Tech-Stock Boom Pits AI Against the Fed

Technology stocks are on a tear. Investors can’t agree on whether their recent run looks like the prelude to an eventual bust—like that of the dot-com era—or the start of a more durable rally. Hype around artificial intelligence has helped drive shares of technology companies to records this year. The rally has only intensified heading into the end of the quarter.

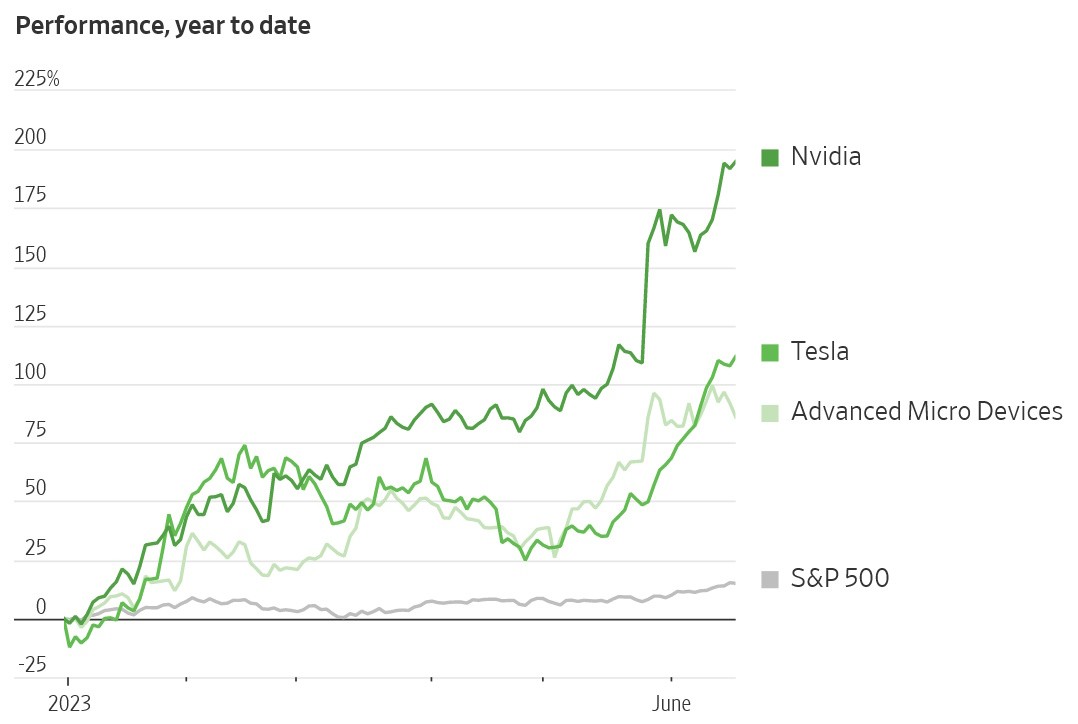

The Nasdaq Composite is coming off its eighth consecutive weekly gain, its longest streak since a 10-week run through March 2019. Individual investors have been snapping up shares of technology-focused companies, with data from Vanda Research showing the group poured more money into Tesla than any other stock last week. Options bets have exploded. The most popular contracts traded Friday were bullish bets on Tesla, Nvidia, Advanced Micro Devices, Apple and Meta Platforms, according to data from Trade Alert.

Investors and analysts who believe the rally has more room to run say that software developers, chip makers and other companies investing money in artificial intelligence have the potential to be at the forefront of a technology that could transform society in the coming years.

“I don’t view this as 1999,” said Dan Ives, senior equity research analyst at Wedbush Securities, referring to the run-up in dot-com companies that preceded a painful market selloff the following year. Others are more skeptical. They say previous boom-and-bust cycles have taught them that it is more difficult than it might seem to pick out the handful of companies that could ultimately dominate a given industry over the long run. “I haven’t seen a technology cycle yet in my career in which the initial run-up isn’t more filled with hype and hope than the longer-term prospects,” said Jason Pride, chief of investment strategy and research at Glenmede, a Philadelphia-based wealth management firm.

In the coming week, money managers will get a chance to hear from Federal Reserve Chair Jerome Powell, who is scheduled to testify before Congress on Wednesday and Thursday. They will get fresh data on existing-home sales and activity in the manufacturing industry. So far, the economy has proved more robust than many expected. Inflation has stayed hot, despite pulling back from multidecade highs reached last year. The combination of factors has pushed the Fed to signal it might raise interest rates at least two more times before the end of 2023.

Last year, that kind of messaging would likely have spooked investors. Money managers blamed the market’s 2022 selloff—which caused megacap technology stocks to lose trillions of dollars in value—on the Fed’s move to raise interest rates rapidly. Their rationale: Investors often view technology companies as investments that pay off over the course of many years. When interest rates rise quickly, money managers can get higher returns in shorter time periods from other assets such as Treasurys. That can make stocks, especially relatively expensive technology shares, look less appealing.

Fast-forward to 2023, and many investors no longer seem to view the Fed as a threat to the tech rally. The Nasdaq Composite is up 31% for the year, far outpacing the broader S&P 500, which has risen 15%. Why? One possible explanation is that investors doubt that the Fed will keep raising interest rates.

“The market’s basically saying, ‘We don’t believe you,’ ” said Brad Conger, deputy chief investment officer at Hirtle Callaghan. He noted that U.S. stocks rallied the day after last week’s Fed meeting, with the S&P 500, Dow Jones Industrial Average and Nasdaq Composite all closing at their highest levels since 2022. Ives is among the analysts who believes the Fed is done. “I feel like there’s a better chance of me playing in the NBA than the Fed raising two more times, and I’m not a good basketball player,” he said. Individual investors placed more money in Tesla than any other stock last week.

In theory the Fed, being close to done with its interest-rate hikes, should benefit technology companies, said Mike Loewengart, head of model portfolio construction for Morgan Stanley’s global investment office. Such companies often rely on borrowing large sums of money at attractive rates to achieve rapid growth, he said. “When rates fall, conditions start easing up for growth names,” Mr. Loewengart added.

One threat to that line of thinking is that investors wind up being wrong about second-guessing the Fed. Inflation might not subside quickly enough for the central bank’s liking. That might force the central bank to follow through with further interest-rate increases, potentially putting the brakes on the stock rally. Another potential threat to the rally hinges on something that investors might not have the answer to for quite some time: whether technology companies whose valuations have soared this year will wind up living up to the expectations of shareholders.

The AI boom is “a very real factor in driving the sector and the market,” Loewengart said. “But it’s important to understand that technological innovation is not always going to translate into durable businesses or durable earnings.”

Rajesh Sharma

Rajesh Sharma is Correspondent for Stock Market of South East Asia based in Mumbai. He has been covering Asian markets for more than 5 years.