Key Events In The Coming Week

Today’s Eurogroup meeting will be key in determining where Greece and its creditors negotiations currently stand. Over in the US today, it’s the usual post payrolls lull with just the labor market conditions data expected.

We kick off in Japan tomorrow with leading and coincident index prints, before we move onto the European timezone where we see French business sentiment and UK industrial and manufacturing production. Focus in the US on Tuesday will be on the JOLTS report as well as the monthly budget statement. The NFIB small business optimism survey is also due.

It’s a busy start in Asia on Wednesday as we get trade data out of Japan as well as retail sales, industrial production and fixed assets investment readings in China. It’s no less busy in Europe where we see Euro area Q1 GDP (advanced reading) and industrial production as well as German Q1 (provisional) GDP and the final April CPI print. Over in France, we also get CPI data along with employment indicators. In the UK we get the BoE inflation report as well as the usual monthly employment data dump including unemployment and average weekly earnings. In the US on Wednesday, April retail sales will be the main highlight while the import price index is also due.

Its quiet data wise on Thursday with no notable releases in Asia or Europe while in the US PPI and jobless claims prints are expected.

It’s a similarly quiet end to the week on Friday with just Japan PPI and consumer confidence due in the early session, followed by US industrial and manufacturing production, capacity utilization and the University of Michigan consumer sentiment print. Fedspeak wise we’ve got Williams expected to talk on Tuesday while earnings seasons creeps to an end with 15 S&P 500 companies due to report and 56 Stoxx 600 companies expected.

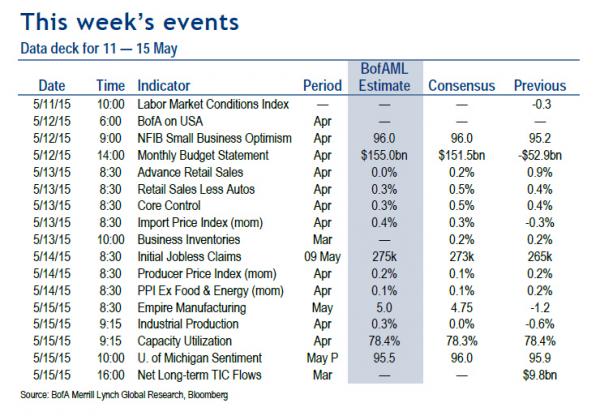

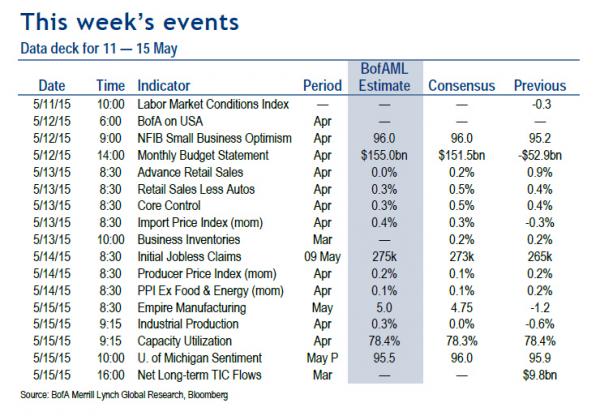

A quick chart summary from BofA:

The full weekly detail comes from Goldman Sachs:

In DMs, highlights of next week include US Retail Sales, UMich Confidence and IP; Eurozone GDP and IP; CPI in EA; UK MP Decision; Japan Consumer Confidence.

- [Monday] CPI in Denmark and Norway; UK MP Decision.

- [Tuesday] Sweden CPI; UK IP.

- [Wednesday] US Retail Sales; Eurozone GDP and IP; CPI in France, Germany, Italy and Spain.

- [Thursday] –.

- [Friday] US IP and UMich Confidence; Japan Consumer Confidence.

In EMs, highlights of next week include MP Decision in the Philippines, South Korea, Chile and Peru; Minutes in Israel and Mexico; China Trade Balance, Retail Sales and IP.

- [Monday] Israel Minutes.

- [Tuesday] IP in India, Romania and Mexico; South Africa Manufacturing Production.

- [Wednesday] China Retail Sales and IP.

- [Thursday] MP Decision in the Philippines, Chile and Peru; Mexico Minutes.

- [Friday] China Trade Balance; South Korea MP Decision.

FULL CALENDAR

Monday, May 11

- Events: Speech by ECB’s Nowotny.

- Denmark | CPI EU Harmonized MoM (Apr): Previous 0.50% (0.30% mom)

- Norway | CPI YoY (Apr): Previous 2.00% (0.30% mom)

- United Kingdom | MP Decision: We expect rates on hold at 0.5%, in line with consensus.

- Israel | Minutes from MP Decision: The BoI kept rates on hold (at 10bp) in April and the accompanying policy statement contained both dovish and hawkish points. The minutes should provide more details on the committee members’ view on these issues. Moreover, it would be a significant dovish signal if the committee repeats that the on-hold decision was partly driven by its assessment that the effect of the interest rate reduction in February has “not yet been exhausted” (like it did in the March Minutes).

- Malaysia | [MAP 4] Industrial Production YoY (Mar): Consensus 4.40%, previous 5.20%

- Also interesting: [DM] Denmark CA; Australia NAB Business Conditions [EM] Malaysia Manufacturing Sales; Trade Balance in India, Hungary and Romania.

Tuesday, May 12

- Events: Speech by Fed’s Williams.

- Sweden | CPI MoM (Apr): Previous 0.10% (0.20% mom)

- United Kingdom | Industrial Production YoY (Mar): Consensus 0.20% (0.10% mom), previous 0.10% (0.10% mom)

- United Kingdom | [MAP 3] Manufacturing Production YoY (Mar): Consensus 1.00% (0.30% mom), previous 1.10% (0.40% mom)

- India | [MAP 3] Industrial Production YoY (Mar): GS 3.00%, consensus 2.90%, previous 5.00%

- India | CPI YoY (Apr): GS 4.90%, consensus 4.99%, previous 5.17%

- Czech Republic | CPI YoY (Apr): GS 0.4%, consensus 0.40% (0.20% mom), previous 0.20% (0.10% mom)

- Romania | CPI YoY (Apr): GS 0.9%, previous 0.80% (0.40% mom)

- Romania | Industrial Output YoY (Mar): Previous 3.10% (0.00% mom)

- South Africa | [MAP 4] Manufacturing Prod NSA YoY (Mar): Consensus -1.00%, previous -0.50% (0.70% mom)

- Mexico | [MAP 4] Industrial Production YoY (Mar): GS 1.60%, consensus 1.80%, previous 1.60% (0.20% mom)

- Also interesting: [DM] US NFIB Small Business Optimism, Monthly Budget Statement and JOLTS Job Openings; France Bank of France Bus. Sentiment; Norway Consumer Confidence; Japan Leading and Coincident Index; Australia Housing Finance and Commonwealth Budge [EM] Philippines Exports; Trade Balance in Israel and Russia; Turkey CA; Mexico ANTAD Same-Store Sales.

Wednesday, May 13

- Events: UK Bank of England Inflation Report; Speech by BOE’s Carney.

- United States | [MAP 4] Retail Sales Ex Auto MoM (Apr): GS 0.5%, consensus 0.40%, previous 0.40%

- United States | Retail Sales Ex Auto and Gas (Apr): GS 0.6%, consensus 0.50%, previous 0.50%

- Eurozone | [MAP 5] Industrial Production SA MoM (Mar): Consensus -0.30% (1.50% yoy), previous 1.10% (1.60% yoy)

- Eurozone | [MAP 5] GDP SA QoQ (1Q A): GS 0.50%, consensus 0.40% (1.00% yoy), previous 0.30% (0.90% yoy)

- France | GDP YoY (1Q P): GS (0.30% qoq), previous 0.20% (0.10% qoq)

- France | CPI EU Harmonized YoY (Apr): Previous 0.00% (0.70% mom)

- Germany | GDP SA QoQ (1Q P): GS 0.4%, consensus 0.50% (1.30% yoy wda), previous 0.70% (1.40% yoy wda)

- Germany | CPI EU Harmonized YoY (Apr F): Consensus 0.30% (-0.10% yoy), previous 0.30% (-0.10% yoy)

- Italy | GDP WDA QoQ (1Q P): GS 0.20%, consensus 0.20%, previous 0.00% (-0.50% yoy)

- Italy | CPI EU Harmonized YoY (Apr F): Consensus 0.00%, previous 0.00%

- Spain | CPI EU Harmonised YoY (Apr F): Previous -0.70% ((r) 2.00% mom)

- United Kingdom | [MAP 4] ILO Unemployment Rate 3Mths (Mar): GS 5.50%, consensus 5.50%, previous 5.60%

- Japan | BoP Current Account Balance (Mar): GS ¥2061.3B, consensus ¥2106.6B, previous ¥1440.1B

- China | [MAP 1] Retail Sales YoY (Apr): GS 10.50%, consensus 10.40%, previous 10.20%

- China | Industrial Production YoY (Apr): GS 6.50%, consensus 6.00%, previous 5.60%

- Hungary | [MAP 5] GDP NSA YoY (1Q P): GS (0.7% qoq), consensus 3.30% (1.00% sa qoq), previous 3.40% (0.80% sa qoq)

- Romania | GDP YoY (1Q A): GS 3.5% (1.3% qoq), previous 2.70% (0.70% qoq)

- Also interesting: [DM] US MBA Mortgage Applications and Import Price Index; France CA; UK Bank of England Inflation Report, Claimant Count Rate, Average Weekly Earnings, Employment and Jobless Claims Change; Japan Economy Watchers Survey and Bank Lending; Australia Wage Price Index [EM] China Fixed Asset Investment; South Korea Unemployment.

Thursday, May 14

- Events: Speech by ECB’s Draghi.

- United States | PPI Final Demand YoY (Apr): GS (0.0% mom), consensus -0.80% (0.10% mom), previous -0.80% (0.20% mom)

- India | Wholesale Prices YoY (Apr): Consensus -2.39%, previous -2.33%

- Malaysia | [MAP 5] GDP YoY (1Q): GS 5.40%, consensus 5.20%, previous 5.80%

- Philippines | MP Decision: We expect BSP to leave policy rates unchanged, the overnight borrowing rate at 4% and the Special Deposit Account rate at 2.5%. Since the March 26 meeting, April headline CPI inflation decelerated to its slowest pace since August 2013 (to +2.2%yoy from +2.4%yoy in March). Still, headline inflation remains within the target range set by the government (between 2% and 4% for 2015 throughout 2018). Given our expectation of the base effects of the oil price decline vanishing by the end of 2015, we maintain our full-year inflation forecast of 2.4%yoy.

- Poland | CPI YoY (Apr): GS -1.1%, consensus -1.30% (0.20% mom), previous -1.50% (0.20% mom)

- Chile | MP Decision: We expect rates on hold at 3.00% and for the directors to reiterate the broadly neutral bias of the April policy statement.

- Mexico | Minutes from MP Decision: In that meeting the MPC left the policy rate unchanged at a stimulative 3.00% and preserved a broadly neutral near-term policy bias. With regard to the external backdrop we expect the majority of Directors to argue that the global economy remains weak but that the balance of risks for global growth and inflation did not change materially from the previous meeting. Furthermore, Directors are also expected to warn against the risk of renewed international financial markets’ volatility that could impact the MXN. In order to mitigate such risk Directors are expected to recommend maintaining a solid macroeconomic stance and consolidating the recent efforts on the fiscal side.

- Peru | MP Decision: We expect rates on hold at 3.25%. An unchanged policy stance would allow the MPC to strike a proper balance between the conflicting goals of stabilizing the exchange rate and the inflation dynamics while stimulating growth and supporting the economy.

- Also interesting: [DM] US Initial Jobless and Continuing Claims; Canada New Housing Price Index; UK RICS House Price Balance and Construction; Japan Money Stock; New Zealand BusinessNZ Manufacturing PMI and Retail Sales [EM] Malaysia CA; South Africa Gold and Mining Production; Brazil Retail Sales; Colombia Industrial Production and Retail Sales

Friday, May 15

- Events: –.

- United States | [MAP 2] Industrial Production MoM (Apr): GS -0.2%, consensus 0.00%, previous -0.60%

- United States | [MAP 2] Empire Manufacturing (May): Consensus 5, previous -1.19

- United States | Capacity Utilization (Apr): GS 78.1%, consensus 78.40%, previous 78.40%

- United States | [MAP 1] U. of Mich. Sentiment (May P): GS 94.5, consensus 96.7, previous 95.9

- Japan | [MAP 4] Consumer Confidence Index (Apr): GS 42.0, previous 41.7

- China | Trade Balance (Apr): Consensus $ 39.60B, previous $ 3.08B

- Hong Kong | [MAP 5] GDP YoY (1Q): GS 2.20%, consensus 1.90% (0.20% sa qoq), previous 2.20% (0.40% sa qoq)

- South Korea | MP Decision: We expect rates on hold at 1.75%, in line with consensus. A surprise rate cut in the May MPC meeting is a risk, although our baseline forecast remains a cut in July.

- Czech Republic | [MAP 5] GDP YoY (1Q A): GS (0.6% qoq), consensus 2.00% (0.80% qoq), previous 1.40% (0.40% qoq)

- Israel | CPI YoY (Apr): GS -0.6% (0.5% mom), consensus -0.60% (0.50% mom), previous -1.00% (0.30% mom)

- Poland | [MAP 5] GDP YoY (1Q P): GS (0.9% qoq), consensus 3.50% (0.80% qoq), previous 3.10% (0.70% qoq)

- Poland | CPI Core YoY (Apr): Consensus 0.20% (0.30% mom), previous 0.20% (0.10% mom)

- Argentina | National Urban CPI MoM (Apr): GS 1.40%, previous 1.30%

- Brazil | [MAP 5] Economic Activity YoY (Mar): GS (-0.60% mom), consensus 1.15% (-0.20% mom), previous -3.16% (0.36% mom)

- Peru | [MAP 5] Economic Activity YoY (Mar): GS 2.00%, previous 0.90%

- Also interesting: [DM] US Total Net TIC Flows and Manufacturing Production; Canada Existing Home Sales; Norway Trade Balance; United Kingdom Construction Output; Japan PPI; Singapore Retail Sales [EM] Indonesia Trade Balance; Philippines Overseas Remittances; Czech Republic CA; Poland CA; Turkey Unemployment; Brazil IGP-10 Inflation; Colombia Consumer Confidence; Peru Unemployment; Venezuela CA

Source: DB, BofA, Germany