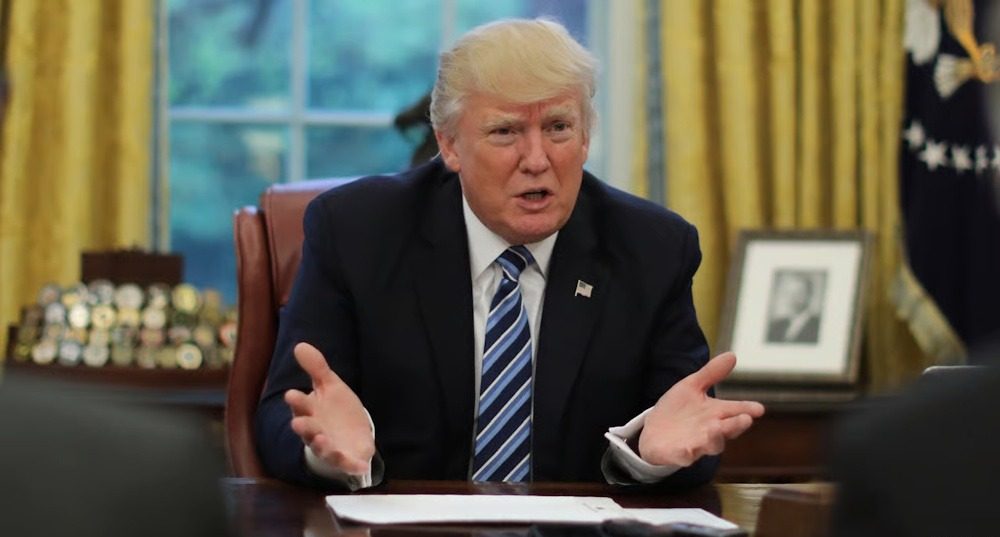

Trump Cuts Beef and Coffee Tariffs to Tackle Grocery Costs

On Friday, President Donald Trump issued an order to significantly reduce tariffs on beef, coffee, bananas, and various other agricultural and food products, representing a notable shift from his previous stance on “reciprocal tariffs” as the administration contends with increasing public anxiety regarding the cost of living. In a recent executive order, Trump modified the reciprocal tariffs established in August, eliminating levies on over a hundred frequently used food items, including fruits, nuts, and spices, as per reports. This reversal indicates a shift in the administration’s previous hardline approach; when the tariffs were first announced in the spring, officials asserted that there would be no exceptions, but exemptions were gradually granted for items not produced in the U.S. or not available in sufficient quantities. The most recent exemptions extend even further, as numerous products now exempt from duties—such as beef, which has recently reached record prices—are predominantly produced domestically, with tariff cuts to take effect retroactively from 12:01 a.m. on Thursday, November 13.

The decision arrives amid mounting pressure on the White House regarding inflation and the uncertainties highlighted during a recent Supreme Court hearing on the legality of the reciprocal tariffs, prompting the administration to reduce these duties while simultaneously expanding other tariffs under Section 232 of the Trade Expansion Act of 1962, which focuses on sectors such as steel, aluminium, and autos. Trump’s action comes in the wake of internal divisions within the Republican Party regarding the appropriate response to voter dissatisfaction, particularly after Democrats effectively campaigned on affordability concerns in the November elections. What measures is the White House implementing to tackle the pressures of rising food prices? Trump has proposed utilizing tariff revenue to distribute $2,000 rebate checks to Americans and has initiated an antitrust investigation into major meatpacking firms, which he accuses of driving up beef prices. Friday’s exemptions build upon earlier carve-outs announced on Thursday for food imports from Argentina, Ecuador, Guatemala, and El Salvador after they agreed to new trade frameworks.

The recent modifications broaden the scope of exemptions to include all nations affected by the reciprocal tariffs, instead of limiting them to those that negotiated agreements. Democrats and various economists asserted that the decision indicates Trump acknowledges that the tariffs have been increasing prices for Americans, despite his ongoing claims that foreign companies bear the cost. “By admitting that lowering tariffs will lower prices for U.S. consumers, the Trump administration is acknowledging what economists have pointed out all along: tariffs raise prices,” said Erica York, Vice-President of federal tax policy at the Tax Foundation, as quoted by the report. The shift in tariff policy reflects growing economic pressures and rising consumer frustration as food and commodity prices continue to climb across the country.

As inflation concerns intensify, the administration faces increased scrutiny from both political allies and opponents regarding its approach to trade and consumer pricing. The expanding list of exempted products suggests a broader recalibration of tariff strategy as the White House seeks to ease economic pressures while retaining leverage in trade negotiations. With affordability emerging as a central political issue, the rollback of tariffs underscores the administration’s attempt to respond to voter concerns ahead of future electoral cycles. The policy shift also highlights the tension between protecting domestic industries and ensuring stable consumer prices, a balancing act that continues to influence the administration’s evolving economic agenda.