| Symbol | Last | Change | % | High | Low |

|---|---|---|---|---|---|

| EUR / CHF | 0.9012 | -0.0048 | -0.53% | 0.0000 | 0.0000 |

| Close | GMT Time : Sat Mar 07 2026 15:30 | ||||

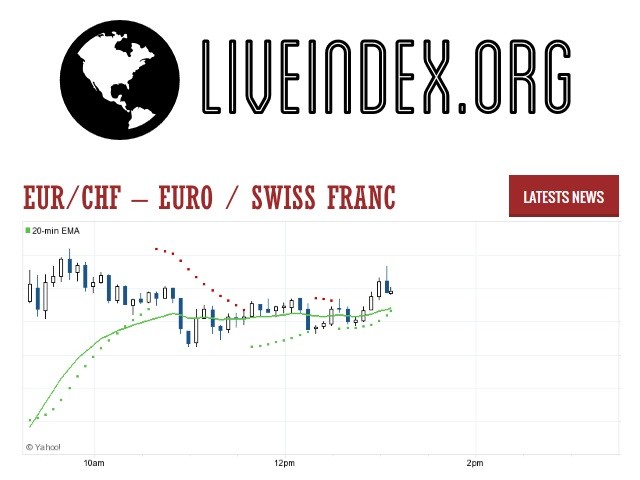

EUR/CHF : Intraday Live Chart

EUR/CHF : Technical Signal Buy & Sell

| 5 Min Signal | 1 Hour Signal | 1 Day Signal |

|---|---|---|

| Buy | Sell | Sell |

EUR/CHF : Moving Averages

| Period | MA 20 | MA 50 | MA 100 |

|---|---|---|---|

| 5 Minutes | 0.90 | 0.90 | 0.90 |

| 1 Hour | 0.90 | 0.90 | 0.91 |

| 1 Day | 0.91 | 0.92 | 0.92 |

| 1 Week | 0.92 | 0.93 | 0.94 |

EUR/CHF : Technical Resistance Level

| Resistance 1 - R1 | Resistance 2 - R2 | Resistance 3 - r3 |

|---|---|---|

| 0.0000 | 0.0000 | 0.0000 |

EUR/CHF : Technical Support Level

| Support 1 - S1 | Support 2 - S2 | Support 3 - S3 |

|---|---|---|

| 0.0000 | 0.0000 | 0.0000 |

EUR/CHF : Periodical High, Low & Average

| Period | High Change from Last | Low Change from Last | Average Change from Last |

|---|---|---|---|

| 1 Week | 0.9110 -0.0098 | 0.0000 +0.9012 | 0.9063 -0.0051 |

| 1 Month | 0.9179 -0.0167 | 0.0000 +0.9012 | 0.9111 -0.0099 |

| 3 Month | 0.9391 -0.0379 | 0.0000 +0.9012 | 0.9227 -0.0215 |

| 6 Month | 0.9391 -0.0379 | 0.0000 +0.9012 | 0.9214 -0.0202 |

| 1 Year | 0.9660 -0.0648 | 0.0000 +0.9012 | 0.9292 -0.0280 |

EUR/CHF : Historical Chart

EUR to CHF Exchange Rate History: A Safe-Haven Perspective on Europe’s Monetary Evolution

The EUR to CHF exchange rate represents one of the most closely watched currency pairs in the global forex market, reflecting not only the dynamics between the eurozone’s economy and Switzerland’s ultra-conservative monetary stance, but also serving as a proxy for risk sentiment in Europe. The Swiss franc (CHF) is widely regarded as a safe-haven currency, sought by investors during times of political or financial turmoil. Meanwhile, the euro, introduced in 1999, has gone through major expansions, crises, and recovery phases that all left their mark on the EUR/CHF pair.

1999–2002: Euro Introduction and Conservative Swiss Policy

The euro was officially launched in 1999, replacing legacy currencies like the Deutsche Mark and French Franc. At the time of launch, the EUR/CHF traded around 1.60. Switzerland, although geographically in the heart of Europe, chose to remain outside the EU, maintaining its monetary independence and low inflation focus.

While the euro faced initial skepticism and weakness, the Swiss franc remained strong, keeping the EUR/CHF rate in a tight range around 1.45 to 1.60. Both economies maintained low interest rates, but Switzerland’s current account surplus and lower inflation boosted CHF demand.

2003–2008: Stability and Mild CHF Strength

During this period, both economies experienced relative stability. The euro strengthened globally due to stronger EU integration, while Switzerland maintained a neutral stance with modest growth.

The EUR/CHF exchange rate remained stable, fluctuating between 1.55 and 1.60, with occasional drops to 1.50 during brief market turbulence. The Swiss National Bank (SNB) stayed conservative, keeping rates close to zero to deter excessive CHF strength.

2009–2012: Global Crisis and the Eurozone Debt Crisis

This was a defining period for EUR/CHF. The 2008 global financial crisis triggered a sharp rise in risk aversion. As a safe-haven currency, the Swiss franc appreciated sharply, and the EUR/CHF rate fell steadily, dropping below 1.40 in 2010.

By 2011, fears of sovereign defaults in the eurozone (Greece, Portugal, Spain) drove investors toward the franc, pushing the rate to 1.01—almost parity. The SNB responded in September 2011 by setting a minimum exchange rate of 1.20 EUR/CHF, calling the franc’s strength “massively overvalued” and threatening to intervene.

2013–2015: SNB Floor and Sudden Removal

For several years, the SNB defended the 1.20 floor, intervening heavily in forex markets. This kept the EUR/CHF rate artificially stable, hovering between 1.20 and 1.24.

However, in January 2015, the SNB shocked markets by abandoning the 1.20 peg, citing unsustainable intervention costs and ECB’s upcoming QE. This caused the EUR/CHF to plummet from 1.20 to 0.98 within minutes, in what became known as “Francogeddon”. The Swiss franc surged almost 30%, triggering market chaos and broker losses.

2016–2019: Stabilization Below Parity Threshold

Following the shock, the EUR/CHF settled into a new range between 1.05 and 1.15. Despite Switzerland’s deeply negative interest rates (as low as -0.75%), the franc remained strong due to Switzerland’s strong macro fundamentals, current account surplus, and low debt.

Throughout this period, political uncertainty in Europe (Brexit, Italian debt concerns, and migration crises) kept investors defensive, further supporting the Swiss franc and capping EUR/CHF upside.

2020–2024: Pandemic, Inflation, and Policy Normalization

The COVID-19 pandemic reignited global risk aversion, causing CHF to appreciate again, with EUR/CHF falling below 1.05 in 2020. Both the ECB and SNB launched emergency liquidity programs, and Switzerland entered deflation briefly.

In 2022–2023, as global inflation surged, the SNB began raising rates faster than the ECB. The Swiss franc continued to gain, and the EUR/CHF hovered between 0.94 and 0.99. Despite higher eurozone interest rates by 2024, safe-haven demand and Switzerland’s fiscal discipline preserved CHF strength.

As of April 2025, the EUR to CHF rate trades near 0.96, with markets watching closely for signals on interest rate cuts from both central banks.

✅ Key:

🟢 = Swiss franc appreciated vs euro

❌ = Swiss franc depreciated vs euro

⚠️ = Minimal change / Range-bound

📊 EUR to CHF Exchange Rate by Decade

| Decade | Avg. EUR/CHF Rate (Approx) | Change vs. Previous Decade | Key Events |

|---|---|---|---|

| 1999–2002 | 1.60 → 1.45 | 🟢 CHF appreciation | Euro launch, Swiss neutrality, moderate CHF strength |

| 2003–2008 | 1.45 → 1.60 → 1.50 | ⚠️ Mostly range-bound | Economic stability, mild franc appreciation |

| 2009–2012 | 1.50 → 1.01 | 🟢 Major CHF appreciation | Eurozone crisis, SNB peg to 1.20 introduced |

| 2013–2019 | 1.20 → 0.98 → 1.10 | 🟢 CHF maintained strength | SNB peg removed, Brexit, EU instability |

| 2020–2024 | 1.05 → 0.94 → 0.96 | 🟢 Continued CHF strength | Pandemic, negative rates, ECB-SNB divergence |

EUR/CHF - Euro / Swiss Franc Currency Pair | EUR/CHF Live Quotes | Euro / Swiss Franc Live Quotes

Live Price of EUR/CHF. EUR/CHF Live Chart, EUR/CHF Intraday & Historical Live Chart. EUR/CHF Buy Sell Signal, EUR/CHF News, EUR/CHF Videos, EUR/CHF Averages, Returns & Historical Data

» EUR/CHF

» EUR/CHF Real Time Quotes

» EUR/CHF Live Chart

» EUR/CHF Intraday Chart

» EUR/CHF Historical Chart

» EUR/CHF Buy Sell Signal

» EUR/CHF News

» EUR/CHF Videos

» EUR/CHF Averages

» EUR/CHF Currency Pair

» EUR/CHF Historical Data