Why did the China shock hurt so much?

THE PEOPLE of Des Moines, Iowa, are no strangers to economic upheaval. When a wave of Japanese imports arrived in America in the 1980s, their city was one of the places most vulnerable to the new competition. In 1974, 4,500 of them worked at making farm machinery and equipment. As many again made tyres and inner tubes. By 1990 only a little over half of those jobs were left. Yet in the intervening 16 years thousands of new jobs had sprouted, in life insurance, building materials and the restaurant trade. In 1990 Des Moines’ unemployment rate was below 4%, less than the national average of 5.6%.

Not everyone fared as well. Mary Kate Batistich and Timothy Bond, of Purdue University, have recently estimated that the “Japan shock” explains about one-fifth of the fall in African-Americans’ labour-force participation between 1970 and 1990. But Des Moines’ experience was typical. Kerwin Kofi Charles, Erik Hurst and Mariel Schwartz, of the University of Chicago, found that local declines in manufacturing employment in the 1980s were not associated with increases in local unemployment rates.

That may surprise someone familiar with research on the impact on America of trade with China in the 1990s and 2000s. Mr Charles and his colleagues also concluded that in the 2000s jobless rates tended to rise when manufacturing employment fell. In a well-known paper in 2016, David Autor, David Dorn and Gordon Hanson found that a wave of Chinese imports kicked exposed workers out of their jobs and left some on the disability rolls. Even their marriage prospects suffered.

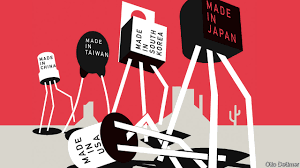

Why did competition from China hurt so much more than that from Japan a generation before? In another new study Katherine Eriksson, Katheryn Russ and Minfei Xu, of the University of California, Davis, and Jay Shambaugh, of George Washington University, sift the evidence and conclude that vulnerability to trade shocks depends on when and where they strike. Whereas earlier shocks—first from Japan, then from the “tiger” economies of East Asia—affected areas that were at that time relatively resilient to change, the China shock hit places that were less able to adapt.

The thesis rests on the idea of production cycles, and the journey from the frontiers of innovation to the backwaters of standardisation. Whizzy gadgets are at the cutting edge when they first appear, but eventually become humdrum. As processes settle down and become standardised, and once-novel gizmos become commodities, the location of production shifts too, away from innovation hotspots with better-educated populations towards communities that might not cope so well if jobs disappear.

Manufacturing employment blossomed at the beginning of the 20th century in places where people tended to be better educated and which produced more patents per person than the average. But as the decades passed and manufacturing employment spread, the correlation with patenting and education weakened. Ms Eriksson and her co-authors find that the import shocks from Japan and East Asia of the 1970s and 1980s hit products that were relatively early in their innovation cycles, such as video and audio equipment. They were made in places that boasted above average numbers of patents per person. Places making products exposed to Japan seemed to have been doing particularly well. They enjoyed above-average levels of income and education levels and below-average rates of unemployment.

The China shock was different. Production in affected industries—this time, for example, toys and shoes—had indeed started out in places with relatively well-off, well-educated workers where patenting was relatively concentrated. Had the shock hit in 1960, 40-50 years before it did, it would have landed on fairly rosy-looking towns. But by 1990 production had already shifted to districts with above-average unemployment, below-average education and no greater propensity for patenting than the country as a whole.

The authors argue that the China shock hurt so much because it whacked people who were already struggling. Areas with fewer college-educated workers suffered bigger dents in labour-force participation. And workers in places where industries were already moving out proved the least nimble. Employment fell by more in places where jobs in exposed industries had declined between 1960 and 1980.

Pick yourself up

Other studies have delved into why the China shock hurt so much. Messrs Autor, Dorn and Hanson describe how the places hit hardest took their suppliers down with them, hurting whole communities. Nicholas Bloom of Stanford University and three co-authors found that, although imports from China did support some new jobs (eg, by providing cheaper inputs), they did not grow in the areas where vulnerable jobs were lost. While places like Des Moines dodged the China shock and some towns gained from the cheaper inputs, others were left to flounder.

As negotiators try to rewrite the terms of Sino-American trade, it may be tempting to conclude that America has paid too high a price for China’s entry into the global trading system. Japan was much richer in the 1980s than China was in the early 2000s; America should have protected its exposed industries. A more helpful conclusion is that politicians should take more care to equip workers labouring far from the innovation frontier to adapt to shocks to their industries—from import competition or anywhere else.

Politicians might learn another lesson, too. Their response to shocks can usually only speed up or slow down broader structural trends. Even without the China shock, toymaking would have moved somewhere else, some time. Cranking tariffs up or down may offer politicians the temporary sense that they can control foreign competition, but the costs of protection will be borne elsewhere in the economy, largely unseen. And the world will meanwhile move on regardless.