Market Live: Sensex, Nifty under pressure; Sun Pharma soars over 3%

11:45 am Buzzing: Shares of PVV Infra is locked at 5 percent upper circuit post it has received an order from Tata Trusts for pre-cast demo of individual household latrine (IHHL) installation at Kesarapalli village, Krishna district, Andhra Pradesh.

Tata Trusts is partnering with Andhra Pradesh government by developing 264 villages covering 2.5 lakh households in Krishna district, Andhra Pradesh, for improved drinking water and sanitation systems and several livelihood enrichment programmes.

“Due to our EPS building system, featuring fast, reliable insulation, anti – seismic properties, typhoon – resistance, reliability, light weightedness, simplicity/fast to erect, durability and cost effectiveness, we are confident that we will be getting a sizeable bulk order from the total installations planned once the demo unit is approved,” company said in press release.

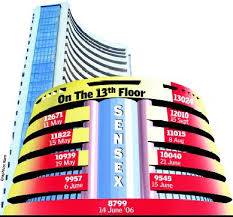

11.26 am Market Check: Equity benchmarks remained under pressure in morning trade, with the Nifty struggling below 9500 level following correction in Asian peers.

The 30-share BSE Sensex was down 49.59 points at 30,807.93 and the 50-share NSE Nifty fell 16.95 points to 9,487.15.

Sun Pharma was the biggest gainer among Sensex stocks, up more than 3 percent.

11:15 am USFDA approval: Cadila Healthcare share price gained more than a percent intraday after receiving approval from the US health regulator for drug that is used for obesity.

Zydus Cadila has received the final approval from the US Food and Drug Administration to market Phentermine hydrochloride orally disintegrating tablets.

The drug is used together with diet and exercise to treat obesity (overweight) in people with risk factors such as high blood pressure, high cholesterol or diabetes.

Phentermine, which is in strengths of 15 mg, 30 mg and 37.5 mg, will be produced at the group’s formulation manufacturing facility at Moraiya in Ahmedabad, the company said.

10:55 am Buzzing: Share price of Unichem Laboratories surged 6.5 percent intraday as its Goa facility has received Establishment Inspection Report from USFDA.

The company’s formulations manufacturing facility at Goa has received an Establishment Inspection Report (EIR) from the United States Food and Drug Administration (USFDA).

The company’s 54th annual general meeting (AGM) of the company will be held on July 22, 2017.

10:40 am Downgrade: Shares of Fortis Healthcare were under pressure after Nomura downgraded the stock to neutral, making investors cautious. The stock fell around 4 percent intraday on the back of this development.

The brokerage house highlighted how the revenue growth has remained muted over the past two years. There is a industry slowdown in both hospitals and diagnostics segments.

“With increased competition and pricing pressure, we reduce our long-term expectations for growth and margins. We now expect long-term EBITDA margins for SRL at 25% vs 30% earlier,” the brokerage house said in its report.

10.17 am Market Check: Equity benchmarks continued to reel under selling pressure, with the Sensex down 91.93 points at 30,765.59, dragged by banks, auto and infra stocks.

The 50-share NSE Nifty struggled below 9500, down 27.10 points at 9,477 on weak market breadth. About five shares declined for every four shares rising on the BSE.

L&T, HDFC, HDFC Bank, ICICI Bank, Reliance Industries, Bharti Airtel, Maruti and Tata Motors were down 0.5-2 percent whereas ITC, Sun Pharma and Dr Reddy’s Labs gained 1-2.5 percent.

10:04 am Bumper Listing: Central Depository Services (CDSL) shares debuted with 68 percent gains on the National Stock Exchange. The share price opened at Rs 250 against the issue price of Rs 149.

The bumper listing was on expected lines as the issue has overwhelming response, oversubscribing 170 times. The grey market premium also indicated the strong listing.

At 10:04 am, the stock price was trading at Rs 264.80, up 77.7 percent, with volume of 1.5 crore shares after hitting a high of Rs 268 in morning trade.

9:50 am CDSL pre-opening: CDSL shares settled at Rs 250 in pre-opening trade, up by 67.78 percent or Rs 101 over its issue price of Rs 149.

It was on expected lines as the issue oversubscribed 170 times.

9:35 am IPO: The Reserve bank of India (RBI) has removed restrictions placed on purchase of shares in AU Small Finance Bank by foreign investors with the total foreign investment coming below the threshold caution limit.

The aggregate limit of total foreign investment that can be received by the company shall remain at 49 percent, the RBI said in a release. The restrictions placed on “the purchase of shares of the above company are withdrawn with immediate effect”, the release said.

AU Small Finance Bank (SFB) has hit the capital market with an IPO to raise around Rs 1,900 crore. Its share sale of 3,76,95,520 shares was oversubscribed 1.36 times on the second day of the offer on Thursday.

9:25 am CDSL to debut: After overwhelming response to issue price, Central Depository Services (CDSL) is all set to make its debut today. The final issue price is fixed at Rs 149, the higher end of price band.

According to sources, the grey market premium for the stock is around Rs 90-100, which indicated that the listing may be around Rs 225-250 per share.

9:15 am Market Check: The market started off July series on a weak note, with the Nifty falling below 9500 level on weakness in banks stocks.

The 30-share BSE Sensex was down 115.22 points at 30,742.30 and the 50-share NSE Nifty slipped 37.20 points to 9,466.90.

Asian Paints, Tech Mahindra, Tata Motors, Tata Motors DVR, HDFC, HDFC Bank and Kotak Mahindra Bank were under pressure while Bank of Baroda and Sun Pharma gained in early trade.

The broader markets were also under pressure, with the Nifty Midcap down 0.5 percent as about two shares declined for every share rising.

Jaypee Infratech, Aditya Birla Money, Aditya Birla Nuvo, Grasim Industries, Amtek Auto, Metalyst Forging and Shiva Cement gained 1-7 percent.

Fortis Healthcare was down 2.5 percent on Nomura downgrade. Jain Irrigation, Havells India, DCB Bank and InterGlobe Aviation were also under pressure.

The Indian rupee slipped 9 paise in the early trade at 64.72 per dollar versus 64.63 Thursday.

Ashutosh Raina of HDFC Bank expects the pair to trade in a range of 64.50-64.90/dollar for today.

Asian markets lost ground despite China manufacturing activity beating expectations. Japan’s Nikkei 225 dropped 1.08 percent while the Kospi slipped 0.2 percent and Australia’s S&P/ASX 200 pulled back 1.45 percent. Hong Kong’s Hang Seng Index declined 0.88 percent. On the mainland, the Shanghai Composite was off by 0.18 percent.