| Symbol | Last | Change | % | High | Low |

|---|---|---|---|---|---|

| EUR / CAD | 1.6159 | +0.0000 | +0.00% | 1.6159 | 1.6166 |

| Close | GMT Time : Sat Feb 14 2026 01:50 | ||||

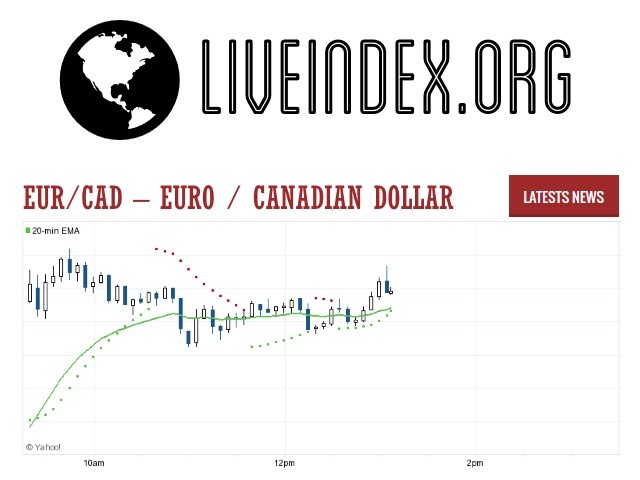

EUR/CAD : Intraday Live Chart

EUR/CAD : Technical Signal Buy & Sell

| 5 Min Signal | 1 Hour Signal | 1 Day Signal |

|---|---|---|

| Buy | Buy | Buy |

EUR/CAD : Moving Averages

| Period | MA 20 | MA 50 | MA 100 |

|---|---|---|---|

| 5 Minutes | 1.62 | 1.62 | 1.62 |

| 1 Hour | 1.62 | 1.61 | 1.61 |

| 1 Day | 1.62 | 1.62 | 1.62 |

| 1 Week | 1.62 | 1.59 | 1.54 |

EUR/CAD : Technical Resistance Level

| Resistance 1 - R1 | Resistance 2 - R2 | Resistance 3 - r3 |

|---|---|---|

| 1.6157 | 1.6152 | 1.6150 |

EUR/CAD : Technical Support Level

| Support 1 - S1 | Support 2 - S2 | Support 3 - S3 |

|---|---|---|

| 1.6164 | 1.6166 | 1.6171 |

EUR/CAD : Periodical High, Low & Average

| Period | High Change from Last | Low Change from Last | Average Change from Last |

|---|---|---|---|

| 1 Week | 1.6181 -0.0022 | 0.0000 +1.6159 | 1.6140 +0.0019 |

| 1 Month | 1.6352 -0.0193 | 0.0000 +1.6159 | 1.6165 -0.0006 |

| 3 Month | 1.6352 -0.0193 | 0.0000 +1.6159 | 1.6171 -0.0012 |

| 6 Month | 1.6434 -0.0275 | 0.0000 +1.6159 | 1.6199 -0.0040 |

| 1 Year | 1.6434 -0.0275 | 0.0000 +1.6159 | 1.5968 +0.0191 |

EUR/CAD : Historical Chart

EUR to CAD Exchange Rate History: Navigating Europe’s Currency Against Canada’s Resource Economy

The EUR to CAD exchange rate reflects the evolving dynamics between the eurozone’s monetary framework and Canada’s commodity-driven economy. Since the euro’s debut in 1999, the EUR/CAD pair has been influenced by central bank divergence, energy and metal cycles, global risk sentiment, and macroeconomic policy shifts. With the Canadian dollar (CAD) often dubbed a “petro-currency” due to its reliance on oil exports, and the euro being one of the most traded currencies globally, this pair offers insight into global economic flows and investor preferences.

1999–2002: Euro Launch and Canadian Dollar Weakness

The euro was officially introduced in 1999, and opened trading against the Canadian dollar at around 1 EUR = 1.50 CAD. In its early years, the euro faced skepticism about the EU’s cohesion, while Canada was grappling with fiscal adjustments and low oil prices.

During this time, the euro weakened globally, but the Canadian dollar underperformed even more. As a result, the EUR/CAD rate rose, peaking around 1.58 by 2001, supported by the ECB’s cautious tightening and Canada’s high public debt.

2003–2008: Commodities Boom Favors CAD

From 2003 onwards, Canada entered a commodity supercycle, fueled by rising crude oil and metals prices. Global demand—particularly from China—boosted Canadian exports, leading to CAD strength. Meanwhile, the euro appreciated against the U.S. dollar, but underperformed against resource currencies.

As a result, the EUR/CAD rate declined from 1.58 in 2003 to 1.43 by 2007, and briefly touched 1.38 in early 2008. The Bank of Canada (BoC) began tightening interest rates earlier than the ECB, which also contributed to the narrowing spread.

2009–2012: Global Crisis and Eurozone Turmoil

The 2008 global financial crisis and subsequent eurozone debt crisis significantly altered EUR/CAD dynamics. The euro gained sharply in early 2009, reaching 1.65, as investors feared economic stagnation in Europe and flight-to-safety flows moved toward the USD and CAD.

From 2010 to 2012, fears of sovereign defaults in Greece, Spain, and Italy weakened the euro’s credibility. The Canadian economy, underpinned by strong banking institutions and better fiscal metrics, helped the CAD regain strength. The EUR/CAD rate fell back to the 1.29–1.32 range by 2012.

2013–2019: Oil Price Collapse and Policy Divergence

Between 2013 and 2014, the EUR/CAD pair remained largely stable between 1.30 and 1.45, supported by moderate oil prices and ECB liquidity injections. However, in late 2014, crude oil prices crashed, and the Canadian dollar suffered major losses.

The EUR/CAD pair surged to 1.55 by 2015, as the BoC cut rates and the ECB launched its Quantitative Easing (QE) program. Despite periods of CAD recovery between 2016 and 2018, the euro remained buoyant in relative terms, with the rate oscillating between 1.45 and 1.52.

By 2019, global growth concerns and trade tensions further pressured the Canadian dollar, while the euro remained stable despite political challenges in Italy and Brexit uncertainty.

2020–2024: Pandemic Shock, Inflation, and Central Bank Reactions

The COVID-19 pandemic hit both the eurozone and Canada hard, but Canada’s recovery was comparatively swift due to strong vaccination, energy exports, and robust government stimulus.

In 2020, EUR/CAD climbed to 1.59, but by late 2021, it had fallen sharply to 1.42, as the BoC was among the first to signal rate hikes while the ECB remained dovish. The pair continued to see volatility through 2022–2023, reacting to ECB’s late tightening, BoC’s aggressive policy, and shifting oil dynamics.

As of April 2025, the EUR to CAD exchange rate stands around 1.47, with traders closely watching Canada’s inflation outlook, European GDP momentum, and interest rate differentials.

✅ Key:

🟢 = Canadian dollar appreciated vs euro

❌ = Canadian dollar depreciated vs euro

⚠️ = Minimal change / Range-bound

📊 EUR to CAD Exchange Rate by Decade

| Decade | Avg. EUR/CAD Rate (Approx) | Change vs. Previous Decade | Key Events |

|---|---|---|---|

| 1999–2002 | 1.50 → 1.58 | ❌ CAD depreciation | Euro launch, Canadian debt drag, weak oil prices |

| 2003–2008 | 1.58 → 1.38 | 🟢 CAD appreciation | Commodity supercycle, BoC hikes, rising exports |

| 2009–2012 | 1.38 → 1.32 | 🟢 CAD appreciation | Eurozone debt crisis, safe-haven flows, Canadian banking strength |

| 2013–2019 | 1.32 → 1.52 | ❌ CAD depreciation | Oil collapse, QE from ECB, global growth concerns |

| 2020–2024 | 1.52 → 1.47 | ⚠️ Slight CAD appreciation | Pandemic, BoC early hikes, ECB policy lag, energy price swings |

The EUR/CAD exchange rate remains a vital barometer for eurozone fiscal confidence and Canada’s export performance. As both central banks enter the next phase of policy normalization, and global commodity trends remain volatile, the EUR/CAD pair continues to be a key focus for institutional investors, importers, and global macro traders.

EUR/CAD - Euro / Canadian Dollar Currency Pair | EUR/CAD Live Quotes | Euro / Canadian Dollar Live Quotes

Live Price of EUR/CAD. EUR/CAD Live Chart, EUR/CAD Intraday & Historical Live Chart. EUR/CAD Buy Sell Signal, EUR/CAD News, EUR/CAD Videos, EUR/CAD Averages, Returns & Historical Data

» EUR/CAD

» EUR/CAD Real Time Quotes

» EUR/CAD Live Chart

» EUR/CAD Intraday Chart

» EUR/CAD Historical Chart

» EUR/CAD Buy Sell Signal

» EUR/CAD News

» EUR/CAD Videos

» EUR/CAD Averages

» EUR/CAD Currency Pair

» EUR/CAD Historical Data