If the stock market seemed like it was zooming along during the dot-com boom of 1999—later to become known as a bubble—just try keeping up with it in 2016.

The Dow Jones industrial average, already trading at record highs, came within 60 points of breaking 20,000 on Thursday, a milestone that would be unprecedented in more ways than one.

After all, the Dow just surpassed 19,000 for the first time less than a month ago—two days before Thanksgiving. That was only 23 days ago, or 16 trading days (15.5 if you account for the stock market’s early close on Black Friday).

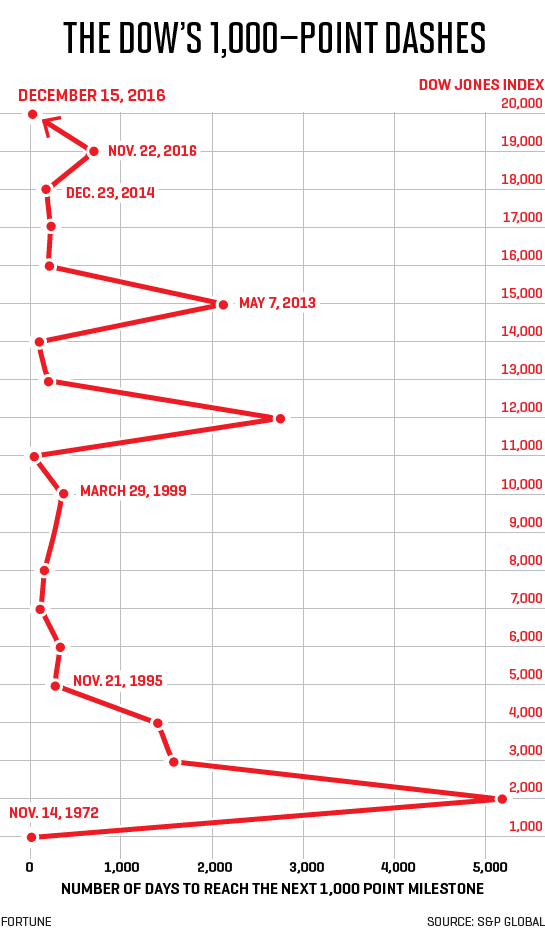

Hitting 20,000 would not only mark a new record level for the Dow, which has been setting new records almost every trading day since Donald Trump won the election, it would also break a much rarer record for speed. The last time the Dow Jones industrial average rose 1,000 points so quickly was in May 1999, in the middle of dot-com hysteria. And that time it took 35 days for the Dow to go from 10,000 to 11,000, according to S&P Global.

There’s a mathematical reason for the Dow’s acceleration: The higher the index goes, the less it has to rise in percentage terms to surpass the next milestone. Think of it like a snowball rolling down a hill. As the snowball picks up more snow with each rotation, getting larger and larger, it rolls even faster.

For example, the Dow first closed above 1,000 in November 1972. But to hit 2,000, the Dow had to double, or gain 100%—which took more than 14 years, until January 1987. In 1999, when the Dow hit 11,000, it had to rise 10% in 35 days. This time, to hit 20,000, the Dow only needs to rise just more than 5% from its last milestone of 19,000.

Take that into account, and the recent run to 20,000, in what would be the shortest number of days, isn’t actually the fastest. That title would go to that Dow run from 10,000 to 11,000 in 1999 over 35 days. Back then, the market rose at an annualized pace of 172%. The most recent 1,000-point dash only measures at an annualized pace of 93%, which would still be the second fastest in history.

Before investors start cheering the 20,000-point finish line, though, there is something to remember: The Dow doesn’t always go up. Sometimes it falls down, way down, and it takes a very, very long time to return to its peak level again.

Just take a look at what happened after its record-fast rise in May 1999. The Dow reached a new peak of 11,722.98 in January 2000, but then the dot-com bubble burst. It took a full 7.5 years (2,726 days) for the Dow to hit its next milestone of 12,000, in October 2006.

After it hit 14,000 at the height of the housing bubble in 2007—less than three months after passing 13,000—the Dow wouldn’t gain another 1,000 points until six years later, in May 2013.

So if and when the Dow hits 20,000 in record time, just remember this: We may have to endure another stock market crash before it takes its next big step up.