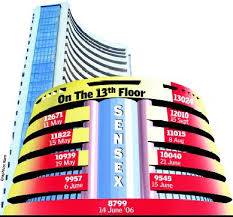

Market Live: Sensex gives up some of its gains, Nifty continues to be around 9800

2:00 pm Market Check: Benchmark indices trimmed some of their gains from the morning, with Nifty around 9800.

The Sensex was up 56.13 points at 31314.98, while the Nifty was up 22.20 points at 9776.55. The market breadth was negative as 894 shares advanced against a decline of 1464 shares, while 117 shares were unchanged.

1:55 pm Buzzing Stock: Ramco Systems shares surged 6.6 percent intraday Tuesday on signing contract with aircraft manufacturer for its China operations.

“After entering the Greater Chinese Aviation market with Far Eastern Air Transport in 2016 followed by Bedek-Lingyun (Belinco), and China Southern Airlines General Aviation, Ramco has secured an order from one of the global top 5 aircraft original equipment manufacturers for its joint venture in China,” the global aviation software provider said in its filing.

Ramco will help the China based manufacturing centre to embrace latest technology offerings to automate its maintenance & engineering (M&E), supply chain, finance, HCM and payroll functions on a unified platform.

1:45 pm Market Check: Benchmark indices were trading in the positive region, with the Nifty inching towards 9800-mark.

The Sensex was up 119.78 points at 31378.63, while the Nifty was up 42.20 points at 9796.55. The market breadth was negative as 933 shares advanced against a decline of 1,408 shares, while 120 shares were unchanged.

1:35 pm Buzzing Stocks: Ramco Systems shares surged 6.6 percent intraday Tuesday on signing contract with aircraft manufacturer for its China operations.

“After entering the Greater Chinese Aviation market with Far Eastern Air Transport in 2016 followed by Bedek-Lingyun (Belinco), and China Southern Airlines General Aviation, Ramco has secured an order from one of the global top 5 aircraft original equipment manufacturers for its joint venture in China,” the global aviation software provider said in its filing.

Ramco will help the China based manufacturing centre to embrace latest technology offerings to automate its maintenance & engineering (M&E), supply chain, finance, HCM and payroll functions on a unified platform.

1:15 pm OMCs gain: Shares of oil marketing companies (OMCs), ONGC and HPCL gained between 1.5 and 4.5 percent intraday, respectively, on Tuesday as investors cheered the M&A developments around the firm.

The Board of ONGC on Tuesday gave an approval to buy government’s stake in the company, according to reports on CNBC-TV18.

For the same, HPCL’s asset valuation will be done by a separate entity and an advisor has been appointed to evaluate the stake sale, he told the channel.

1:00 pm DRL outlicences some segments: Drug major Dr Reddy’s Laboratories today said it has out-licensed the future development, manufacturing and commercialisation rights of its topical high potency steroid DFD-06 to Encore Dermatology.

The drug is intended to be used for the treatment of moderate to severe plaque psoriasis.

“Under the terms of the agreement, Encore will be responsible for the commercialisation of DFD-05 in the United States,” Reddy’s Laboratories said in a regulatory filing.

12:45 pm Europe update: European markets opened higher on Tuesday morning, after modest gains on Wall Street while investors awaited the annual central banking conference in Jackson Hole later this week.

The pan-European Stoxx 600 was 0.4 percent higher shortly after the opening bell with all sectors and major bourses in positive territory.

12:22 pm Market Check: Benchmark indices continued to trade higher amid volatility, supported by index heavyweights Reliance Industries, ITC and HDFC Group stocks.

The 30-share BSE Sensex was up 103.67 points at 31,362.52 and the 50-share NSE Nifty rose 37.50 points to 9,791.85 despite weak market breadth.

About three shares declined for every share rising on the BSE.

11:40 am USFDA approval: Zydus Cadila has received the final approval from the US Food and Drug Administration to market Pindolol tablets, USP 5 mg and 10 mg.

Pindolol belongs to a class of medication called beta-blockers and is used to treat hypertension.

The drug will be manufactured at the group’s formulations manufacturing facility at Pharma SEZ, Ahmedabad.

11:25 am Buzzing: Shares of Westlife Development gained around 15 percent intraday as investors could have cheered positive outlook on the stock post developments around McDonald’s business in the North.

McDonald’s India on Monday terminated the franchise agreement for 169 fast-food outlets in North and East India run by Connaught Plaza Restaurant Ltd (CPRL) and said the outlets cannot use its brand for any operations.

CPRL is led by Vikram Bakshi, the estranged partner of the US-based food chain giant.

The decision comes weeks after 43 outlets run by CPRL in the national capital were shut due to non-renewal of eating house licences by local authorities. CPRL was a 50:50 joint venture between Bakshi and McDonald’s India.

Brokerages too had a positive stance on the stock. CLSA believed the development was good for the company and the stock.

11:10 am Market Outlook: At a time when the market seems to be in a consolidation or corrective phase, several experts point to the times when they had flagged concerns of overvaluation in the market.

HSBC Global Asset Management Company (AMC) is sticking to its plan to stay invested in the market, but will keep evaluating segments where valuations are higher.

Choosing an alternative is also dependent based on the investor you are. One could look at the rate of return, the risk and market volatility. Check for allocation of your portfolio and take bets off the areas where an investor feels the allocation is higher, Tushar Pradhan, CIO, HSBC Global Asset Management (India) told CNBC-TV18 in an interview.

10:55 am Interview: Lupin said Aurangabad unit is one of the smallest but oldest units for the company.

It received clearance from USFDA for Aurangabad facility.

Lupin is very confident about receiving Tamiflu approval soon.

Tamiflu is not filed from Aurangabad facility and it has not done any major filings from Aurangabad unit, the pharma company’s management said in an interview with CNBC-TV18.

It expects Goa & Pithampur units to be cleared in a few weeks.

Japan is a very important market for company and contributes 12-15 percent of total revenue, management said.

10:40 am Dr Reddy’s in focus: Dr Reddy’s Labs outlicensed commercialisation rights of DFD-06 to Encore Dermatology.

DFD-06 is a topical high-potency steroid.

10:25 am IPO: Apex Frozen Foods, which is in the business of aquaculture products, has opened its initial public offering for subscription today.

The company raised over Rs 43 crore from anchor investors on Monday.

In a statement, the company said it has allotted 24.90 lakh equity shares to three anchor investors at Rs 175 per piece, totalling Rs 43.57 crore.

The anchor investors are Reliance Capital Trustee Company Ltd, HSBC Midcap Equity Fund, HSBC India Opportunities Fund and ITPL –Invesco India Contra Fund.

The public issue will close on August 24.

The IPO of up to 87 lakh equity shares of face value of Rs 10 each will be offered through a book-building route at a price band of Rs 171-175 per share.

Proceeds from the issue would be utilised towards setting up a new shrimp processing unit with a capacity of 20,000 tonnes per annum in Andhra Pradesh and for general corporate purposes.

10:01 am Q1 earnings analysis: Suhas Harinarayanan of JM Financial said earnings in Q1FY18 have been worse than anticipated.

For the companies under coverage, profit had a YoY decline of 15 percent against expectation of 9 percent decline. This, despite a better than expected YoY revenue growth of 10.9 percent, he explained.

“Our model portfolio emerges from a bottom-up approach with a recommended overweight on private financials, pharma, and industrials like L&T,” Harinarayanan said.

9:51 am Market Check: Equity benchmarks erased some gains in morning, with the Nifty falling below 9,800 level due to profit booking HDFC Bank and SBI.

The 30-share BSE Sensex was up 51.82 points at 31,310.67 and the 50-share NSE Nifty rose 24.20 points to 9,778.55.

The broader markets turned flat as market breadth is balanced. About 897 shares declined against 815 advancing shares on the BSE.

9:37 am Distribution Agreement: HCL Infosystems shares rallied as much as 17 percent in morning trade on distribution agreement for Apple products in India.

The HCL Group company inform exchanges that the distributor agreement for distribution of iPhone and other Apple Products has been signed with Apple India Private Limited.

A confirmation of the same is received by the company from Apple today, it said.

9:25 am Buzzing: Share price of Lupin advanced 3 percent in the early trade on the back of EIR from USFDA.

The company has received an establishment inspection report (EIR) from the US Food and Drug Administration (USFDA) for its Aurangabad facility in Maharashtra.

EIR indicates closure of inspection.

The facility was inspected by the USFDA in April this year.

9:15 am Market Check: Equity benchmarks started off Tuesday’s trade on a strong note, with the Nifty reclaiming 9,800 level, supported by broadbased buying.

The 30-share BSE Sensex was up 173.60 points at 31,432.45 and the 50-share NSE Nifty rose 56.45 points to 9,810.80.

About two shares advanced for every share falling on the BSE.

Infosys rebounded 1 percent after 15 percent correction in previous two consecutive sessions.

Hindalco, Vedanta, Dr Reddy’s Labs, IOC, Tata Steel, Tata Motors, Coal India, ICICI Bank, Axis Bank, GAIL, Tech Mahindra, Aurobindo Pharma and Bank of Baroda gained up to 2 percent.

TCS and UltraTech Cement were under pressure.

Among midcaps, Reliance Capital, Capital First, PNB Housing Finance, LIC Housing Finance, Jaiprakash Associates, Repco Home, Indo Count, Chennai Petroleum, Manappuram, Reliance Defence, BEML, V-Guard, HCL Infosystems and Bhushan Steel rallied up to 16 percent.