In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is at 16360.71 for a loss of -195.24 points or -1.18 percent. Hong Kong’s Hang Seng Index is at 22909.54 for a gain of 94.59 points or 0.41 percent. China’s Shanghai Composite is at 3070.31 for a gain of 1.98 points or 0.06 percent. India’s S&P BSE Sensex is at 27782.25 for a loss of -53.66 points or -0.19 percent. In Europe, the FTSE 100 Index is at 6824.79 for a gain of 7.89 points or 0.12 percent. Germany’s DAX is at 10509.32 for a loss of -20.27 points or -0.19 percent. France’s CAC 40 is at 4404.27 for a loss of -2.34 points or -0.05 percent. The Stoxx Europe 600 is at 341.81 for a loss of -0.21 points or -0.06 percent.

Friday’s Factors and Events

Janet Yellen’s Jackson Hole speech Friday morning at 10:00 AM EST at the Monetary Policy Symposium will be the highlight of the trading day. Yellen’s speech is titled, “Designing Resilient Monetary Policy Frameworks for the Future.” Investors will be watching for comments on the timing of the next rate increase and also long-term plans for how the Federal Reserve will be repealing the accommodative monetary policy it has been instituting over the last eight years.

Also on the economic calendar for Friday will be the second estimate of GDP. Consensus is calling for basically no change in the GDP rate at 1.1 percent down from 1.2 percent in the first report. The consensus range for the second quarter GDP report is 0.8 percent to 1.5 percent.

Along with the GDP report, the Bureau of Economic Analysis will release its first report on second quarter corporate profit growth on Friday. Economists are expecting corporate profit growth overall to be around -2 percent which should be a slight improvement from the first quarter.

Other reports Friday include International Trade in Goods, Consumer Sentiment and the Baker-Hughes Rig Count.

The second quarter earnings season has basically ended with only four companies reporting earnings on Friday. Trading actively in the pre-market for Friday are the following stocks:

Dollar General

Mylan

Alexion Pharmaceuticals

AmerisourceBergen Company

HP Inc.

Salesforce.com Inc.

Thursday’s Activity

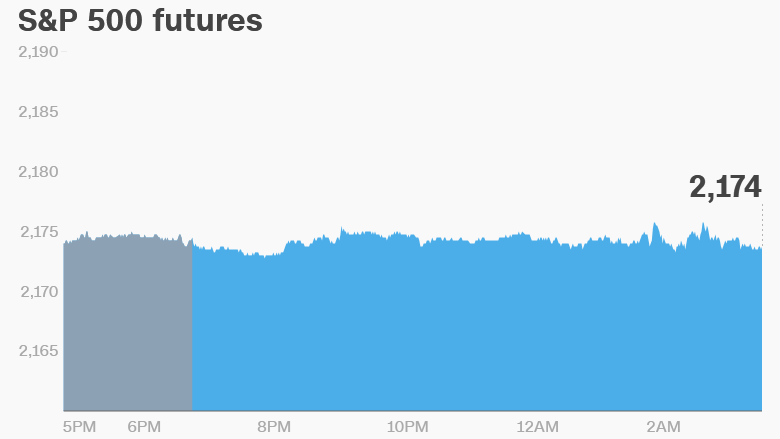

On Thursday, stocks were mostly lower. The Dow Jones Industrial Average closed at 18448.41 for a loss of -33.07 points or -0.18 percent. The S&P 500 was also lower, closing at 2172.47 for a loss of -2.97 points or -0.14 percent. The Nasdaq Composite closed lower at 5212.20 for a loss of -5.49 points or -0.11 percent.

Other notable index closes included the small-cap Russell 2000, higher at 1240.00 for a gain of 2.75 points or 0.22 percent; the S&P 600 Small-Cap Index, higher at 754.01 for a gain of 2.46 points or 0.33 percent; the S&P 400 Mid-Cap Index at 1564.80 for a gain of 3.90 points or 0.25 percent; the S&P 100 Index at 959.81 for a loss of -1.65 points or -0.17 percent; the Russell 3000 Index at 1285.33 for a loss of -0.98 points or -0.08 percent; the Russell 1000 Index at 1203.91 for a loss of -1.21 points or -0.10 percent; and the Dow Jones U.S. Select Dividend Index at 619.59 for a gain of 1.70 points or 0.28 percent.