AstraZeneca forecast boosts shares as COVID shot sales hit $275 mln

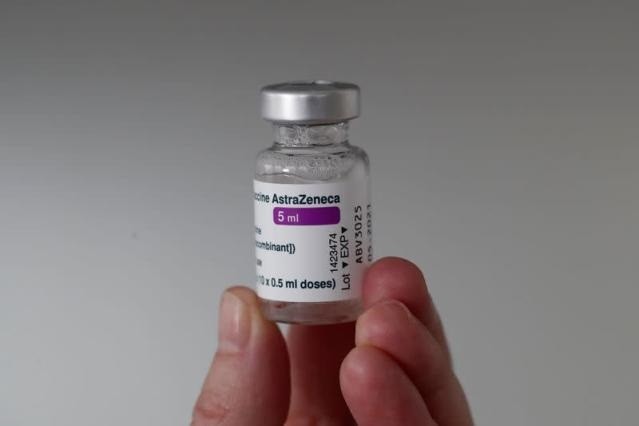

AstraZeneca’s COVID-19 vaccine delivered $275 million in first-quarter sales while shaving three cents per share from earnings, the drugmaker said on Friday as it posted better-than-expected results and forecast second half growth.

This is the first time the Anglo-Swedish drugmaker has given financial details of the distribution and sales of the vaccine, which it developed with Oxford University. It has said it will not make a profit from the shot during the pandemic.

The vaccine revenue included delivery of about 68 million doses, AstraZeneca (AZN.L) said, adding that sales in Europe, where it faces a legal case, were $224 million, in emerging markets $43 million and $8 million in the rest of the world.

Sales of $275 million for 68 million doses equates to a price tag of around $4 per shot.

AstraZeneca was one of the leaders in the global race to develop a COVID-19 vaccine. Its cheap and easily transportable shot was hailed as a milestone in the fight against the crisis, but has since faced a series of setbacks.

“Shipments (of COVID-19 vaccines) are increasing as manufacturing improves,” Chief Executive Pascal Soriot said during a results briefing, adding that it was on track to deliver 200 million doses a month from April.

AstraZeneca shares were up 4% to 7,705 pence at 0845 GMT, putting them on track for their best day since October. The stock, which hit record highs in July 2020 due to optimism around the vaccine, ended last year 4% lower.

The results come after a bruising start to the year as the drugmaker struggles with production of its vaccine and faces a legal battle after cutting deliveries to Europe, while regulators probe rare blood clots in people who got the shot.

“Despite the intense operational and political challenges created by AZN’s COVID-19 vaccine roll out, the core business continues to perform above market expectations in a most challenging quarter, demonstrating strength across therapeutic areas and geographies,” Citigroup analysts said in a note.

VACCINE RACE

Pfizer (PFE.N), whose COVID-19 vaccine co-developed with German partner BioNTech is several times more costly than AstraZeneca’s, has forecast $15 billion for its share of sales, with analysts expecting as much as $18 billion on average.

BioNTech expects close to 10 billion euros ($12.1 billion) in revenues from committed vaccine deliveries this year but raised the prospect of more supply deals. read more

Moderna (MRNA.O) in February said it was expecting sales of $18.4 billion from its own vaccine this year.

Before AstraZeneca’s earnings, market researcher GlobalData said it expected annual sales of $278 million this year and next for the drugmaker’s coronavirus vaccine, branded Vaxzevria.

AstraZeneca said an application for U.S. emergency use had been delayed. It said in late March that it planned to apply for U.S. approval in the coming weeks after U.S. trials showed the vaccine was 76% effective. read more

“There’s a lot more data than just a phase three study and so we’re working as fast as we can to pull it all together and submit,” Soriot said.

AstraZeneca’s core business has proved resilient, with the drugmaker sticking to its forecast for 2021 on Friday and predicting better times ahead.

This guidance does not include any impact from sales of the vaccine and its $39 billion purchase of Alexion, which is expected to close in the third quarter.

Total revenue of $7.32 billion for the three months to March exceeded analysts’ expectations of $6.94 billion, while core earnings of $1.63 cents per share beat a consensus of $1.48.

Quarterly sales growth was driven by best-selling lung cancer drug Tagrisso, up 17% to $1.15 billion, while revenues from heart and diabetes drug Farxiga jumped to a better-than-expected $625 million, on new prescriptions for heart failure.