How Do You Turn Around a Bear Market? China Has One Answer

China has pushed a group of state-linked companies to buy exchange-traded funds, part of an effort to boost stock prices. So far, it isn’t working.

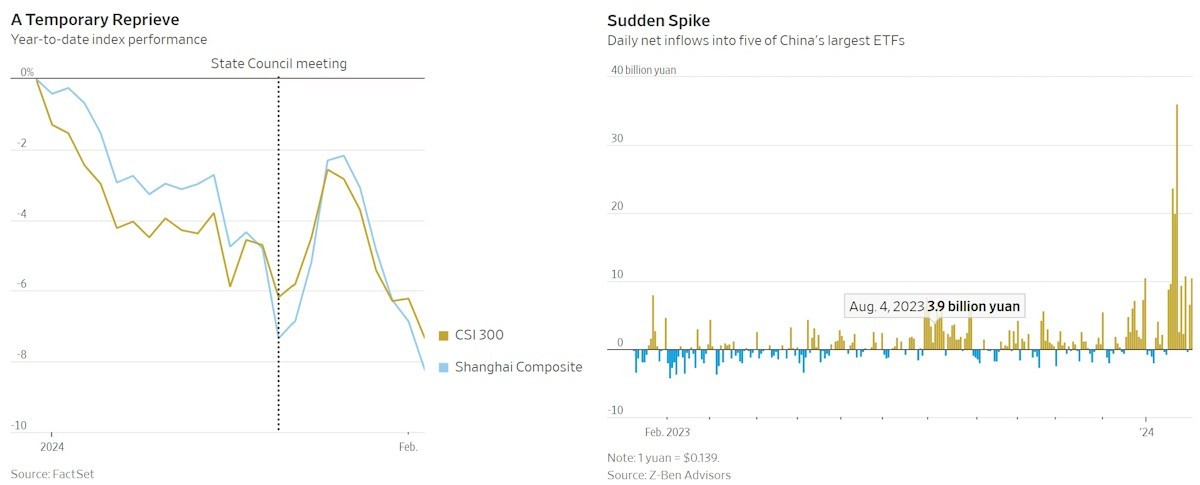

China’s benchmark CSI 300 index has entered its fourth consecutive year of declines, and is down 7.3% so far this year. Foreign investors are pulling out of the market. China’s hundreds of millions of individual investors are shifting to safer assets or betting on stock markets elsewhere.

The prolonged downturn in share prices is getting attention from regulators and politicians. The securities regulator has curbed short selling and reduced a tax on stock trading. The State Council, China’s cabinet, has called for more to be done to boost capital markets. Wang Jianjun, vice chairman of the regulator, said last week that “market fluctuations directly impact the wallets of everyday Chinese.”

Enter the national team, a group of state-linked investors that buy shares and ETFs to drive up stock prices.

There is no fixed definition of the national team, a term favored by analysts and investors but not used by the government. But most analysts think it includes a mix of state-owned investment funds, insurers, pension funds and brokers.

In January, five of China’s biggest exchange-traded funds tracking the CSI 300 and Shanghai Composite Indexes received $20.2 billion worth of net flows, more than 10 times the monthly average last year, according to Z-Ben Advisors. This concentration of flows is a sign of China’s national team at work, according to market participants.

But investors are skeptical that the national team can end the stock market’s slide….

Stocks rallied last week, getting support from the State Council meeting and an announcement by the central bank that it would cut a reserve requirement for banks. But the optimism proved short-lived, despite the national team continuing to buy more than usual. The CSI 300 has fallen more than 4% this week.

“I think we need to be realistic,” said Bhaskar Laxminarayan, chief investment officer for Asia at Julius Baer. “Intervention has limits.”

Beijing has never confirmed the existence of the national team, but the authorities have hinted about its existence in official statements and media reports. State-owned newspapers sometimes call on big funds and companies to help stabilize the stock market.

Most analysts agree that Central Huijin Investment, a unit of China’s sovereign-wealth fund, is a core member. China Securities Finance, a margin lender, is another. Some major pension funds, state-backed asset-management companies and brokerages have also been included in the definition.

The recent spree of buying by the national team echoes Beijing’s approach to another stock-market slump almost a decade ago.

In 2015, Beijing created new institutions to buy shares and gave orders to other existing firms that had spare capital. The authorities channeled some of the funds through state-owned brokerages, which were given discretion over the timing and allocation of their investments into individual stocks. But some of these brokers allegedly leaked the information to their clients. At least six firms were investigated for insider trading, and two senior regulators lost their jobs.

Now, China is pushing the national team to buy ETFs instead of individual shares. These funds take a broad allocation to the stock market, meaning national team buying doesn’t have an outsize impact on just a few stocks a day. That reduces the risks of information about national team buying being leaked.

“They want a layer in between. They don’t want a moral hazard,” said Peter Alexander, founder of Z-Ben Advisors. “What you’re finding now is there’s still a moral hazard that can be debated. But in current conditions, it’s probably the best of the worst possible scenarios.”

The national team is a key part of Beijing’s attempt to boost the stock market, but authorities are using multiple tactics to try to shift sentiment. Social-media platforms have targeted journalists and economists who have written critical articles, and warned users about disparaging the economy and the stock market. Some online articles that contain negative views of China’s economy have disappeared.

China’s stock market is now trading at historically low valuations. The average stock in the CSI 300 index trades at a price of just 10 times forward earnings, compared with 12.45 on Jan. 1, 2015, according to Wind data. The market is now being seen by some foreign investors as a place to pick up bargains. Some investors think that will give the national team’s stock buying a better chance of working.

“When stocks are this low, then something like that could be the catalyst for people to at least realize that these stocks are too cheap and start buying them,” said Jonathan Pines, lead portfolio manager for Federated Hermes’s Asia ex-Japan fund.