India : After tariff war, Bharti Airtel challenges Reliance Jio with 135 mbps data speed

Bharti Airtel is gearing up to engage with new entrant Reliance Jio Infocomm on another front: data speed.

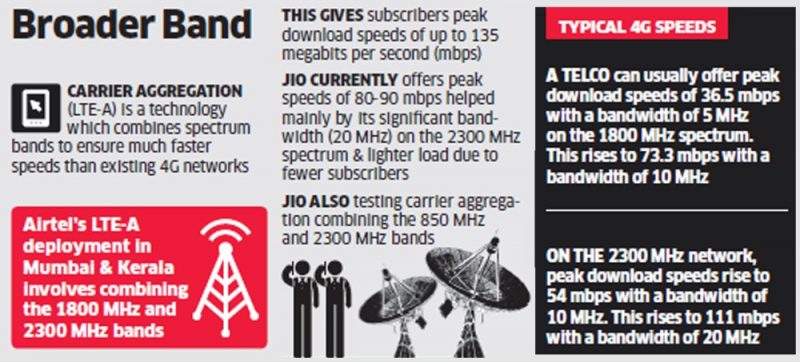

The company said on Wednesday it has deployed technology known as “carrier aggregation” in Mumbai and Kerala to combine different bands of spectrum and create larger blocks of airwaves to offer faster and more stable 4G data services for mobile users. The enhanced service enables peak download speeds of as much as 135 mbps, which is faster than what users get on a normal 4G network.

Experts said Airtel has virtually thrown down the gauntlet at Jio, which has touted 40-80 per cent faster broadband speeds as a big differentiating factor with incumbent telcos. In Jio’s ongoing trial phase, a relatively empty network has offered peak speeds of 80-90 mbps.

Faster speeds achieved through carrier aggregation will transform 4G into a better product for consumers and will give carriers an additional marketing handle, said Rohan Dhamija, head-India and South Asia at Analysys Mason, a telecom, media and technology advisory firm.

“Potentially, they (carriers) can publicise it and it could be a part of their marketing strategy as they would want to highlight it to consumers as a differentiating factor,” Dhamija said.

The speed battle comes on the back of an anticipated tariff war, given Jio’s comments that it will offer services at “substantially lower” rates than rivals. Bharti Airtel, Vodafone India and Idea Cellular have already slashed effective data tariffs by 67 per cent for prepaid customers.

Market leader Airtel has started offering free and unlimited voice calls with some post-paid data packs. Airtel has also offered data at rock-bottom prices in some plans, aiming to retain higher-paying users. This comes amid Jio’s ongoing three-month preview offer of free voice and data for users of most smartphone brands available in India.

Airtel plans to widen the war on the speed front by deploying the technology in other areas in the coming months. With the help of spectrum acquired from Aircel through a trading deal, Airtel can potentially offer enhanced speeds in 13 circles in India.

Jio conducting trials

Reliance Jio is also currently conducting trials on combining spectrum across the country, a person familiar with the matter said. In addition, it has started talks for trials of another version of carrier aggregation technology designed to use unlicensed spectrum, which is open to everybody, along with licensed airwaves to ease the burden on networks.

With video becoming a major driver of data growth, any technology that is able to handle larger throughput and give better speed is a preferred technology, said Hemant Joshi, a partner at Deloitte Haskins & Sells.

“The customer is very impatient and slow speeds can impact the overall experience. The deployment of these technologies is a very positive sign,” Joshi said.

All eyes on auctions

For the moment, the clash is between Airtel and Jio. Vodafone and Idea can’t leverage this technology because they don’t have multiple 4G bands across India, although that could change after the spectrum auctions scheduled later this year. Vodafone has been considering deployment of this technology and has conducted a trial with equipment vendor partners, another person said.

“Assuming that they will buy spectrum in the upcoming auction, they are keeping the network ready with features and functionalities that can take care of carrier aggregation,” the person added. “With the deployment of 4G Advanced, we are taking a quantum leap in delivering a superior mobile broadband experience to our customers,” Ajai Puri, director-operations (India & South Asia), Bharti Airtel, said in a statement.

Queries sent to Vodafone, Idea and Reliance Jio didn’t elicit any response.