U.S. inflation subsiding as consumer prices rise moderately in boost to economy

U.S. consumer prices rose less than expected for a second straight month in November amid decreases in the costs of gasoline and healthcare as well as used cars and trucks, leading to the smallest annual increase in inflation in nearly a year.

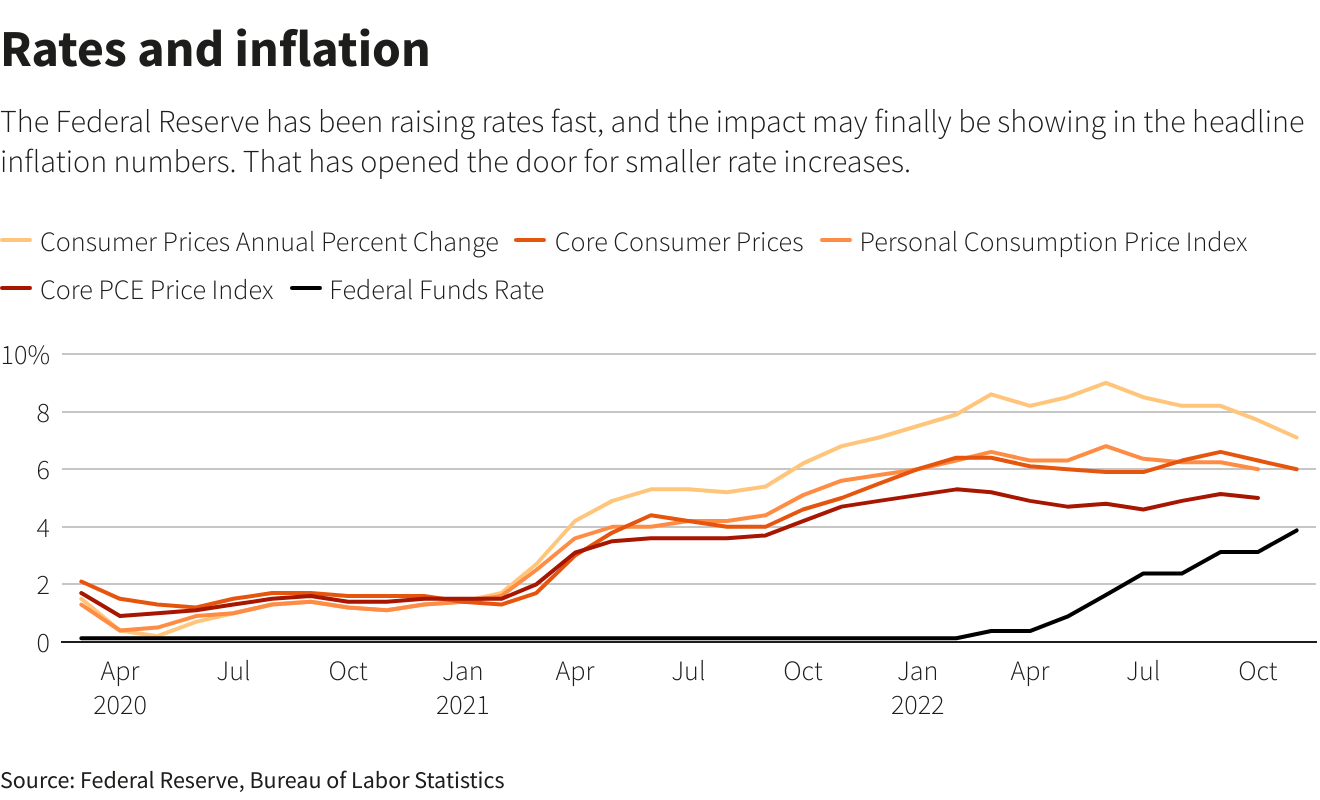

Underlying consumer prices advanced by the least in 15 months, the report from the Labor Department on Tuesday also showed, clearing the way for the Federal Reserve to start scaling back the size of its interest rate hikes on Wednesday.

While Americans still faced higher costs for rental housing, economists expected a moderation next year. The report was published as officials at the U.S. central bank gathered for their final two-day policy meeting of the year.

The Fed, in the midst of its fastest rate-hiking cycle since the 1980s, is expected to lift its benchmark overnight interest rate by 50 basis points Wednesday, snapping a string of four straight 75-basis-point increases. Economists still expected the Fed to maintain its monetary policy tightening campaign at least through the first quarter of 2023.

“The broad improvements raise hopes price pressures are easing and the Fed will not have to tighten as much next spring,” said Will Compernolle, a senior economist at FHN Financial in New York. “But it is still not quite the ‘compelling’ inflation improvement (Fed Chair Jerome) Powell needs to be convinced the Fed can pause soon.”

The consumer price index increased 0.1% last month after advancing 0.4% in October. Economists polled by Reuters had forecast the CPI would increase 0.3%.