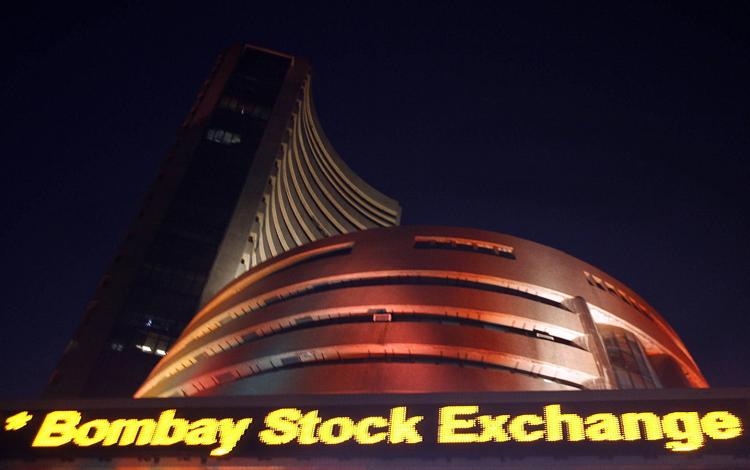

India : Sensex sinks 389 pts, Nifty ends below 8000 on growth worries

It was a disappointing start to the week on Monday as equity benchmarks erased all 2016 gains. The BSE Sensex shed 432 points intraday as concerns over economy & earnings growth after demonetisation and consistent outflow of funds on fears of likely Fed rate hike in December policy dented the market sentiment.The 30-share BSE Sensex closed below the psychological 26000 level, down 385.10 points or 1.47 percent at 25765.14. The index fell for the sixth consecutive session today, the biggest losing streak since March 2015.

Dealers say margin calls triggered after the 50-share NSE Nifty breached the 8000-mark. It plunged 145 points or 1.80 percent to close at 7929.10.

Big brokerage houses started lowering earnings and GDP growth estimates to factor in the impact of demonetisation.

Deutsche Bank expects the remainder of 2016 to be highly uncertain, which will keep markets volatile with a downward bias. It cut December 2016 Sensex target to 25,000 (from 27,000 earlier) as India will not remain immune to the outflow pressure seen across emerging markets, though balance of payments situation has improved sharply since the taper tantrum in May 2013.

While setting new Nifty target at 7500, Jefferies reduced its FY18 earnings growth estimates to 15 percent from 20 percent. Citi also lowered multiple to 15x (from 17x) one year forward consensus earnings to factor in uncertainty.

DBS has warned of major downside risks to growth due to the demonetisation exercise, and has estimated that the gross value added can come down by up to 0.80 percent lower than its 7.6 percent target.

The broader markets continued to underperform benchmarks as the BSE Midcap and Smallcap indices were down around 3 percent each on weak breadth. About five shares declined for every share rising on the exchange.

Meanwhile, bringing some relief for banks and non-banking finance companies (NBFCs) from demonetisation, the Reserve Bank of India today relaxed certain asset classification and provisioning norms in certain cases. The central bank has decided to allow banks 60 more days for recognition of loans as standard in certain cases. The revised norm is applicable for loans payable between November 1 and December 31.

Banks hit hardest with the Nifty Bank index falling 2.7 percent and PSU Bank down 6.9 percent. Bank of Baroda, PNB, SBI, Canara Bank, Allahabad Bank, OBC and Union Bank plunged 5-9 percent. HDFC Bank, ICICI Bank and Axis Bank fell over a percent.

Auto stocks like Tata Motors, Mahindra & Mahindra, Maruti Suzuki were down 3-3.5 percent while Tata Steel and BHEL slipped 3.5-4 percent. Reliance Industries and Sun Pharma bucked the trend with marginal gains.

ONGC ended higher as government will bear entire burden on sale of PDS kerosene and subsidised LPG for FY17. Technology stocks like Wipro, Mindtree, TCS and Tech Mahindra gained 0.2-1 percent on further fall in rupee.

European stocks were higher amid pause in dollar upside and rise in crude oil prices. France’s CAC, Germany’s DAX and Britain’s FTSE gained around half a percent, at the time of writing this article.