Investors greet inflation progress with cautious optimism

New signs of cooling inflation sparked market gains last week. But is the pain from inflation—and the Federal Reserve’s interest-rate-raising campaign to fight it—really over?

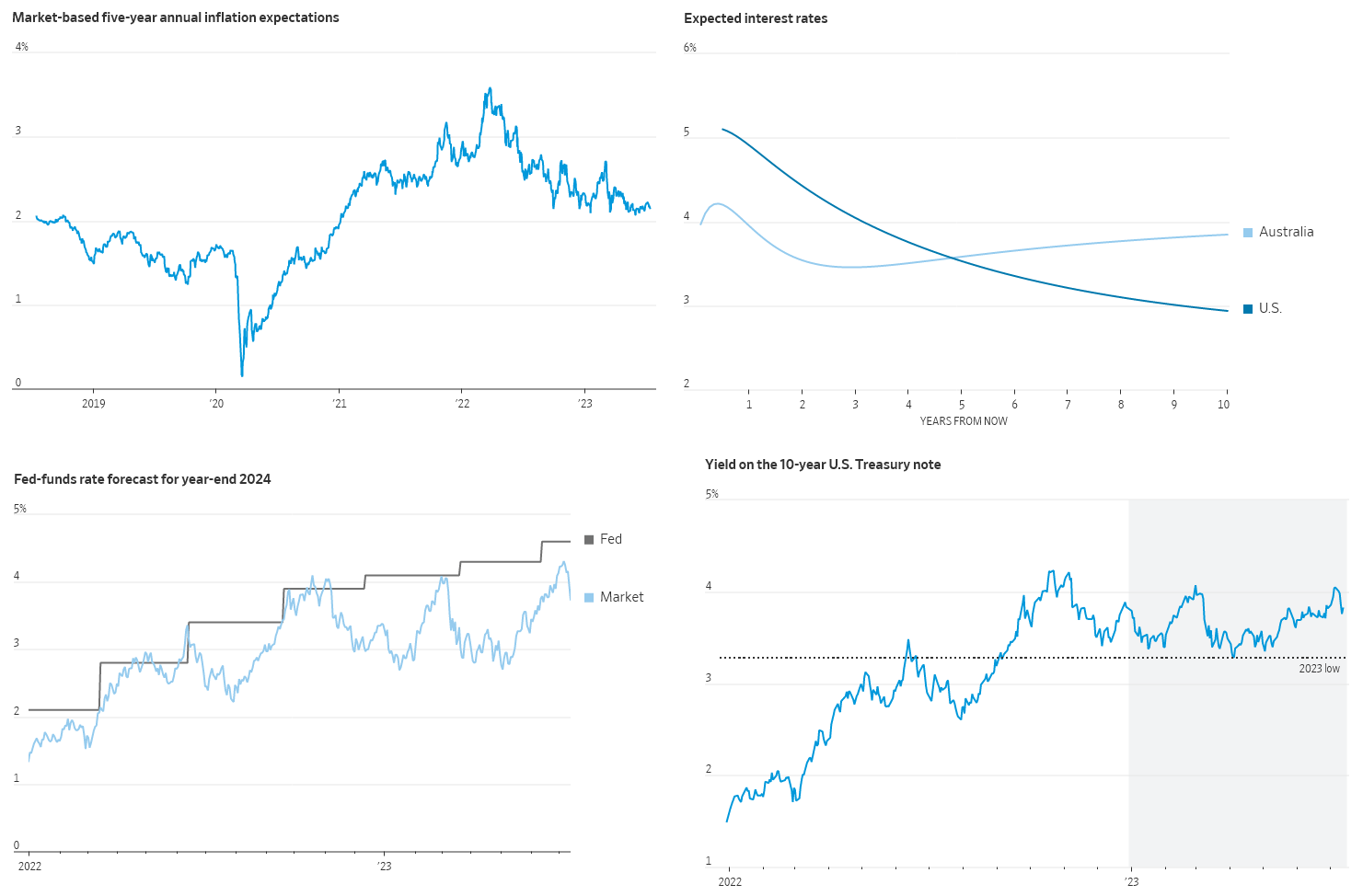

Investors have long expected inflation to fall back to the Fed’s 2% target relatively quickly, a bet that is starting to look better now than it did a few months ago. The biggest question for investors, however, remains how high rates will need to go.

U.S. Treasury yields closely track investors’ expectations for interest rates and dropped sharply when bonds rallied last week after the release of lower-than-expected readings on consumer and supplier prices. Yet yields remain well above their lows for the year, suggesting many aren’t convinced that the Fed’s work is done.

Past moments of optimism have met with disappointment. The Fed has repeatedly raised its own interest-rate forecasts since early 2022. Investors have often been hesitant to follow suit but have ultimately been dragged along for the ride.

The Fed’s preferred inflation measure—the core personal-consumption expenditures price index, which strips out volatile food and energy items—stood at 4.6% in May, still well above its 2% target. But there have been signs of progress, with even some easing in non-energy or housing services—a key category for the Fed sometimes known as “supercore” inflation.

One note of caution for investors is that progress on inflation has come despite a very tight labor market. Many believe that wage increases, in particular, will need to subside for inflation to come fully under control.

Investors do expect interest rates to fall in the coming years, but their forecasts don’t necessarily include a recession.

The Fed’s benchmark federal-funds rate is expected to fall gradually over the next decade to a long-term level that neither stimulates nor slows growth, according to an analysis of Treasury yields by Benson Durham at Piper Sandler. By comparison, Australian bond yields suggest a more concerted effort to boost the economy over the next couple of years, with rates dipping below their long-term expected level before climbing back later in the decade.