China’s manufacturing PMI drops to 49.3

China’s factory activity experienced a decline in January, as weak domestic demand negatively impacted production at the beginning of the new year, according to an official survey released on Saturday. The official purchasing managers’ index fell to 49.3 in January, down from 50.1 in December, indicating a shift below the 50-mark that delineates growth from contraction. It fell short of the 50.0 forecast in a Reuters poll of analysts. Sub-indexes of new orders and new export orders experienced declines, falling to 49.2 from 50.8 in December and 47.8 from 49.0 in December, respectively. The non-manufacturing PMI, encompassing services and construction, decreased to 49.4 from 50.2 in December, marking its lowest point since December 2022. Huo Lihui remarked in a note that certain categories of manufacturers typically experience a slowdown in January, and market demand continues to be subdued. The world’s second-largest economy achieved the government’s official growth target of 5% last year, supported by robust exports that withstood the challenges posed by US President Donald Trump’s tariff offensive.

However, the headline figure concealed profound imbalances within the economy. Retail sales experienced a further decline in the final quarter, resulting in fourth-quarter GDP growth hitting a three-year low. Policymakers are increasingly expressing concern as the downturn in domestic demand continues. The government allocated 62.5 billion yuan (8.99 billion dollars) from ultra-long special treasury bond funds to bolster its initiative providing consumers with subsidies for replacing various products, including home appliances and smartphones. Earlier this month, the central bank announced cuts to sector-specific interest rates and signalled it has room this year to further reduce banks’ cash reserve requirements and deliver broader rate cuts. As authorities grapple with the challenge of stimulating household spending on goods, they are simultaneously shifting their focus towards initiatives designed to enhance services consumption, in an effort to accommodate the output of the manufacturing sector.

Analysts continue to express skepticism regarding the potential effectiveness of these measures in stabilizing growth. In the coming months, Beijing will need to take significant actions to achieve an annual GDP growth rate exceeding 4.5% in 2026. “As Beijing runs out of easily implemented policy tools, policymakers may need more time to prepare more comprehensive measures,” Ting Lu said in a note. Beijing has committed to prioritizing the enhancement of domestic demand this year, while intensifying its efforts to attain technological self-reliance in order to mitigate risks associated with foreign trade blockades and protectionist policies.

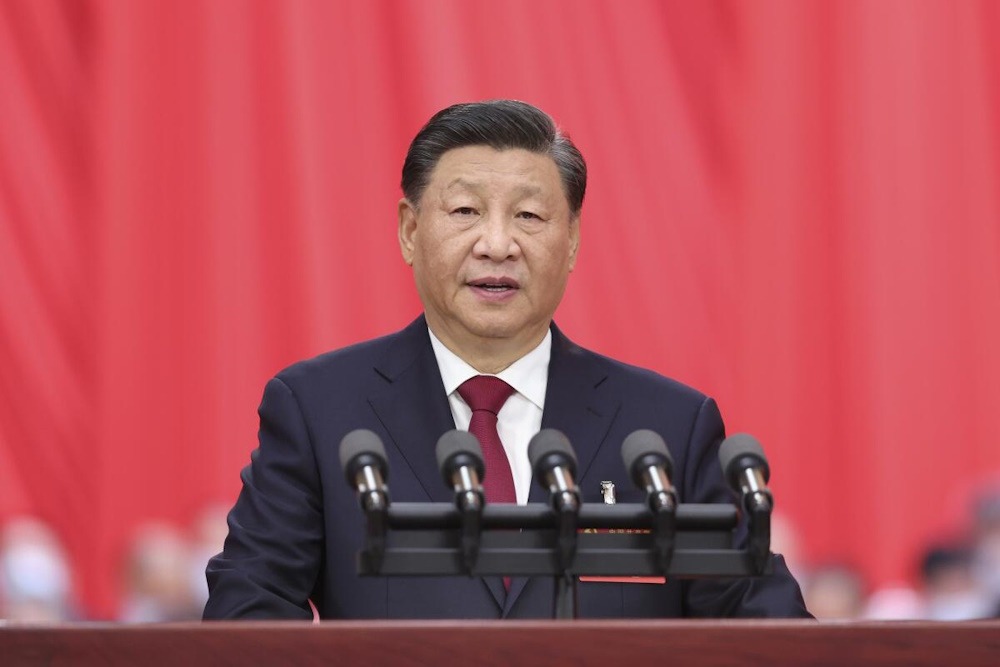

During a recent seminar with senior government officials, President Xi Jinping emphasized the need for vigorous development of advanced manufacturing and committed to prioritizing domestic demand as the primary engine of economic growth. According to the reports, China is expected to establish this year’s official growth target within the range of 4.5% to 5%, as policymakers adopt a careful stance on stimulus amid concerns regarding a stock market bubble. Analysts surveyed by Reuters predict that the private sector RatingDog PMI will rise to 50.3, an increase from 50.1 the previous month.