for the day as the US Dollar Index was down -0.41 points or -0.42 percent to 96.76.

Small-Cap Stocks

In small-caps, the Russell 2000 Index was higher at 1218.92 for a gain of 2.06 points or 0.17 percent. The S&P 600 Small-Cap Index was higher at 745.31 for a gain of 1.59 points or 0.21 percent. The Dow Jones Small-Cap Growth TSM Index was higher at 7421.06 for a gain of 2.49 points or 0.03 percent. The Dow Jones Small-Cap Value TSM Index was lower at 8710.95 for a loss of -18.70 points or -0.21 percent.

Other Notable Indexes

Other notable index closes included the S&P 400 Mid-Cap Index lower at 1548.49 for a loss of -6.22 points or -0.40 percent; the S&P 100 Index higher at 958.59 for a gain of 1.50 points or 0.16 percent; the Russell 3000 Index lower at 1279.61 for a loss of -1.68 points or -0.13 percent; the Russell 1000 Index lower at 1199.79 for a loss of -1.87 points or -0.16 percent; the Dow Jones U.S. Select Dividend Index closed at 621.05 for a loss of -2.17 points or -0.35 percent.