China : Corporations and State Owned Enterprises will need another bailout

Here we go again. China is primed for more bailouts as their corporations and State Owned Enterprises (SOE) continue burning through billions of yuan. At the turn of the month we learned Sinopec manipulated revenues. As Reuters reported at the time, some 12 subsidiaries of Sinopec had fake invoices among other faults. Chinese companies are loading up on debt and they are investing it terribly.

Reuters also said 10 state-owned firms had “huge losses” driven primarily from bad investment decisions. Sinopec subsidiaries blew cash on 14 unused chemical plants as well acquiring two dozen fuel stations illegally.

“China’s national audit department reviewed the financials of the 10 largest state-owned companies including Aluminium Corporation of China (CHALCO), Sinopec and China National Offshore Oil Corporation (CNOOC), exposing huge losses in these firms as a result of low efficiency and bad investment decisions. The auditing office also pointed to wasted investments Sinopec’s subsidiaries made, such as 14 unused chemical plants, and raised red flags on two dozen “illegally acquired” fuel stations.“

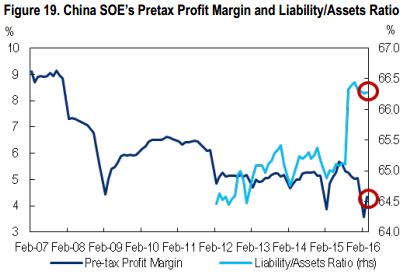

Oh yeah, these guys are real winners when it comes to running business and making investments. As Citi pointed out, China’s SOE’s have Pre-tax Profit Margins and Liability-to-Asset ratios that do not appear to reflect wise decision making:

China’s corporations are horrible with investment. We are not shocked by this. We expect many more Chinese bailouts to come as the country’s money-gods lose total control of the monster they have unleashed through reckless monetary policy.

The investment decisions have become so bad that a source told Bloomberg that up to 10 SOE’s may require a bail out:

In an effort to throw the kitchen sink plus more at the equity market, China will now be deferring a portion of a $ 300 billion pension fund into the Chinese market. A wise choice? Perhaps not, especially since the Chinese have painted themselves into another bailout corner.

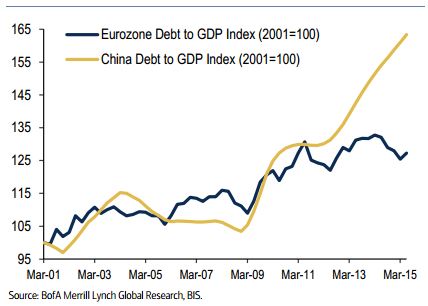

With malinvestment as we saw re: Sinopec, to China’s need to backstop at least 10 failing state-owned enterprises, and now the clear desperation of getting pension money exposed to the equity market, presumably ahead of more central bank stimulus, it’s becoming evident that the Chinese are running out of options. Once the entire nation is invested in stocks and the central bank is buying hand over fist, the Chinese market manipulation will have jumped the shark, because their explosive Debt-to-GDP didn’t seem to mark a turning point in the Chinese economic story as of yet:

But don’t worry, the National Council for Social Security Fund in China that will manage the pension fund investments has an appreciation from the Chinese people akin to what some believe American’s have for Warren Buffett, reportedly:

China just burning cash and it is amazing they have lasted this long. How much longer will the cash pile burn? Maybe MOAR cash infusions is the answer…