Garmin: A Bargain for Patient Investors

Just a quarter century ago, a company called Garmin helped usher in a new wave of navigation devices. For many of us, our first taste of Global Positioning Systems (GPS) came in the form of little screens from Garmin and a couple of other companies. We propped those screens on the dashboards of our cars and boats, and with their help we arrived at unknown destinations more quickly than ever before — or, as was sometimes the case, we became even more lost.

In the early days, few companies offered this new technology and the prices reflected that scarcity and novelty. Today, GPS is ubiquitous, we find it everywhere and in or on just about everything that moves, including our own bodies.

For Garmin Ltd. (GRMN), that’s making business more difficult. For example, many auto manufacturers now install their own GPS systems in cars and trucks at their factories. In its quarterly earnings reports recently, Garmin has warned that its biggest sales segment faces flat to lower results. And some investors have bailed from the company, fearing that the Apple Watch will, if you’ll forgive the expression, ‘clean the clocks’ of competing companies.

Yet, Garmin has a massive pipeline of current products, extending well beyond auto and wearable technology. It also has increased its dividend, extended authorization for share buybacks, upped its research and development budget to almost $ 400 million, and is still looking for acquisitions or strategic partnerships — all out of cash on hand and cash flow.

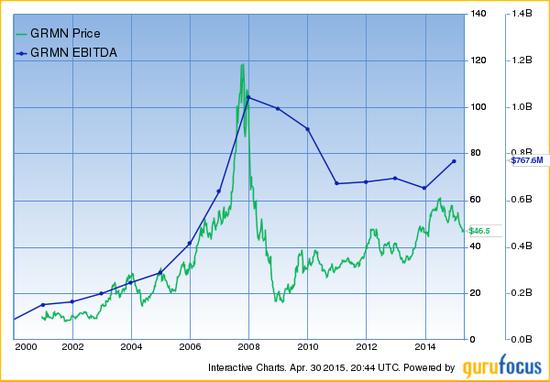

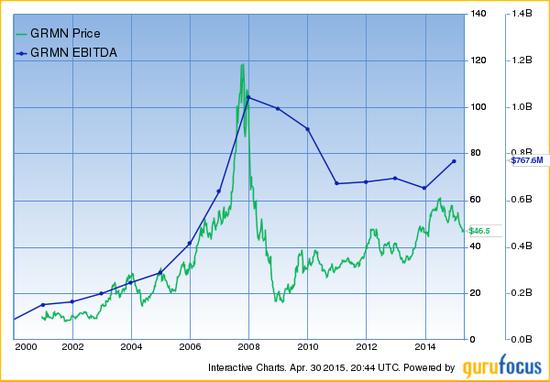

So, what should we think of this company, that we now find on the Guru Bargains list at GuruFocus? Let’s start with a quick look at its price (green line) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization – blue line), over the past 15 years:

History

1989: Gary Burrell and Min H. Kao found the company, in Lenexa, Kansas, as ProNav. The company later changes its name Garmin, using the first names of its founders. It’s first product is GPS 100, a panel-mounted GPS receiver aimed at the marine market, priced at $ 2,500.

1991: The U.S. Army becomes its first customer.

1998: The first Garmin StreetPilot is unveiled.

1999: Allies with AirCell to develop new products using AirCell’s cellular air-ground link to bring flight communications, navigation, and safety to general aviation aircraft.

2000: Begins trading on NASDAQ, symbol GRMN.

2003: Acquires UPS Aviation Technologies, Inc., a subsidiary of United Parcel Service, Inc., to expand its product line of panel-mounted GPS/NAV/COMM units and integrated cockpit systems for private and commercial aircraft.

2003: Gary Burrell retires as CEO and is replaced by Min H. Kao.

2004: Min Kao replaces Gary Burrell as Chairman; Burrell becomes Chairman Emeritus.

2006: Buys Dynastream Innovations Inc., which specializes in personal monitoring technology, such as foot pods and heart rate monitors.

2007: Acquires Digital Cyclone Inc., which provides weather solutions for consumers, outdoor enthusiasts, and pilots on a subscription basis.

2015: Acquires iKubu Ltd. for its Backtracker on-bicycle low power radar system.

History based on information at Wikipedia.org and company news releases.

Comments: This quick overview of Garmin’s history indicates that company has used both internal, organic, growth and acquisitions to vault itself into the big leagues of GPS and related categories.

Garmin’s Business

The company specializes in Global Positioning System (GPS) navigation and wireless devices/applications. It describes itself this way in its 10-K for 2014, “…designs, develops, manufactures, markets and distributes a diverse family of handheld, wearable, portable and fixed-mount GPS-enabled products and other navigation, communications, sensor-based and information products.

Garmin operates through five reporting segments:

- Auto/mobile

- Aviation

- Fitness

- Marine, and

- Outdoor Recreation.

This table, from the 2014 Management Discussion & Analysis outlines the net sales contributions by segments, along with year-over-year comparisons:

As we see, Automotive/Mobile is the biggest of the segments, making up 43% of net sales. In 2014, net sales in that segment were down 5%.

Competition

In its 10-K, Garmin acknowledges it operates in highly competitive markets, adding that the degree of competition varies from product to product. It lists the competitors this way:

- Portable automotive products: TomTom N.V. and MiTAC Digital Corporation (MiTAC), which distributes Magellan, Mio, and Navman.

- Infotainment solutions: Harman International Industries, Panasonic Corporation, and the Mitsubishi Group.

- Outdoor product lines: Bushnell, Delorme, Lowrance Electronics, Inc., Magellan, SportDOG Brand and Suunto Oy.

- Mobile products: Google Inc., Apple Inc., and Telenav Inc.

- Fitness products: Bryton Corp., Fitbit Inc., AliphCom dba Jawbone, Polar Electro Oy, Sigma Sports, Suunto Oy and Timex Corp.

- Marine products: Furuno Electronic Company, the Humminbird division of Johnson Outdoors, Inc., Navico and Flir Systems, Inc.

- Aviation product lines: Aspen Avionics, Avidyne Corporation, Chelton Flight Systems, CMC Electronics, Free Flight Systems, Honeywell, Inc., L-3 Avionics Systems, Rockwell Collins, Inc., Sagem Avionics, Inc. and Universal Avionics Systems Corporation.

Yahoo! Finance lists its competitors as MiTAC International Corporation (traded on the Taiwanese market), Navico Holding A.S. (privately held), and TomTom N.V. (privately held). According to Yahoo! Finance, it represents about 10% of this $ 90-billion industry.

GuruFocus compares Garmin with Agilent Technologies Inc. (A), Roper Industries Inc. (ROP), Hexagon AB (HXGBY), Trimble Navigation Ltd (TRMB), and Nanometrics Inc (NANO). It lists the industry as Computer Hardware » Scientific & Technical Instruments.

As you’ll recall, we earlier noted that one of the reasons for Garmin’s fall from grace this year was the impending arrival of Apple Watch, which was expected to be a category killer. When we look at this competitive issue, though, we see it will likely affect only two of five segments (Fitness and Outdoor), and only a few of the many products in these segments. The biggest segment, Automotive/Mobile should not be affected by Apple Watch.

The company notes, in its 10-K, that it believes the key competitive factors are, “…design, functionality, quality and reliability, customer service, brand, price, time-to-market and availability. Garmin believes that it generally competes favorably in each of these areas and as such, is generally a significant competitor in each of our major markets.”

Other

Garmin’s fiscal year is a 52- or 53-week period ending on the last Saturday of the calendar year.

At the end of fiscal 2014 it had 11,185 full and part-time employees worldwide, including 5,276 in Taiwan and 4,177 in the United States.

The company is incorporated in Switzerland, specifically Schaffhausen, Switzerland; headquarters at Olathe, Kansas.

Comments: Garmin is a very big player in the GPS and related industries, with a broad line of related products. While it does have strong competitors, it appears to have the ability to compete. And, we believe concerns about the Apple Watch are overblown.

Opportunities, Risks, & Growth

Opportunities

Aviation: investing heavily in OEM opportunities

Marine and automotive/mobile investment: focused on marine product enhancements and automotive OEM opportunities

Outdoor and Fitness: a number of new product categories debuted in 2013.

The company will continue to seek out acquisitions or investments in complementary technologies/sectors where appropriate.

Risks

GRMN’s biggest segment, Automotive/Mobile is declining because of competing technologies and market saturation; for example, Personal Navigation Devices (PNDs) now can be found on smart phones and some auto makers build GPS into their vehicles.

This is just one of the issues related to research & development; there are also a host of other issues ranging from patent infringement to sole source suppliers.

The company came out ahead on currency exchange in 2014, but that hasn’t been the case this year. In particular, Garmin has substantial connections in Taiwan and Switzerland (its country of incorporation) that mean exposure to various risks.

General economic conditions matter; as Garmin reports in its 10-K, “Our revenue and margins depend significantly on general economic conditions and the demand for products in the markets in which we compete.”

In January 2015, insiders owned more than 40.6% of the outstanding shares; as a result, the company warns that officers and directors “…exert substantial influence over us.”

For more on Garmin’s opportunities and risks, see the 10-K for 2014.

Growth

Here’s what we’ve seen from Garmin over the past decade and a half, with the share price on the green line and Earnings Per Share (EPS) on the blue line:

For 2015, Garmin offers guidance that indicates revenue will be roughly flat, coming in again at about $ 2.9 billion, as growth in the fitness, marine, and aviation segments will be offset by ongoing declines in the PND (Personal Navigation Devices) market. It expects EPS of $ 3.10 for fiscal 2015, the same as 2014.

Analysts followed by Yahoo! Finance also estimate this year’s EPS at $ 3.10, and project an average of an anemic $ 3.23 for 2016.

The company remains optimistic. In its Fourth Quarter 2014 news release, it announced it will carry on with a bigger research & development budget: almost $ 400 million in 2015. It also recommended increasing the cash dividend from $ 1.80 to $ 2.04 per share (subject to shareholder approval at the AGM in June). And in February, the Board authorized buybacks of up to $ 300 million by the end of 2016, noting, “The Company views the stock repurchase as an appropriate use of cash given the long-term growth prospects of the Company and ongoing free cash flow generation.”

Comments: Despite Garmin’s current struggle to grow revenue and EPS, its research budget, dividend status, and share buyback plans suggest the company sees strong growth somewhere ahead.

Management

President & CEO: Clifton A. Pemble, age 49, joined Garmin International in 1989 as a software engineer; succeeded co-founder Dr. Min Kao as CEO in 2013; member of the Garmin Ltd. board of directors since 2004. Previously worked as a software engineer for AlliedSignal.

Executive Chairman: Dr. Min Kao, age 66, co-founded Garmin Corporation with Gary Burrell in 1989. The company says, “Dr. Kao is credited with the breakthrough design and engineering of the GPS software technology that formed the foundation of the original Garmin product line.”

Chief Financial Officer & Treasurer: Doug Boessen, age 52, joined Garmin in 2014 as chief financial officer and treasurer; he oversees financial planning, accounting, investor relations, treasury and internal audit functions for Garmin Ltd. He was previously an independent auditor for Arthur Anderson.

Board of Directors: Three related directors (CEO Pemble, Executive Chairman Min Kao, and Chairman Emeritus Burrell) plus four independent directors. Independent directors have experience and/or expertise in GPS consulting and management, software development, accounting (KPMG LLP), and aviation.

ISS Governance QuickScore: 8, on a scale that ranges from 1 (lower governance risk) to 10 (higher governance risk); therefore a poor risk rating. Garmin lLd.. receives four red flags, for: Board Composition, Board Policies, Equity Risk Mitigation, and Meeting and Voting Related Issues. It also receives two green stars, for: Termination, and Other Issues.

Management & governance based on information at the company’s website and Reuters.com.

Comments: As noted above, insiders own more than 40% of Garmin’s shares, giving them serious influence at the boardroom table. This may also explain why there are only four independent directors. Mangerially, the CEO has extensive experience with the company and should know its products and operations as well as anyone can.

Ownership

Gurus: Only one of the influential investors followed by GuruFocus has a holding in Garmin; Joel Greenblatt (Trades, Portfolio) owns 1,126,874 shares; most recently, he added nearly 300,000 shares in the fourth quarter of 2014.

Institutional Investors: These investors, including pension funds and mutual funds, own slightly more than 43% of outstanding shares, according to nasdaq.com:

Insiders: The two co-founders, Burrell and Kao, own 20% of the outstanding shares, plus we note that float contains only 108 million shares, as compared to the 191 million shares outstanding, taking the insiders share to about 40%.

Short Interests: Currently 13.4%, roughly in the middle of the range experienced since 2009. Here’s that history in chart form:

Comments: Most notably, insiders have a very big stake in Garmin, thanks to continued holdings by the founders. Short interests are also significant, of course, and should be considered before an investment in the company.

Garmin by the Numbers

Comments: A big gap between shares outstanding and the float, the current price is near the 52-week low, the dividend is relatively high and the payout is simply high, while the company bought back a significant number of shares last year.

Financial Strength

Garmin receives a 9/10 (very good) rating from the GuruFocus automated system, and a middling 6/10 for Profitability & Growth:

With that, let’s look more closely at a couple of key issues involved in assessing financial strength, starting with long-term debt, which is essentially zero:

Free cash flow (FCF) is our second stop, and as the following chart shows, it’s been heading down since the end of 2009:

Yet, the company still has ambitious plans, as we saw, for research & development spending, a dividend increase, and share buybacks. As the company notes in its 10-K, “We believe that our existing cash balances and cash flow from operations will be sufficient to meet our long-term projected capital expenditures, working capital and other cash requirements.”

Third, EBIT AND EBITDA have taken a turn for the better in the past fiscal year:

Comments: Although free cash flow has declined for several years, the absence of long-term debt and returning strength of EBIT and EBITDA align with the strong financial strength rating assigned by GuruFocus.

Valuation

Garmin Ltd. appears on the Guru Bargain list because its shares have dropped more than 10% since a recent Guru purchase. The Guru in this case was Joel Greenblatt (Trades, Portfolio), who added to his Garmin holdings in the fourth quarter of 2014 at an estimated average price of $ 54.44 (more than 10% above the April 30, 2015 closing price of $ 45.19).

For our evaluation of GRMN, we’ll use an intrinsic value strategy, modified by GuruFocus for companies that have inconsistent revenues and earnings. It is described as, “…a valuation model based on normalized Discounted Cash Flow and Book Value of the company.”

Further, “As of today [mid-day, April 30, 2015], Garmin LTD.’s DCF projected intrinsic value is $ 48.85. The stock price of Garmin Ltd.. is $ 46.01. Therefore, Garmin Ltd’s Price to Intrinsic Value (DCF Projected) Ratio of today is 0.9.”

From another perspective, we could say the value of $ 46.01 is $ 2.84 (about 5.8%) below its projected intrinsic value. We also note that the stock price fell $ 1.95 the day before, from the previous day’s close of $ 47.49, after the first quarter 2015 earnings disappointed the market.

Greenblatt, by the way, has his own relatively unique approach to valuing and choosing stocks, examples of which we can see if we select the Magic Formula (Greenblatt) screener at GuruFocus:

In The Little Book That Still Beats the Market, Greenblatt says he is building on a Magic Formula devised by legendary value investor Benjamin Graham. Greenblatt sorts and ranks companies based on their Return on Capital and then does the same for Earnings Yield. Finally, his formula combines these two rankings. As he emphasizes, though, the key is to find the best combination of these two measures.

You won’t find Garmin on the current Magic Formula screener – either Return on Capital or Earnings Yield, or both, have declined to the point that the company falls off the list generated by this screener.

Conclusion

Garmin Ltd. is a bargain, a modest bargain, based on the DCF intrinsic valuation we’ve reviewed. The current price is a few percentage points below the calculated intrinsic value.

But an investment now is something of an act of faith. The company’s revenues and earnings face what are euphemistically known these days as ‘headwinds’. At the same time, though, the company has an impressive pipeline of products, and with its heavyweight research and development spending, a strong pipeline of ideas.

Thanks to the declining share price, it now sports a dividend near 4.25%. That will be attractive to yield seekers who can live with the current 101% dividend payout. The company will continue to buy back shares, which should put some upward pressure on EPS.

I would argue that those who jumped out of the stock because of the Apple Watch have overreacted, while those who got out because of the recent earnings announcements might have better served themselves by holding for a couple of years. For investors considering entry, Garmin could be an interesting opportunity when (or if) Garmin’s fortunes begin rising again.

About the author:

Robert F. Abbott has been investing his family’s accounts since 1995, and in 2010 added options, mainly covered calls and collars with long stocks. He’s currently exploring two potential routes to an income portfolio: First, to combine dividend challengers, contenders, and champions with covered calls, and second, to combine more volatile stocks with collars.

As a writer and publisher, Abbott explores how the middle class has come to own big business through pension funds and mutual funds, what management guru Peter Drucker called the Unseen Revolution. In Big Macs & Our Pensions: Who Gets McDonald’s Profits?, the first of a series of booklets on this subject, he looks at the ownership of McDonald’s and what that means for middle class retirement income.

In an eclectic career, Robert Abbott was a radio news writer and announcer, a newsletter writer and publisher, a farmer, a telephone operator, and a construction worker. When not working, he has been a busy volunteer, which includes more than a decade of leadership roles at the Airdrie Festival of Lights, one of North America’s leading holiday light displays. He lives in Airdrie, Alberta, Canada.