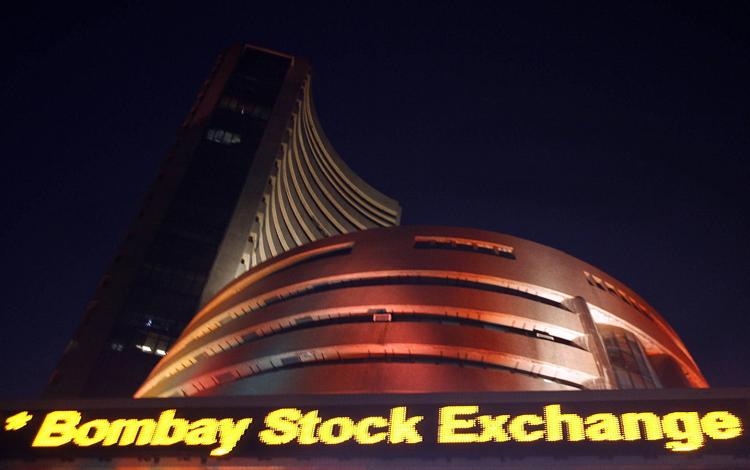

India : Sensex, Nifty close higher; Lupin soars 8 pct, Tata Steel down 5 pct

Mumbai : After a consolidation, equity benchmarks closed marginally higher.The Sensex was up 34.62 points at 27201.49 and the Nifty gained 7 points at 8342.95. The market breadth remained positive as about 1556 shares advanced against 1203 declining shares on BSE.

Lupin surged 8 percent in late trade after the company received establishment inspection report from the USFDA for Goa facility.

HDFC, HDFC Bank, ITC, HUL, Dr Reddy’s Labs and Cipla gained 1-3 percent while TCS, Infosys, Tata Steel, L&T, Adani Ports, ONGC and SBI fell 1-5 percent.

Claris Lifesciences shares gained more than 13 percent intraday on approval from the US health regulator for anti-bacterial injection.

The estimated market size in the US is USD 6 million and the product is currently in shortage list of US Food & Drug Administration.

With this, Claris now has a total of 14 approvals and 24 under approval ANDAs.

About 1632 shares advanced against 1064 declining shares on BSE.

Nomura has maintained buy rating on CESC, the Kolkata-based power utility company, but raised target price by Rs 20 percent to Rs 725 on likely solid earnings growth. The stock gained nearly 2 percent.

“We raise SOTP-based target price by 20 percent to Rs 725, largely on account of the higher value of the Haldia project, core business, and CESC’s holding in Firstsource,” says the brokerage.

It believes a solid earnings growth outlook, healthy balance sheet and imminent free cash flow generation peg CESC amongst the better placed independent power plants (IPPs) in India.

India’s economy may grow at a slightly slower pace of 7.4 per cent this fiscal amid weaker global demand and risk aversion, says an HSBC report, flagging “methodological concerns” in computation of official GDP data.

According to the global financial services major, some of the factors that are weighing on the economy include weaker global demand, banking sector risk aversion, sluggish domestic private investment, gradually climbing oil prices, and statistical auto-correction in growth prints.

“All considered, we expect GDP growth to slow gently from 7.6 per cent last year to 7.4 per cent in 2016-17 and further to 7.2 per cent in 2017-18,” HSBC said in a research note, adding that despite lower prints, this will be among the best growth performances globally.

India’s first quarter GDP growth print was 7.9 per cent y-o-y, primarily led by urban consumption demand.

PNB surges over 4%, housing finance arm files for Rs 2500 cr IPO

FMCG, banking & financials and pharma stocks supported the market while IT and auto stocks were under pressure.

Equity benchmarks gained strength in afternoon trade as European markets extended early rally with the FTSE’s Britain, Germany’s DAX and France’s CAC rising 1-1.6 percent.

Europe’s higher open follows a rebound in the US on Wednesday on the back of a rise in oil prices and dovish minutes from the U.S. Federal Reserve’s June meeting.

Federal Reserve policymakers said it was prudent to wait for more data and the Brexit vote result before raising rates, and cited a slowdown in hiring as a reason to keep rates unchanged last month, according to meeting minutes released Wednesday afternoon. The non-farm payrolls report due Friday will be the next key data followed by markets.

Oil prices rose, supported by a report of another fall in US crude inventories as well as a weaker dollar, although a glut of refined products and economic growth concerns continue to weigh on markets. International Brent crude oil futures were trading at USD 49.20 per barrel, up 40 cents from their last settlement. US West Texas Intermediate (WTI) crude was up 44 cents at USD 47.87 a barrel.