TransferWise Reaches $3.5 Billion Valuation After Secondary Stock Sale

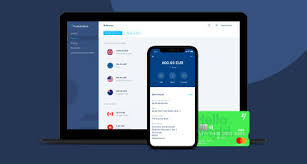

BlackRock and other large investment funds have acquired a $ 292 million stake in TransferWise, a cross-border money transfer service that has grown rapidly since launching in 2011, and is a star of Europe’s startup scene.

In an announcement on Wednesday, London-based TransferWise said the stock purchase put the value of the company at $ 3.5 billion, which is double its last reported valuation.

The share purchase was a so-called secondary sale, meaning it consisted entirely of investors purchasing shares form earlier investors in a so-called secondary sale.

The transaction was led by growth-stage investors, Lead Edge Capital, Lone Pine Capital and Vitruvian Partners, and also saw earlier investors, Andreessen Horowitz and Baillie Gifford, expand their positions in TransferWise.

TransferWise got started after two friends, located in the U.K. and Lithuania, became frustrated with the high cost of moving money by wire transfer between the countries. They arranged to a system to put euros and pounds into each others’ bank accounts, and then grew their system into a global, peer-to-peer money transfer service.

Like its competitor Remitly, TransferWise has found a thriving niche by undercutting banks and wire transfer services, which can charge 5% or higher of every transaction.

In the case of TransferWise, which now has 5 million customers in over 170 countries, its transfer fees are typically well under 0.5%, while a fifth of its transactions take place in 20 seconds or less.

In an interview, co-founder Kristo Kaarmann told Fortune that the new investors will provide guidance to the company as it continues to grow, while also serving to pay out some of its early-stage backers.

Despite rumors last year that TransferWise was planning to go public, Kaarmann said the company plans to stay private for the foreseeable future.

“An IPO is not going to happen anytime soon. It’s very unlikely to happen this year,” he said. “Remaining private, for now, means we can remain focused on our mission and long-term strategy, without any distractions from the markets… Lastly, in terms of capital, we’re quite confident in our financial position. We love to be funded by our users.”

While TransferWise has been profitable since last year, the company has been focused on reducing its fees and expanding its geographic footprint.

According to Kaarmann, TransferWise’s profits are coming both from its traditional money transfer business, and from its newer business products, which let small and medium-sized companies keep accounts in different countries in order to pay suppliers in local currencies.

And despite brash ads bashing banks over high fees, TransferWise is increasingly working with them to offer its services. Last year, it announced a partnership with the UK challenger bank Monzo and with France’s second largest bank, BCPE.

Meanwhile, as other parts of the finance industry embrace Bitcoin, Ripple and other cryptocurrencies as a means of transferring money, TransferWise has remained skeptical about such projects.