You hear a lot of complaining about the state of the labor market these days, but human resources are actually one thing Corporate America is willing to pay up for.

As the Federal Reserve’s monetary policy committee, the FOMC, pointed out in the statement following its July meeting, job growth has been quite strong of late, but one of the most important factors holding back the U.S. economy is weak “business fixed investment.”

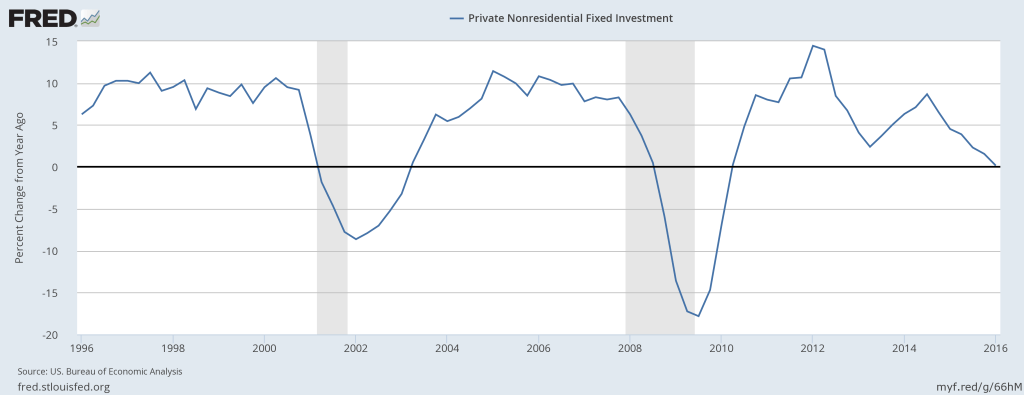

To put that into plain English, businesses are not investing in plants, property, and equipment. And as you can see from the following chart, that has largely been the case since the end of the Great Recession except for a brief period in 2012.

Capital investment by businesses has actually become a drag on growth, falling 2.1% in the final quarter of 2015 and 4.5% in the first quarter of 2016. That’s quite uncommon for periods in which the overall economy is growing, and especially when employment growth is so strong.

So what’s going on here? Some analysts have pointed to the recent decline in oil prices as a reason because that hurts energy industry spending, which tends to be capital intensive. Others have used the occasion to complain about taxes and regulation as the cause. But as Jason Furman, the Chairman of President Obama’s Council of Economic Advisors has written, these arguments don’t explain the fact that business investment has been on the decline all across the wealthy world.

He argues that there are likely two more plausible reasons for the global slump in investment. One is simply the overall sluggish growth experienced by the wealthy world today. “In the United States as well as in many of the other advanced economies, investment growth has largely been consistent with the recovery in business output,” he writes. Because output growth has just been so slow, business are pessimistic that they’ll need much more capacity in the future.

He also argues that the sort of firms that are having success in today’s economy—information technology companies like Google and Facebook—simply require less investment in expensive equipment than other sorts of companies like manufacturing firms. This hypothesis is supported by data that shows that investment in intellectual property has grown faster since the recession than investment in hard assets.

Either way, keeping rates lower for longer isn’t likely to do much to get businesses to spending more. As a result, this is likely an economic weakness that Janet Yellen and the Fed will have to live with.