Hope Rises for Rally in Small Stocks After Historic Underperformance

Smaller, speculative stocks have endured a historically weak stretch. Investors are betting that a turnaround is finally in the works. Investors poured $1.6 billion into exchange-traded funds focused on small-cap stocks last week, according to data compiled by Jefferies. About $3.5 billion has flowed into small-stock ETFs since the start of the year.

The Russell 2000, an index of small and midsize companies with an average market value of just under $3 billion, has advanced 6.5% in June. That marks its best performance since January, according to Dow Jones Market Data, and tops the S&P 500’s 4.4% advance over the same period. The index is more speculative than its larger peers. Top holdings include companies that are sensitive to the financial health of the consumer, such as restaurants, and unprofitable firms in categories such as biotechnology. Companies that haven’t turned a profit in the past year account for about a fifth of the index.

Investors pay close attention to the performance of smaller stocks because it offers signals about the health of the U.S. economy. Small stocks often rally or fall ahead of the broader market.

An easing in worries about the economy has contributed to the rally in smaller stocks.

The current rally comes ahead of an annual rebalancing of the benchmark at the close of trading Friday, when many companies will be added to or removed from the index. That rebalancing has historically led to volatile trading as investors buy and sell stocks to match the new index composition. The recent good fortune is a welcome change for investors. Higher interest rates, concerns about a possible recession and instability in the banking system have plagued smaller stocks.

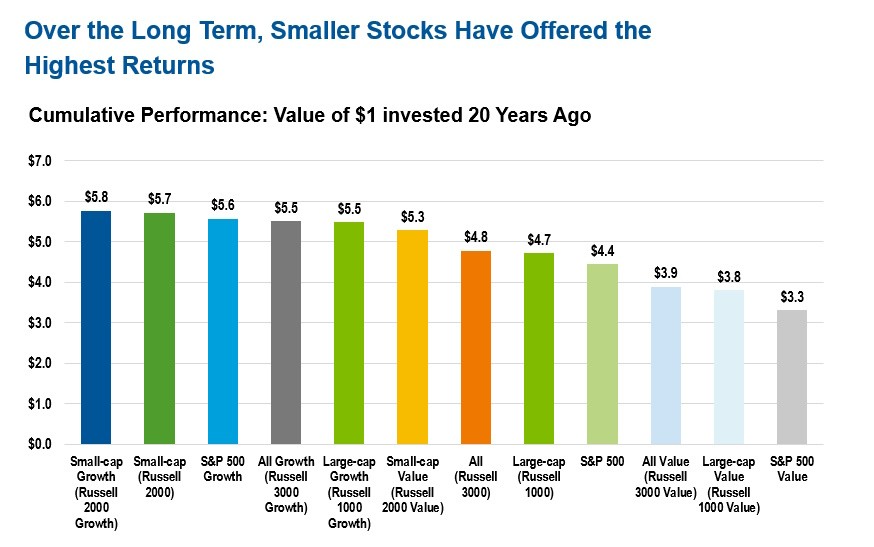

“The rubber band got so tightly wound in one direction,” said Steven DeSanctis, small and midcap equity strategist at Jefferies, “and now you’re starting to see a snap back.” The index is down 24% from its record set in 2021. The Russell 2000 has lagged behind larger stocks by more than 7 percentage points annually over the past five years. That underperformance is among the worst relative five-year returns since 1926, DeSanctis said.

Investors and strategists attributed the poor returns, and subsequent rally, to worries about the economy, which have lately begun to ease. Bank executives began warning of a possible recession more than a year ago, as inflation surged and the Federal Reserve began a lengthy campaign to tighten monetary policy. “If you’re worried about the economy, investors tend to gravitate to larger companies with strong balance sheets and reliable access to capital,” said Tom Hainlin, senior investment strategist at U.S. Bank.

Large technology stocks perceived to be leaders in artificial intelligence, such as Microsoft and Nvidia, have thrived this year. The Nasdaq Composite has gained 29%, while the S&P 500 has advanced 14%. The Russell 2000 has gained just 5.8% this year.

Bank executives began warning of a possible recession more than a year ago as inflation rose and the Federal Reserve began tightening monetary policy. So far, the economy has proved more robust than many expected. Housing starts reached 1.6 million in May, up 22% from April and ahead of economists’ expectations. The U.S. economy has added more than 1.5 million jobs this year, including 339,000 in May. Inflation is still high, but the rate has been cut in half since last year. The Russell 2000 also suffered after several small and midsize banks failed earlier this year. Financial stocks account for roughly 15% of the index.

Smaller stocks have also benefited from a recent thaw in the capital markets, strategists said. Companies sold more than $17 billion of stock in follow-on offerings in May, well above the $6.9 billion monthly average last year. The sales were done at smaller discounts than usual, which is a positive sign for the market. The Russell 2000 still trades at a valuation discount to larger peers: The small-cap index trades at about two times the value of its net assets. The S&P 500 trades at over four times book value, according to FactSet.

For that gap to close, strategists said, worries about the economy may need to recede further. “I still want to see the full impact of Fed tightening on the consumer,” Hainlin said.