Why You Keep Chasing the Wrong Stock Market

If you’re like most investors, you can probably guess roughly where the Dow Jones Industrial Average is at a given moment, but that doesn’t mean you know how well the stock market is doing. That can obscure your view of your own performance and distort your decisions.

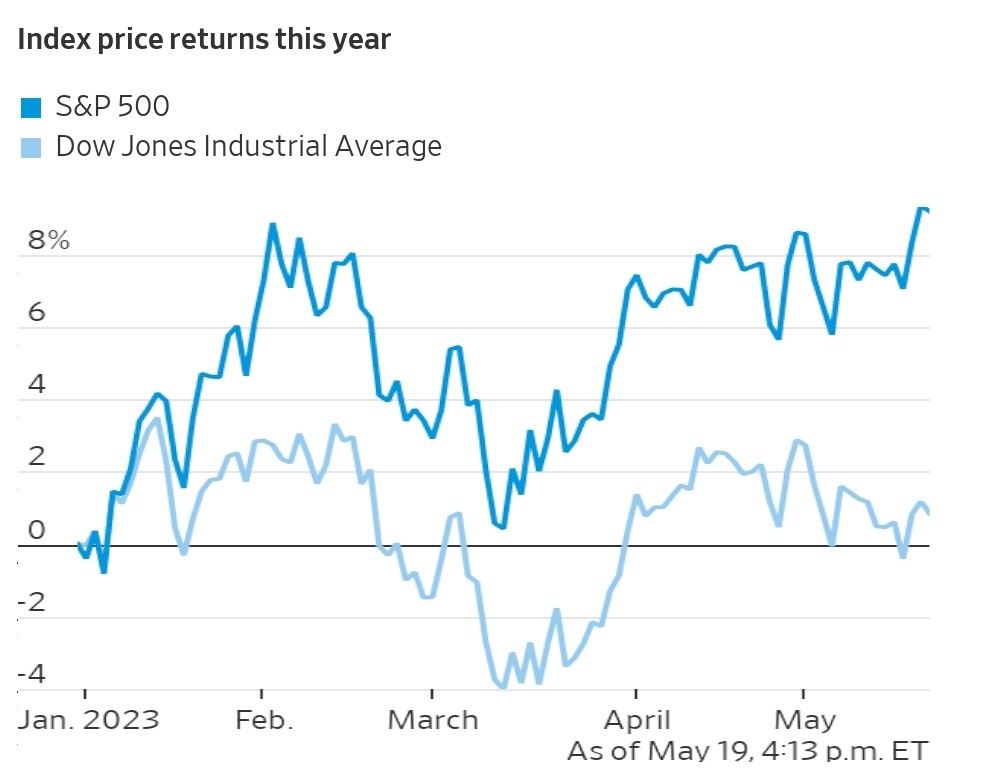

This year’s stock market is split in two. One consists of a few big technology companies, and it’s booming. The other is everything else, and it’s been stinking up the joint. In 2023, the Dow is up only 1.2%, while the broader S&P 500 has gained more than 9%, not including reinvested dividends. That’s the widest year-to-date performance gap between the two indexes on record since 1945, according to Bespoke Investment Group. Focusing on the tepid returns of the Dow could make you feel you’re even farther from recovering the losses of 2022 than you really are.

You might be tempted to throw a Hail Mary pass, or take on extra risk, to try to catch up to the hottest players in the stock market. It’s not hard to see why. So far this year, pricier growth stocks have gained 21%. Stock picking celebrity Cathie Wood’s ARK Innovation fund, which favors futuristic stocks trading at high prices relative to their earnings, is up 25%. MicroSectors FANG+, a security that bundles up the hottest technology giants, is up 53%.

Meanwhile, cheaper value stocks have done even worse than the Dow, falling 2%. The Dow’s quirky design is to blame for its underperformance. Its 30 stocks aren’t scaled by their total value in the stock market, with bigger companies getting greater weight, as they do in the S&P 500. Instead, stocks with higher share prices make up more of the Dow.

So UnitedHealth Group, trading around $480, is the “biggest” stock in the Dow, constituting more than 9% of the value of the index. In the S&P 500, however, UnitedHealth’s market weight puts it at barely more than 1%. With its shares down almost 10% this year, UnitedHealth is partly why the Dow is ailing.

What about Apple? It’s in the Dow, and is up 35% this year. Shouldn’t that help? Apple’s share price, roughly $175, is well below United Health’s. So it makes up less of the Dow, weighing in at 3.4%. By contrast, Apple comprises 7.4% of the S&P 500.

Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, points out that if Apple were weighted in the Dow by market value rather than share price, it would have made up 24.8% of the index this week. Microsoft, now 6.3% of the Dow based on share price, would be 22.6% if the index were weighted by market value.

All this is a reminder that if you or your funds hold plenty of the biggest technology stocks this year, you’ve made lots of money. And if you don’t, you haven’t. Fixating on your underperformance may lead to what psychologists call loss chasing, or taking bigger, more-frequent and more-impulsive risks in the effort to get back to break-even. That doesn’t necessarily mean buying more of whatever’s gone down the most. Often, it means buying whatever you think can go up the most — even (or especially) if it’s a long shot.

Neuroscience experiments have shown that choosing to quit chasing your losses can fire up the same part of the brain that registers pain and disgust. When you hunt what you hope will be gains, it hurts to admit that what you’re likely to catch is more losses. No wonder it can be hard to stop this behavior — even if you realize your persistent bad bets are putting you deeper in the hole.

Over the past month, the Health Care Select Sector SPDR exchange-traded fund has taken in $1.2 billion in new money, fifth among all stock ETFs, according to FactSet. Investors might be doubling down on their losses, gambling on a quick rebound. Others may fly to what feels like safety. Long-term Treasury bonds were up almost 10% for the year in early April, and investors have poured money into them since then. The iShares 20+ Year Treasury Bond ETF has taken in $2.6 billion over the past month, according to FactSet.

That’s a bet with a little bit of upside if the Federal Reserve begins cutting interest rates soon–and plenty of downside if it doesn’t. Like so much of investing, making peace with your losses is a mind game. How you define a loss depends on your reference point: Is the value of your investment down from its peak price? from the end of 2022? from the lows of March 2020? from five years ago? from 10 years ago? from what you originally paid for it?

A loss that seems severe over one measurement period may feel lighter when you look at it over a different horizon; the farther back you measure, the better. You might not be so far behind the market once you change your reference point. Before you start loss chasing, be sure to ask whether what you have is a loss at all.