Why AMD Shares Have Plummeted Almost 25% In 2 Days

Stock market darling Advanced Micro Devices appears to be a darling no more. The company, which makes microchips to power PCs and servers as well as video graphics cards, saw its share price shrivel by almost 25% in trading just on Wednesday through midday on Thursday.

It’s been a wild ride this year for investors in AMD, which—regardless of the market gyrations—has been benefitting from a long-term chip redesign effort under CEO Lisa Su. AMD shares ended 2017 at $ 10.28, rose above $ 34 last month, and have since sold off considerably to trade at $ 19.40 midday on Thursday. At the height, AMD’s shares had more than tripled. Now they have fallen a total of 43% from that recent high, hit back on Sept. 13.

The immediate catalyst for the sell-off this week was the company’s third quarter earnings report on Wednesday, along with the general market weakness among tech stocks. AMD’s revenue increased 4% to $ 1.65 billion for the quarter, slightly short of Wall Street analyst estimates, but the company’s forecast of $ 1.45 billion for fourth quarter revenue, which would represent an 8% gain, was a deeper miss versus Wall Street expectations.

Still, the real story of AMD’s highs and lows is a complex tale related to the growth of its revamped line up of chips for PCs, servers and graphics, the ups and downs of the cryptocurrency market, and the stumbles of primary competitor Intel.

To start, Su oversaw a wholesale redesign of AMD’s chip lineup to focus on higher performance that started delivering new products last year and saw second generation updates go on sale in 2018. Strong reviews and solid sales of the Ryzen chip for PCs, Epyc server chips, and Vega graphic chip drove AMD’s sales through the first nine months of this year to $ 5.1 billion, up 29% from the same period of last year. That’s also produced a net income of $ 299 million versus a loss of $ 14 million in 2017.

But some of the sales boost had little to do with new products and resulted instead from the unsustainable boom in cryptocurrencies.

People who wanted to crunch the calculations that lead to the creation of new digital coins, known as digital currency miners, often rely on graphics cards using chips from AMD and Nvidia (nvda). As cryptocurrency prices peaked, demand for graphics cards shot up.

But lately prices have slumped and the resulting drop in demand showed up in AMD’s third quarter results. AMD said graphics chip sales related to mining made up almost 10% of sales total revenue in the third quarter last year, or about $ 150 million, versus almost nothing in this year’s quarter. That fall off was steeper than Wall Street, and maybe some AMD executives, expected.

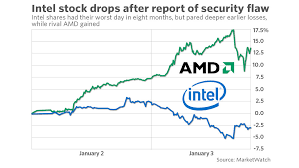

The final issue driving AMD’s stock price has been all of the problems at Intel, which lost its CEO in June and has been struggling to move its manufacturing process to cutting-edge techniques for several years.

Intel admitted at the end of July that its much delayed 10-nanometer chip line, first expected to arrive back in 2015, wouldn’t be available in high volumes until the end of next year. AMD’s shares closed at $ 18.94 the day before Intel’s announcement and subsequently spent the next six weeks skyrocketing as investors dreamed that Intel’s delay would open the door for a massive sales increase.

Lately, Intel (intc) has been offering more optimistic information and releasing chips that, at least on paper, appear to be strong competitors for AMD’s (amd) products, with or without the 10-nanometer process. A part of the disappointment with AMD’s third and (projected) fourth quarter revenue stemmed from a failure of the company to cash in quite as significantly as some hoped from Intel’s troubles.

As longtime chip industry analyst Stacy Rasgon at Bernstein Research summed up in a report on Thursday: “It is clear that expectations got significantly overheated over the last few months, and now must come back down to earth, with the question of ultimate earnings power (and what one wants to pay for it) remaining up in the air even if the core businesses are on track.”