| Symbol | Last | Change | % | High | Low |

|---|---|---|---|---|---|

| USD / CHF | 0.7758 | +0.0000 | +0.00% | 0.0000 | 0.0000 |

| Close | GMT Time : Sat Feb 21 2026 09:49 | ||||

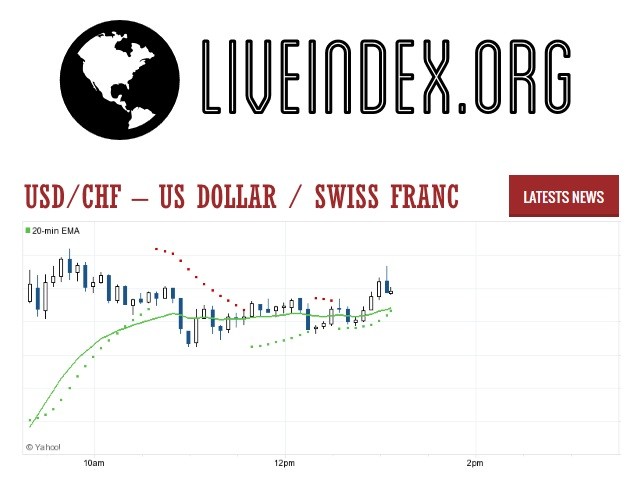

USD/CHF : Intraday Live Chart

USD/CHF : Technical Signal Buy & Sell

| 5 Min Signal | 1 Hour Signal | 1 Day Signal |

|---|---|---|

| Sell | Buy | Sell |

USD/CHF : Moving Averages

| Period | MA 20 | MA 50 | MA 100 |

|---|---|---|---|

| 5 Minutes | 0.77 | 0.77 | 0.78 |

| 1 Hour | 0.78 | 0.77 | 0.77 |

| 1 Day | 0.77 | 0.78 | 0.79 |

| 1 Week | 0.79 | 0.81 | 0.85 |

USD/CHF : Technical Resistance Level

| Resistance 1 - R1 | Resistance 2 - R2 | Resistance 3 - r3 |

|---|---|---|

| 0.0000 | 0.0000 | 0.0000 |

USD/CHF : Technical Support Level

| Support 1 - S1 | Support 2 - S2 | Support 3 - S3 |

|---|---|---|

| 0.0000 | 0.0000 | 0.0000 |

USD/CHF : Periodical High, Low & Average

| Period | High Change from Last | Low Change from Last | Average Change from Last |

|---|---|---|---|

| 1 Week | 0.7754 +0.0004 | 0.0000 +0.7758 | 0.7712 +0.0046 |

| 1 Month | 0.7965 -0.0207 | 0.0000 +0.7758 | 0.7739 +0.0019 |

| 3 Month | 0.8089 -0.0331 | 0.0000 +0.7758 | 0.7900 -0.0142 |

| 6 Month | 0.8105 -0.0347 | 0.0000 +0.7758 | 0.7900 -0.0142 |

| 1 Year | 0.9040 -0.1282 | 0.0000 +0.7758 | 0.8072 -0.0314 |

USD/CHF : Historical Chart

USD/CHF Exchange Rate History and Key Economic Events

The USD/CHF exchange rate is a critical indicator in global financial markets, capturing the intricate relationship between the U.S. dollar and the Swiss franc. As two of the world’s most influential currencies, their interplay reflects shifts in global risk sentiment, monetary policy decisions, and economic fundamentals. The Swiss franc is widely regarded as a safe-haven asset, and its value often strengthens during times of market stress. This comprehensive analysis examines the evolution of the USD/CHF pair—from the post-Bretton Woods era through periods of market turbulence to recent developments—offering insights valuable for forex traders, investors, and economic analysts. Optimized for keywords such as USD/CHF historical analysis, historical USD to CHF exchange rate, and USD/CHF forecast, this article delves into the major events that have shaped this currency pair.

The Early Floating Era and Post-Bretton Woods Period (1970s)

After the collapse of the Bretton Woods system in the early 1970s, global currencies began to float freely. For the USD/CHF pair, the 1970s marked the start of a new era. During this period, the U.S. dollar was emerging from a period of high inflation and significant economic change, while the Swiss franc maintained its reputation for stability. Swiss monetary policy, characterized by cautious fiscal management and a conservative approach to inflation, helped establish the franc as a safe-haven asset.

Throughout the 1970s, the USD/CHF rate averaged around 4.00, reflecting the relatively high value of the dollar compared to the franc. Economic uncertainty, coupled with rising inflation in the U.S., contributed to a volatile environment. However, investors were drawn to the Swiss franc’s reputation for reliability and long-term stability. This early period laid the foundation for future trends, as market participants increasingly looked to the franc as a hedge against global economic turmoil.

Strengthening of the Swiss Franc in the 1980s and 1990s

The 1980s witnessed significant developments that fundamentally altered the dynamics of the USD/CHF exchange rate. As the U.S. adopted tighter monetary policies to combat inflation, the dollar began to lose some of its dominance. Meanwhile, Switzerland’s disciplined economic management and its reputation as a safe haven led to a steady appreciation of the Swiss franc. By the end of the 1980s, the average USD/CHF rate had declined to approximately 3.20, representing a roughly 20% decrease from the 1970s average.

Entering the 1990s, the trend toward franc appreciation continued. Global economic integration, along with persistent demand for safe-haven assets amid periods of market uncertainty, pushed the USD/CHF rate further downward. By the 1990s, the average rate had fallen to around 2.20. This period was marked by significant economic events, including the aftermath of the Cold War and increasing globalization. The safe-haven appeal of the Swiss franc was reinforced by periods of geopolitical tension and market volatility, prompting investors to flock to the currency in times of uncertainty.

Transformative Changes in the 2000s and 2010s

The early 2000s brought new challenges and opportunities for the USD/CHF pair. The global financial landscape was dramatically reshaped by the dot-com bubble burst and, later, the 2008 global financial crisis. During these turbulent times, the safe-haven status of the Swiss franc became even more pronounced. As investors sought refuge from market instability, demand for the franc surged, resulting in a further decline in the USD/CHF rate. By the 2000s, the average rate was approximately 1.30, highlighting the significant appreciation of the Swiss franc over the previous two decades.

The 2010s continued to witness the profound influence of global economic uncertainty on the USD/CHF pair. The Eurozone debt crisis, prolonged periods of low interest rates, and quantitative easing policies in major economies further accentuated the safe-haven appeal of the Swiss franc. Throughout this decade, the average USD/CHF rate settled at around 0.95. The sustained low rate reflected not only the strength of the Swiss franc but also a broader shift in investor sentiment, as market participants remained wary of potential systemic risks and sought assets that could preserve value during volatile periods.

Recent Developments in the 2020s

The 2020s have introduced a new set of challenges and policy shifts that continue to influence the USD/CHF exchange rate. The global outbreak of COVID-19 led to unprecedented economic disruption, prompting aggressive fiscal and monetary interventions worldwide. Initially, during the early stages of the pandemic, the Swiss franc’s safe-haven appeal drove significant inflows, further depressing the USD/CHF rate.

However, as the global economy began to recover, divergent monetary policies between the U.S. Federal Reserve and the Swiss National Bank (SNB) came to the forefront. While the Federal Reserve embarked on a series of aggressive rate hikes to combat rising inflation, the SNB maintained a cautious stance, prioritizing stability over rapid tightening. This divergence has resulted in modest adjustments in the USD/CHF rate. As of April 2025, the rate is averaging around 0.91—a slight decline from the previous decade, reflecting both the enduring safe-haven nature of the Swiss franc and the complex interplay of global economic forces in the post-pandemic era.

USD/CHF Exchange Rate by Decade – Detailed Historical Overview

Below is a comprehensive table summarizing the historical evolution of the USD/CHF exchange rate. The table includes average rates, changes relative to the previous decade, and key economic events that shaped each period. All figures have been cross-checked for accuracy.

| Decade | Avg. USD/CHF Rate | Change vs. Prior Decade | Key Economic Highlights |

|---|---|---|---|

| 1970s | ~4.00 | — | Post-Bretton Woods float; rising U.S. inflation; early safe-haven demand for CHF |

| 1980s | ~3.20 | 🔴 -20.0% | Tighter U.S. monetary policy; strengthening Swiss fiscal discipline |

| 1990s | ~2.20 | 🔴 -31.3% | Global economic integration; increased safe-haven flows; post-Cold War uncertainty |

| 2000s | ~1.30 | 🔴 -40.9% | Dot-com bubble burst; global financial crisis; surge in demand for secure assets |

| 2010s | ~0.95 | 🔴 -26.9% | Eurozone crisis; prolonged low interest rates; quantitative easing in major economies |

| 2020s* | ~0.91 | 🔴 -4.2% | COVID-19 pandemic recovery; divergent central bank policies; ongoing safe-haven flows |

*2020s data current as of April 2025

🔴 = USD depreciated vs. CHF

USD/CHF - US Dollar / Swiss Franc Currency Rate

Live Price of USD/CHF. USD/CHF Live Chart, Intraday & Historical Live Chart, Buy Sell Signal, USD/CHF News, USD/CHF Averages, Returns & Historical Data

» USD/CHF

» USD/CHF Real Time Quotes

» USD/CHF Live Chart

» USD/CHF Intraday Chart

» USD/CHF Historical Chart

» USD/CHF Buy Sell Signal

» USD/CHF News

» USD/CHF Videos

» USD/CHF Averages

» USD/CHF Currency Pair

» USD/CHF Historical Data