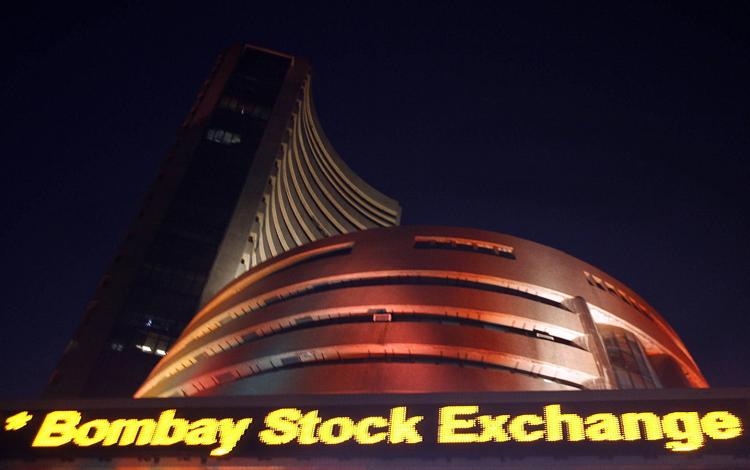

India : Selling in Europe drags Sensex below 28k, Nifty marginally lower

After trading higher from the opening, equity benchmarks lost shine in afternoon trade to close marginally lower on Tuesday, especially due to selling in the European stocks. Overall the market remained in a consolidation mode as investors still eagerly waited for the GST bill that is likely to be tabled in the Rajya Sabha on Wednesday.The 30-share BSE Sensex ended below the psychological 28000-mark, down 21.41 points at 27981.71. The 50-share NSE fell 13.65 points to 8622.90.

Experts feel the market may continue to consolidate till the verdict of GST bill. They don’t expect sharp correction in near term due to consistent support of the foreign money.

“We believe that market has been already rallying in expectation of passage of the GST. Since much of the benefits are in the long-term, the extent of the short-term rally will depend on the finalised tax rate, product exemption list and the time of implementation,” Vinod Nair of Geojit BNP Paribas Financial Services said.

Foreign institutional investors bought more than Rs 11,000 crore worth of equity shares in the month of July against Rs 5,174 crore worth of buying in June.

Even the August in terms of foreign money inflow started on a positive note as FIIs purchased more than Rs 700 crore worth of shares on August 1 (as per provisional data available on the exchange).

The broader markets’ fall was higher compared to benchmarks. The BSE Midcap and Smallcap indices were down 0.6-0.8 percent due to weak market breadth. About two shares declined for every share rising on the exchange.

European stocks were lower with the France’s CAC and Germany’s DAX down 1.5 percent each, dragged down by banking shares as worries about the health of the region’s lenders continued to weigh on sentiment. Britain’s FTSE declined half a percent at the time of writing this article.

Asian markets ended lower with Japan’s Nikkei 225 falling 1.5 percent. Japan’s cabinet approved 13.5 trillion yen (USD 132.04 billion) in fiscal measures today.

India’s largest private sector lender ICICI Bank continued to correct, down 1.5 percent on top of 5 percent fall in previous session after bad asset quality performance that resulted 25 percent fall in profit in Q1 on yearly basis.

Lupin lost over a percent after the Competition Commission of India imposed penalty of Rs 73 crore due to anti-competitive practice in Karnataka.

Tata Motors shed 2.8 percent despite 7 percent sales growth in July while Maruti Suzuki rose 2.5 percent on top of 2.4 percent rally in previous session after the car maker hiked prices of select models from Rs 1,500-Rs 5,000 and reported a 12.7 percent growth in July sales.

Tech Mahindra was up 1.85 percent after Q1 revenue met expectations and profit beat estimates, though operational performance was a miss. HCL Technologies gained 2.6 percent ahead of June quarter earnings.

ITC was the biggest gainer, up 3.7 percent followed by Hero Motocorp and ONGC with over a percent rise while HDFC fell more than 2 percent. Adani Ports, Bharti Airtel, Wipro, Cipla and BHEL were down 1-2 percent.

Indian Bank rallied 20 percent after stellar performance and stable asset quality in June quarter while InterGlobe Aviation tanked 11 percent as Q1 net profit declined 7.4 percent to Rs 591.7 crore on yearly basis.