Housing Bubbles Are Everywhere!

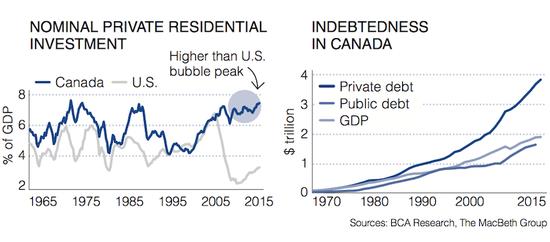

The housing bubble currently plaguing Canada’s major metro markets has been getting a lot of press lately. The statistics are fairly daunting.

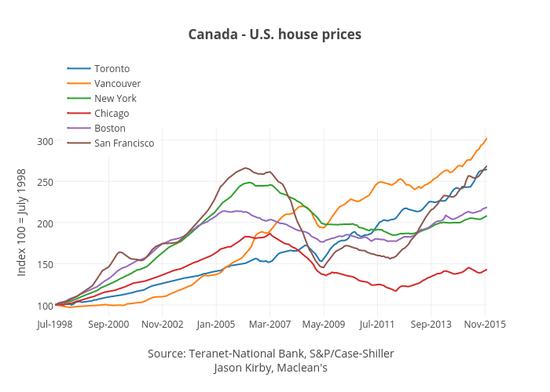

Compared to 2015 levels, the Vancouver area saw average home prices increase by 25% with a median selling price of $ 1,098,599. This year, Royal LePage expects Vancouver prices to rise another 27% along with a 15% rise in the Toronto market. “I believe it is the highest value put forward by a serious forecasting agency since the turn of the century,” said Royal LePage’s CEO.

The rapid rise in housing costs are concerning because Canadian citizens are already fairly stretched. A new survey by Bank of Montreal (NYSE:BMO) found that almost one-quarter of Canada’s citizens are still living paycheck to paycheck. Roughly 25% of respondents said they had hardly anything set aside, and more than half reported having less than $ 10,000 in emergency funds. Almost one-third of first-time home buyers reported that they borrowed money from close acquaintances to help afford their down payments.

The Canadian housing bubble is fairly contained. Because prices are rising so quickly in just a handful of cities like Vancouver and Toronto, the average home price statistic is skewed higher than that with which most Canadians are actually dealing. Most analysts point to areas like Alberta andSaskatchewan — which are experiencing housing price declines — to demonstrate that the bubble, while real, isn’t completely pervasive.

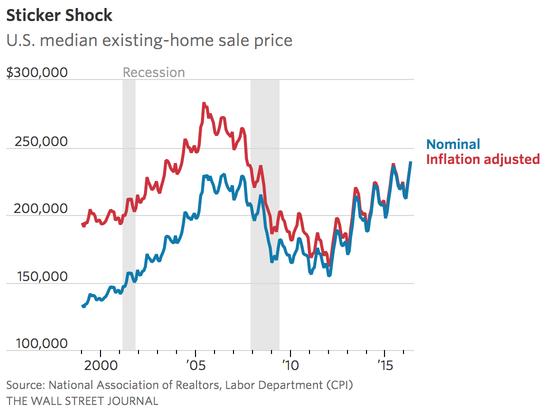

The same can be said of many U.S. cities. While the average U.S. home price has yet to reach an historic high, many individual cities have seen prices increase at rates equal to Vancouver, an undeniably overpriced market.

For example, after falling 30% during the recession, median home prices in San Francisco have rebounded by over 90% since 2012. Miami prices, which plunged 69%, are up over 140% from their lows. Even Manhattan, which only experienced a 20% decline during the crisis, has seen prices surge by over 50%.

Some experts are already arguing that many U.S. cities are overheated.

“When you start seeing 20% to 30% year-over-year increases in prices, which we’ve seen over the last four years in some of these markets, it’s just not sustainable,” said Daren Blomquist, a senior vice president at RealtyTrac. “People’s wages are not rising 20% or 30% a year.” It looks like history may yet again repeat itself, albeit on a localized level. “It is disturbing to think we could potentially be repeating mistakes that were made just within the last 10 years,” Blomquist added.

If you think real estate bubbles are confined to just a few North American cities, think again.

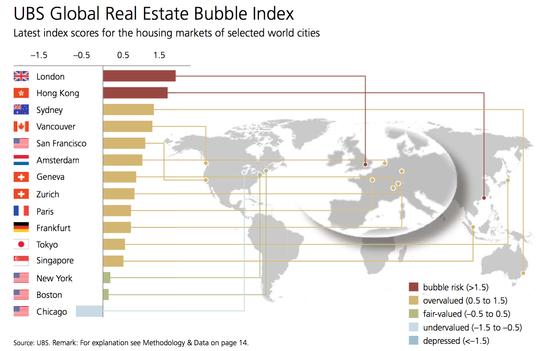

It now takes an average skilled worker 14 years to buy a 600-square-foot one-bedroom apartment in London, the equivalent of renting it for 30 years. The UBS global real estate bubble index for 2016 predicts declines in 10 major cities this year, saying that a majority of world cities are significantly overvalued.

According to the report:

“Real estate prices in many global cities have doubled since 1998 in real terms. On average, they are higher than they were before the 2007-2008 financial crisis. A mix of optimistic expectations, favorable economic fundamentals and capital inflows from abroad has caused valuations to soar in certain cities in recent years. Loose monetary policy has prevented a normalization of housing markets and encouraged local bubble risks to grow.”

While the averages don’t show the whole story, it’s very likely that the real estate markets of many major global cities are headed for a meltdown.