Chinese $11 Trillion Stock Market: Catch-22 for Xi & Trump

Central to the understanding of consumer behavior in China—characterized by high savings rates and low spending—is the dynamics of the nation’s stock market. This fundamental aspect presents a significant challenge for leaders like Xi Jinping and Donald Trump, who may find it difficult to alter these entrenched patterns, regardless of their intentions. Despite a recent rally, Chinese indexes have merely reverted to levels observed following a significant bubble burst a decade prior. Rather than encouraging consumer expenditure, subpar equity returns have prompted a shift towards increased saving behavior. An investment of $10,000 in the S&P 500 Index ten years ago would have experienced a remarkable increase, more than tripling in value. In contrast, the equivalent investment in China’s CSI 300 benchmark would have yielded an additional $3,000.

According to long-term observers of China, one contributing factor is structural in nature. Established 35 years ago to facilitate state-owned enterprises in directing household savings towards the construction of infrastructure such as roads, ports, and factories, exchanges have historically exhibited a limited emphasis on generating returns for investors. The skew has generated a range of issues, including an oversupply of shares and dubious post-listing practices, which persist in exerting pressure on the $11 trillion market. The nation’s policymakers face mounting pressure to address this issue. President Xi is relying on domestic consumption to achieve the targeted 5 percent economic growth, particularly in light of the escalating tariff conflict with the United States concerning the significant trade deficit. Simultaneously, Beijing has compelling motivations to continue emphasizing the market’s function as a capital source: the nation requires substantial financing to support enterprises that are fundamental to its technological aspirations — even in the face of uncertain profitability.

“China’s capital market has long been a paradise for financiers and a hell for investors, although the new securities chief has made some improvements,” stated Liu Jipeng, a securities veteran and educator at China University of Political Science and Law, during an interview. “Regulators and exchanges are consistently, whether intentionally or inadvertently, favoring the financing aspect of the business.”

)

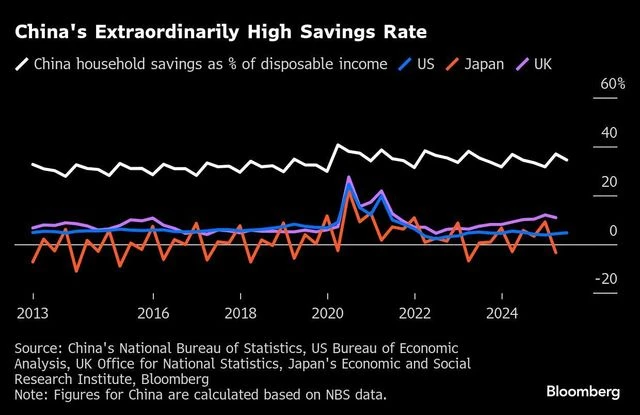

This year has once again highlighted the constraints surrounding China’s stock market rally. The CSI 300 has experienced an increase of less than 7 percent, even amidst a surge of optimism surrounding AI, falling behind benchmarks in both the US and Europe. The underperformance, coupled with an uncertain economic outlook, elucidates China’s remarkably elevated savings rate, currently at 35 percent of disposable income. Chen Long, a professional in the asset management sector, has utilized the social media platform Xiaohongshu to caution individuals about the potential hazards associated with pursuing the recent market rally. “Many ordinary people come in thinking they could make money, but the majority of them end up poorer,” Chen stated in an interview, noting that he has been investing since 2014. “State-owned companies primarily answer to the government rather than shareholders, while many private entrepreneurs have little regard for small investors.”

In the last year, the highest echelons of China’s leadership have demonstrated an increased recognition of the stock market’s role as a mechanism for wealth generation. That is particularly evident in the context of a persistent downturn in the property market and a disjointed social safety net, which intensifies feelings of insecurity. The Politburo of the Communist Party committed to “stabilize housing and stock markets” during a meeting in December — marking an unusual endorsement for equities at this senior assembly. The body additionally advocated for “increasing the attractiveness and inclusiveness of domestic capital markets” in July. According to Hao Hong, chief investment officer at Lotus Asset Management Ltd., there is no immediate solution to enhancing household confidence “except for a stock market rebound. This is a topic that has been under discussion in the closed door meetings in Beijing.”

)

In certain respects, the market’s stagnation has been developing over many years. “The exchanges are motivated to fulfill the government’s call for increasing companies’ financing,” stated Lian Ping, chairman of the China Chief Economist Forum, a think tank that provides advisory services to the government. “However, in the realm of safeguarding investors’ interests, there are limited individuals driven to take action.” China emerged as the world’s largest IPO market in 2022, driven by a remarkable surge in new listings. Insufficient safeguards for shareholders and lax oversight of IPO frauds have resulted in significant share price declines and delistings — a phenomenon that retail investors describe as “stepping on a land mine.”

Consider Beijing Zuojiang Technology, which went public in 2019. The company indicated in a statement from 2023 that its product was designed based on Nvidia’s BlueField-2 DPU. The company issued a cautionary statement in January of the subsequent year regarding the potential risk of delisting, referencing an ongoing investigation into disclosure violations. It was subsequently delisted from the Shenzhen stock exchange. In recent years, there has been an increased emphasis on the scrutiny of subpar IPOs and a concerted effort to combat financial fraud. There is an ongoing effort to limit further stock issuances by publicly traded companies and the divestitures by significant shareholders, while simultaneously advocating for a greater distribution of corporate profits to investors. There has been observable advancement. Initial public offerings contracted to approximately one-third of the levels observed in 2023 during the previous year. According to state media, companies listed in Shanghai and Shenzhen distributed a total of 2.4 trillion yuan in cash dividends for 2024, reflecting a 9 percent increase compared to the prior year. “The regulations and overall requirements after IPO have become stricter, in terms of reliability, transparency, or information disclosure,” stated Ding Wenjie, investment strategist at China Asset Management Co.

Reforms, however, have not succeeded in reshaping the market to emphasize investor returns. Despite the increase in share buybacks, CSI 300 companies allocated merely 0.2 percent of their market value to repurchasing shares in 2024, significantly lower than the nearly 2 percent expended by S&P 500 firms. The recent policy initiative aimed at increasing the number of tech listings raises concerns among certain investors. Regulators are reinstating the listing of unprofitable companies on the STAR board, referred to as China’s Nasdaq, while simultaneously permitting such listings for the first time on the Shenzhen-based ChiNext board, which is designated for growth enterprises. Initial public offerings this year have risen by almost 30 percent compared to the corresponding period in 2024. This development is a necessary step to ensure capital availability for companies crucial to China’s competition with the US in sectors such as AI, semiconductors, and robotics.

However, it also indicates that regulatory bodies might be prioritizing funding requirements over the safeguarding of investor interests. Accelerating the process for additional firms to go public without addressing the fundamental issues surrounding corporate credibility will “just add volume without restoring investor trust,’’ stated Hebe Chen, an analyst at Vantage Markets in Melbourne. Officials at the stock exchange have been proactively engaging with investment banks and urging companies to pursue initial public offerings, as reported by sources with knowledge of the situation. Certain high-caliber tech candidates may gain entry to designated “green channels” that facilitate an expedited review and approval process, according to sources. “The entire regulatory environments are still not up to the task of delivering the best out of those companies,” stated Dong Chen, chief Asia strategist at Pictet Wealth Management. It necessitates a more thorough enhancement of the institutional framework “to provide the right incentives’’ for firms to generate value for their shareholders, he stated.