Americans are hit by inflation and feeling worse financially

Americans are experiencing the impact of inflation and are facing worse financial conditions.

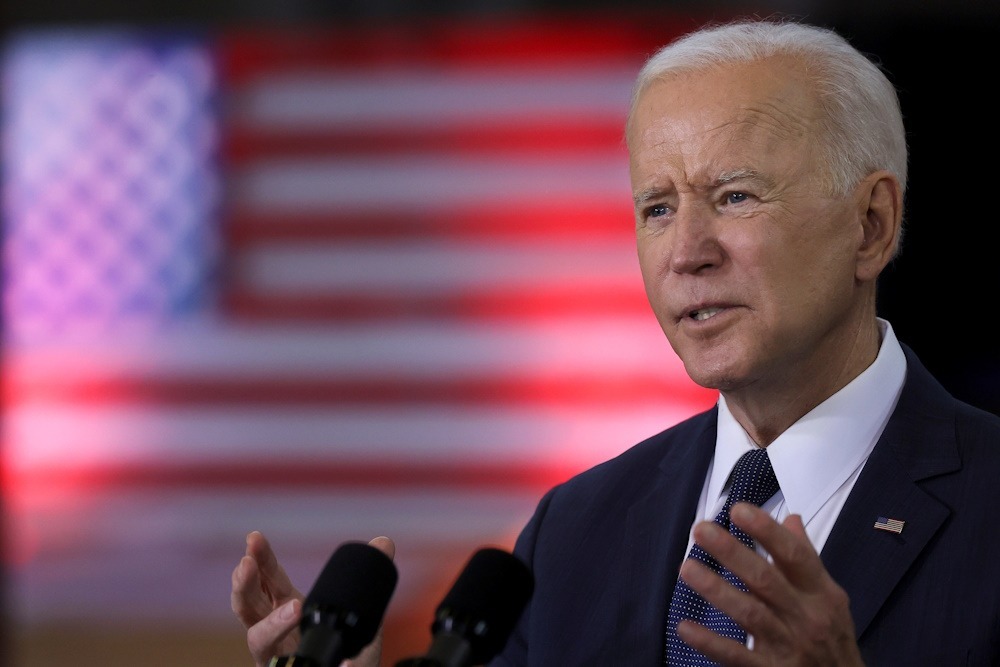

The proportion of American adults who reported being financially stable decreased in the previous year, highlighting one of the significant obstacles to President Biden’s chances of being re-elected.

In its annual survey of financial well-being, the Federal Reserve reported that 72% of respondents indicated that they were at least “doing OK” in 2023. The percentage decreased from 73% in the previous year to 78% in 2021, as households had a plenty of money from pandemic stimulus payouts.

The decrease in self-reported well-being was particularly noticeable among parents residing with children below the age of 18. Within that particular cohort, a mere 64% expressed satisfaction with their financial situation, a down from 69% in 2022 and 75% in 2021.

The current state of the U.S. economy is exceptional, surpassing most benchmarks set in the preceding 50 years. Unemployment has been below 4% for a period of 27 months, which is the longest duration in over 50 years. In March, consumer expenditure experienced a significant increase of 5.8% compared to the same period last year, and it was over 30% higher than the levels observed before the pandemic. The S&P 500 stock index is currently approaching its highest levels ever recorded.

However, Biden is currently behind former President Donald Trump in both nationwide polling and in crucial swing states. A mid-April CNN poll indicated that respondents hold an increasingly positive perception of Trump’s presidency. 55% of respondents consider the previous president’s four-year term to be successful, which is an increase from 41% at the end of his term in 2021. This percentage is significantly higher than the 39% who believe that President Biden’s presidency has been successful.

Economists have been perplexed by the disconnection for some months. However, the Federal Reserve study provided more evidence supporting the most probable reason for Americans’ negative perception of the economy: inflation. The proportion of poll participants who identified price rises as their primary financial difficulties increased to 35% in the previous year, up from 33% in 2022 and 8% in 2016.

Despite inflation peaking in 2022 and subsequently slowing down, there was still a rise in the number of individuals concerned about the increasing prices. That implies that whereas economists typically concentrate on year-to-year price fluctuations, individuals have a more enduring recollection.

According to Census data, U.S. disposable incomes, when adjusted for prices, set a record high in the first quarter of 2021, surpassing the level in the first quarter of this year by 10%. The windfall was generated by two factors: proactive federal expenditure to counteract the epidemic, which included substantial stimulus payments to households with children, and the absence of inflation at that time.

The University of Michigan’s measurement of consumer mood has increased by around 60% since its lowest point in June 2022, coinciding with a four-decade peak in inflation. However, it has decreased by 21% compared to February 2020, which was the month before the pandemic disrupted a thriving economy. Additionally, it is still lower than the lowest position seen during the 2001 recession.