Stocks Trading Flat after Fed Meeting Projections

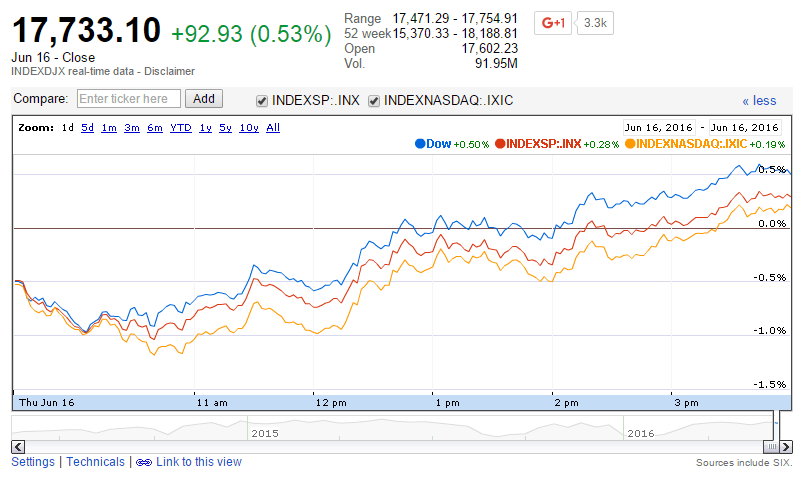

U.S. market indexes traded flat on Thursday following the Federal Reserve’s June meeting report released on Wednesday afternoon. For the day the Dow Jones Industrial Average closed at 17733.10 for a gain of 92.93 points or 0.53 percent. The S&P 500 was also higher, closing 2077.99 for a gain of 6.49 points or 0.31 percent. The Nasdaq Composite closed higher at 4844.91 for a gain of 9.98 points or 0.21 percent. The VIX Volatility Index continued to decrease with a loss of -0.75 points or -3.72 percent at 19.39.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Thursday’s Market Movers

The market was packed with activity Thursday in both the U.S. and global markets. In the U.S., investors saw reports on the Consumer Price Index, Jobless Claims, Mortgage Rates, Current Account Trade, the Housing Market Index, the Fed Balance Sheet and the Money Supply. Market moving reports included jobless claims which were up 13,000 for the week after a previous decrease of 4,000. The Consumer Price Index reported annual inflation at 1.0 percent and the CPI minus food and energy was at 2.2 percent annually. The Housing Market Index gained two points from the previous month at 60 and was above consensus of 59. Mortgage rates reported by Freddie Mac were also lower for the week. In the Current Account report released on Thursday data showed the U.S. with a balance of $-124.7 billion, remaining at a deficit despite the strong U.S. dollar currency.

In global markets, U.S. stocks continued to react to a weaker outlook from the U.S. Federal Reserve after its monetary policy report on Wednesday which left rates unchanged. Other central banks reporting globally this week include Japan, Switzerland and the Bank of England.

U.S. stocks trading actively for the day with gains included Apple, Microsoft, General Electric and Ford. Stocks trading actively with losses included Bank of America and Regions Financial.

In the Dow Jones Industrial Average, the following stocks led gains and losses:

Gains (percent)

Merck 2.51

DuPont 1.79

Microsoft 1.41

3M 1.27

Exxon 1.21

Losses (percent)

Nike -1.55

Boeing -0.61

Pfizer -0.12

Caterpillar -0.11

Top sectors for the broad market were utilities, consumer staples and healthcare. In technology, the Nasdaq Composite closed higher at 4844.91 for a gain of 9.98 points or 0.21 percent. The Nasdaq 100 was higher at 4424.23 for a gain of 14.72 points or 0.33 percent. Stocks leading gains in the technology sector included:

Gains (percent)

Viacom 6.75

Symantec 4.16

Liberty Media 3.13

In commodities, gold traded lower as evidenced by the SPDR Gold Trust which reported a loss of -1.26 points or -1.02 percent. The dollar was lower for the day as the U.S. Dollar Index was down -0.06 points or -0.06 percent at 94.55.

Small-Cap Stocks

In small-caps, the Russell 2000 was lower closing at 1148.19 for a loss of -1.11 points or -0.10 percent. The S&P 600 closed at 703.01 for a loss of -0.70 points or -0.10 percent. The DJ Small-Cap Growth TSM was lower at 7017.78 for a loss of -18.85 points or -0.27 percent. The DJ Small-Cap Value TSM was lower at 8248.73 for a loss of -6.28 points or -0.08 percent.

Other Notable Indexes

Other notable index closes included the S&P 400 Mid-Cap Index which closed at 1478.81 for a loss of -1.16 points or -0.08 percent; the Russell 3000 which closed at 1225.09 for a gain of 2.91 points or 0.24 percent; and the Dow Jones U.S. Select Dividend Index which closed at 595.98 for a gain of 1.95 points or 0.33 percent.