Can military hold promise for the struggling economies of Europe

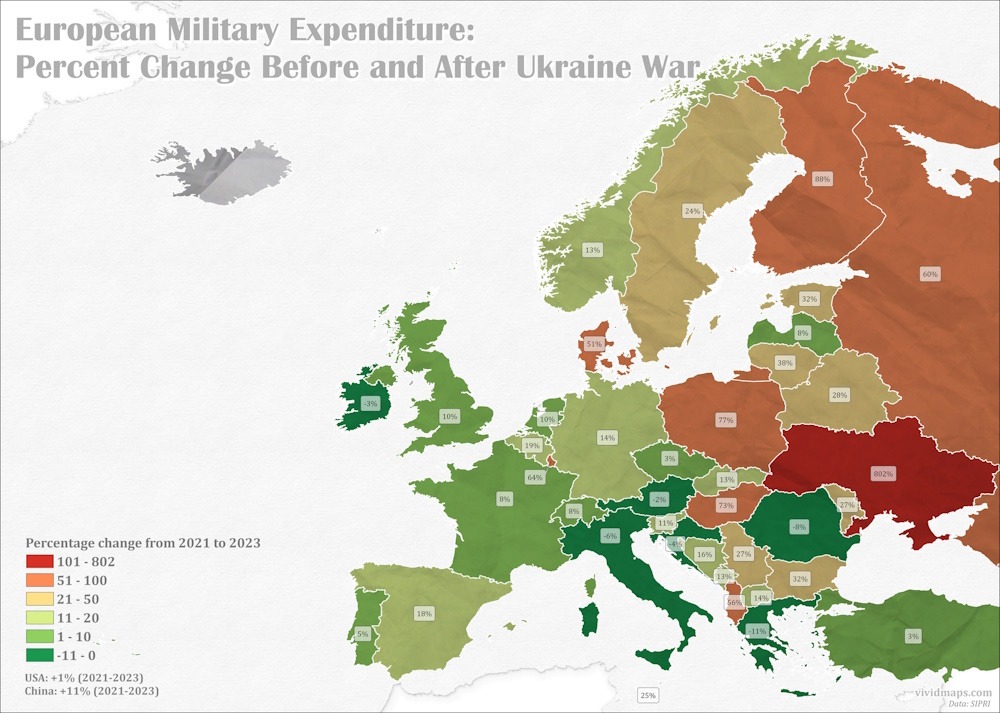

The military can serve as a potential catalyst for revitalizing Europe’s struggling economies. A significant military expansion throughout Europe has the potential to accomplish what policymakers have struggled to achieve for years: invigorate a stagnant economy, foster new innovations, and establish emerging industries. Various nations, including the U.K., Germany, and Denmark, have declared significant escalations in military expenditures in response to perceived threats from Russia, while the United States cautions Europe against complacency regarding American defense assurances.

For certain analysts, this may represent precisely what the region requires to bolster a manufacturing sector facing challenges and to activate new drivers of growth and export potential. Numerous obstacles exist, including a shortage of skills, and the potential benefits may not be equitably shared, they caution. Rearmament may necessitate concessions in certain domains as the peace dividend that Europe has experienced since the conclusion of the Cold War is gradually reversed. Recent economic research indicates that the advantages associated with the dividend, which was predominantly utilized to support a consistent expansion of the welfare state, may have been overstated.

This month, the European Commission, acting as the executive body of the European Union, introduced the “ReArm Europe” initiative, which seeks to mobilize approximately €800 billion, or about $868 billion, for military expenditures. In Germany, prospective Chancellor Friedrich Merz has proposed the idea of exempting certain expenditures from the nation’s stringent self-imposed debt constraints. Last month, Denmark announced an intention to elevate its defense budget to exceed 3% of gross domestic product within the next two years, while the United Kingdom revealed strategies to enhance military expenditure to 2.5% of GDP by 2027.

According to European Commission President Ursula von der Leyen on Sunday, the investments have the potential to generate significant momentum for key industries. She noted that advancements in artificial intelligence, quantum computing, secure communication, satellite networks, autonomous vehicles, and robotics are poised to yield significant benefits. Military expenditure influences the economy through various channels, often yielding conflicting outcomes. In the immediate context, it has the potential to utilize underemployed labor and resources, while simultaneously stimulating expenditure and investment from private enterprises and households. It may also redirect public funds from potentially more efficient applications, increase borrowing expenses, and displace certain private investments.

Longer term, research suggests that military expenditure can increase the efficiency of the broader economy. According to analysts, government defense contracts have the potential to create economies of scale and stimulate innovation within civilian sectors. The foundation of the internet is rooted in protocols originally developed for the U.S. Defense Department. The prevailing view indicates that gross domestic product indeed increases to support defense expansions. It’s not a fixed pie,” said Ethan Ilzetzki, associate economics professor at the London School of Economics.

To be sure, producing munitions and warheads doesn’t have the same economic benefit as investing in factory machinery or infrastructure. Weapons are intended to be stored or destroyed, rather than used to speed production or shorten journey times. Yet Ilzetzki estimates that increasing European military spending from 2% to 3.5% of GDP could increase the continent’s economic output by 0.9% to 1.5%, based on his broad survey of the economic literature published last month for the Kiel Institute for the World Economy.

Conversely, falling military spending can coincide with slower growth. Annual GDP growth in the U.S. declined from around 4% in the 1960s to less than 3% recently as military spending slumped from 8% of GDP to less than 4%, Ilzetzki noted. In the EU, economic growth has halved since the 1960s as military spending declined by two-thirds. One reason is that public investment in cutting-edge research during wartime or military buildups is lost in peacetime. A temporary increase in military spending of 1% of GDP could increase long-term productivity by 0.25%, Ilzetzki found. A 10% increase in government-funded military research and development can bolster private R&D by more than 4%, according to a 2019 study by economists Enrico Moretti, Claudia Steinwender and John Van Reenen.

“Perhaps we can find ways [to support cutting-edge research] that don’t necessitate military expenditure, but so far there are few examples of that,” Ilzetzki said. “It is difficult to imagine nuclear power emerging so early without World War II R&D or space exploration technologies in the 1960s without NASA.” America’s military R&D spending is currently 12 times as large as Europe’s, according to a 2024 report on Europe’s economic competitiveness by former European Central Bank President Mario Draghi. Increasing the share of government defense R&D to GDP in the eurozone to U.S. levels would result in a 350% to 420% boost to defense industry R&D, according to an estimate by Barclays.

Military spending can also offer jobs for idled workers with the right skills. German carmakers, for instance, have cut tens of thousands of jobs as global demand for the country’s cars has softened. “The types of jobs created are exactly those jobs hollowed out in the middle of the income distribution…higher-paid jobs that don’t require large amounts of education,” Ilzetzki said. On both sides of the Atlantic, war has spurred industrial development. The American Civil War appeared to promote industrialization of the North, by stimulating infrastructure investments such as the first transcontinental telegraph line and railroad expansions.

In Europe, the Franco-Prussian War of 1870 may have supported the nascent industrial base of newly unified Germany, boosting industrial giants including Krupp, BASF and Siemens. Last century, President Richard Nixon’s threat to withdraw U.S. troops from the Korean Peninsula motivated government support for military-relevant industries in South Korea, which caused them to nearly double from the late 1960s to the mid-1980s, according to research by Nathan Lane, an economist at the University of Oxford. Yet there is a caveat: To maximize the benefits of higher military spending, Europe needs to build more equipment domestically rather than buying it overseas.

This isn’t what’s happening: Arms imports to European North Atlantic Treaty Organization members more than doubled from 2020 to 2024 compared with the previous five years, and the U.S. supplied 64% of those weapons, according to the Stockholm International Peace Research Institute. Historically, a much larger portion of European defense supplies have been purchased domestically—around 90% in France and 80% in Germany between 2005 and 2022, according to Goldman Sachs.

There are other hurdles, too. Finding enough skilled workers will be challenging in aging Europe. There is also a limit to how much highly indebted nations like France or Italy can borrow to finance their buildups. These and other reasons mean Germany could benefit more than most given its large and currently underused industrial base and its comparatively low public debt.

European defense stocks such as Rheinmetall of Germany and Leonardo of Italy have soared this year, while bigger American counterparts such as Lockheed Martin have sagged as investors anticipated more aggressive European competition. “Europe is going to be a formidable military exporter,” said Jacob Kirkegaard, senior fellow at the Peterson Institute for International Economics.