Guru Is Betting Big on This Falling Railroad Holding

Guru Richard Snow (Trades, Portfolio) is the founder, president and chief investment officer of Snow Capital Management. Snow has more than 30 years of experience as a research analyst and portfolio manager. His investment experience dates back to 1980 when he formed R.A.S. Capital management, managing private family assets.

Tuesday, Snow added 129,400 shares – a +27.17% increase – and now holds a total of 605,624 shares of L.B. Foster Co. (NASDAQ:FSTR)

L.B. Foster manufactures and distributes products and services for rail, construction, energy and utility markets. The company classifies its activities into three business segments: Rail Products, Construction Products, and Tubular Products. The company’s Rail Products segment is comprised of manufacturing and distribution businesses, which provides products for railroads, transit authorities, industrial companies and missing applications for North America and the United Kingdom. It has sales offices in the United States, Canada and the United Kingdom and bids on rail projects where it can offer products manufactured or sourced from numerous suppliers.

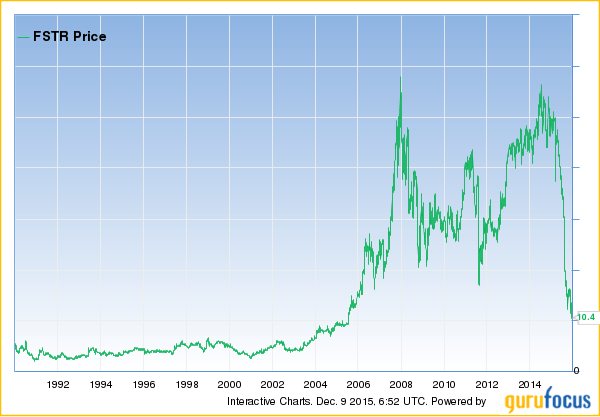

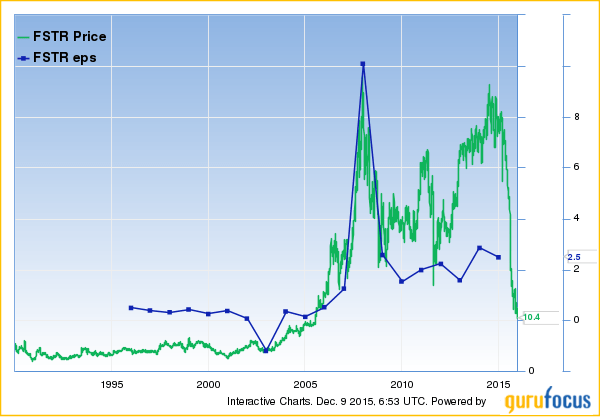

Below is a Peter Lynch chart for L.B. Foster Co.

There are a few good signs for L.B. Foster.

- Per Share Revenue: L.B. Foster has shown predictable revenue and earnings growth.

- The company dividend yield is close to a five-year high.

- The P/S ratio is close to a 10-year low.

- The company has a high dividend payout.

- The company has dropped 464% in market price since Jan. 2, but the book value has grown over the past 10 years at a rate of 13.4%.

- The company is trading below its intrinsic value.

There is one severe warning sign for L.B. Foster.

Asset Growth: Faster than revenue growth – If a company builds assets at 12.8% a year faster than its revenue growth rate of 8.4% over the past five years, it means that the company may be getting less efficient.

Another thing to consider with L.B. Foster.

The company is still reeling from a legal battle with long-time client Union Pacific (UNP), which is lasting longer than expected. Management thought the lawsuit was controllable but Union Pacific continues to press and will not settle. This resulted in management withdrawing all Union Pacific-related business from its earnings guidance.

Disclaimer: The author does not currently hold any shares in this holding.

Cheers to your investment success.