These Investing Legends Are Preparing For A Crash

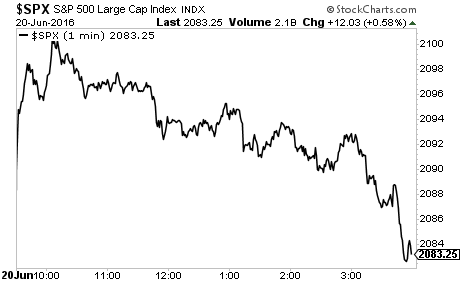

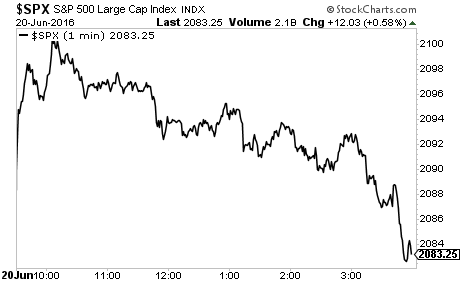

Stocks exploded higher last week on hopes that the tragedy in Britain would not result in a Brexit.

The ramp job continued into Monday morning… but there it ended. Stocks erupted higher Monday morning but then gradually gave back most of their gains.

The fact of the matter is Brexit or no, the world is facing a huge amount of negative developments.

Globally over $ 10 trillion in bonds are trading with negative yields. This, in of itself, is the makings of a tremendous crisis. With negative yields, bondholders are forced to pay the issuer for the right to lend money.

However, the far bigger issue is the $ 200+ trillion in interest rate based derivatives. The big banks use sovereign bonds, such as German Bunds, as collateral to backstop the derivatives markets.

Globally over $ 10 trillion in bonds are trading with negative yields. This, in of itself, is the makings of a tremendous crisis. With negative yields, bondholders are forced to pay the issuer for the right to lend money.

However, the far bigger issue is the $ 500+ trillion in interest rate based derivatives. The big banks use sovereign bonds, such as German Bunds, as collateral to backstop the derivatives markets.

With the number of bonds with negative yields growing daily, the derivatives markets are forced to price in yields at levels never before seen by humanity.

This is a ticking time bomb waiting to go off. No less than the Bond King Bill Gross has stated that we’re heading for a massive crisis. Investing legends Carl Icahn, George Soros, and Stanley Druckenmiller are all taking out MASSIVE trades to profit from a market collapse.

Say what you will about any of these individuals, ALL of them are masters of the financial markets. And ALL of them are preparing for a CRASH.