Oil squeeze will end on August 17th – Morgan Stanley

Following his bearish note last week, Morgan Stanley’s oil analyst Adam Longson is out with a new report, in which he accurately explains that the recent oil-price jump is driven by traders covering bearish bets, even as market fundamentals are seen remaining weak in coming months.

According to Longson, a “sizeable” amount of Sept. WTI put positions at $ 40, $ 45 recently came into or near the money, leading to spike in hedging by traders to cover their exposure. However, the good news for oil bears is that the effect of this action will fade once option expires Aug. 17. As we have pointed out previously, the recent comments from OPEC, and IEA helped reverse bearishness and also unleash the recent short squeeze which led to the biggest weekly jump in oil in 4 months.

He then notes that he “would not be surprised to see tank top fears return in 1Q17” as he sees rising U.S. crude inventories in coming months.

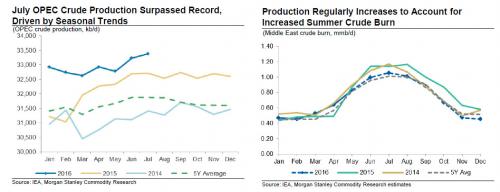

He list other bearish factors for oil, which include modest implied draw in global oil stockpiles in 3Q, as well as a lack of meaningful cuts to refinery run rates. A record OPEC production, albeit seasonal, with potentially higher Libyan exports and Iraqi output growth into 2017 add to bearish indicators.

He notes that the draw in U.S. gasoline inventory seen deceptive as higher net exports – lower imports and more overseas shipments – could be “masking the problem.” He concludes that if global product markets remain oversupplied, ability to export on larger scale may be limited and run cuts unavoidable.

This is what he said on the imminent end of the oil squeeze:

Here are the details on what many believes is the key factor in the latest price spike, the short squeeze, and why Longson believes it will end in just two days.

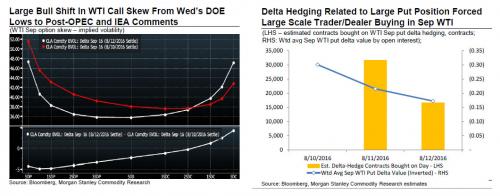

Positioning is moving short term prices, but fundamental setup remains bearish.Sentiment regarding oil continues to swing with price momentum – from bullish in May/June to bearish in July/Aug and back to bullish of late. In the short run, rapid shifts in positioning can move prices. Even this past week, the market sold off sharply on bearish DOEs before reversing late in the week on OPEC and IEA comments. We expect this back-and-forth volatility to continue. However, fundamentals tend to be a stronger driver medium term, and the picture appears negative over the coming months.

Large option position and delta hedging left the market vulnerable to a rally. The market had built up sizeable WTI put positions for Sep at $ 40 and $ 45, which had recently come into or near the money. As these options gain or fall in value, traders/dealers need to buy and sell a corresponding number of contracts to hedge their exposure (the delta value). These delta values tend to rise quickly as contracts approach the money.

Therefore, bullish comments from OPEC and the IEA caught the market uniquely offside to reverse bearish positioning. Rising prices lifted the weighted avg Sep WTI put delta across over 380,000 contracts from (0.30) to (0.17) in just 2 days. As these puts fell in value and delta values climbed, traders/dealers were forced to buy back contracts quickly to cover their exposure. To put this in context, we estimate traders needed to buy 48,000 Sep WTI contracts from 8/10-8/12 vs. only 215,000 reported open interest in WTI Sep futures (although Sep option interest is far larger), simply to cover this hedging interest before we consider other short covering.

We expected this OPEC floor at a lower level with more extreme positioning – hence our $ 35 floor. But option positioning was far enough offside to create a short squeeze and pain trade higher. Once option expiry passes on Aug 17th, this issue should fade. Short squeeze running out of steam? A notable amount of short position has likely been flushed out, but we would be remiss if we didn’t acknowledge a large open interest in $ 45 puts. However, this move higher also brought in some bullish buying from those who believe the worst is past. In fact, the call skew is now shifted bullish for Sep, and we would expect lagged CFTC positioning data to follow. Not only does this likely leave less upside from positioning, but a more balanced market suggests upcoming bearish fundamentals are likely to drive markets.

As for fundamentals, nothing good here:

Physical market challenges to crude oil still lay ahead of us. As we wrote previously, the market sell off on product market concerns did not lead any notable change in crude oil fundamentals. Refiners have yet to pull back meaningfully on crude oil purchases (run cuts and maintenance have yet to begin in earnest), and crude oil inventory builds are only starting to turn bearish in both the weekly US statistics and globally.

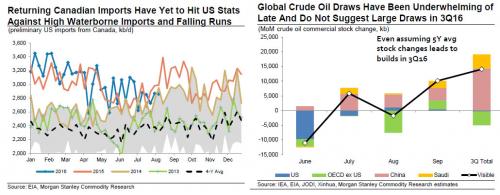

US crude oil inventories face growing challenges. As we’ve noted and seen, US crude oil inventories are set to build – likely above normal – over the coming months. In essence, the US is done drawing for the year (other than random weeks and Dec). Given the market’s intense focus on these US statistics of late, it may be difficult to support any larger oil rally if US inventories are rising. In fact, we would not be surprised to see tank top fears return in 1Q17. Key headwinds include:

- Not only are Canadian imports likely to continue to rise, but waterborne imports should be slow to fade after strong incentive pricing just a few weeks ago.

- The US is also past peak refinery runs, and a number of refineries are already reporting unplanned outages or lower utilization. Upcoming maintenance and potential run cuts may be helpful for product markets, but they will only exacerbate the headwinds for crude oil.

Global challenges await too: We vehemently disagree with the IEA assessment of a 1 mmb/d crude oil stock draw in 3Q16, and we see little evidence for that in reported data. Global draws are common in July and August, and the IEA’s estimated number may not be far from historical averages, but this year appears underwhelming. We see only a modest implied global draw in 3Q16, while countries we can track are likely to build.

US crude oil inventories are already building counterseasonally in Aug and fell well under 5Y avg draws for much of July. Sep will likely show larger than normal US builds. China commercial crude oil inventories climbed counterseasonally in June and typically rise materially in July, Aug and Sep. That said, the IEA does admit their crude oil throughput estimate may be too high, and the organization shows large global builds returning in 4Q16

Finally, the biggest confusion emerges when looking at OPEC production, which despite a new bout of speculation about a production freeze next month, is producting at a record pace.

Saudi Arabia: Record production Has so far held to its promise not to “flood” the market, but the kingdom has kept production elevated. July estimates indicate Saudi production was at 10.62 mmb/d spurred primarily by higher domestic consumption. A heatwave across much of the Middle East is adding pressure to already high summer demand.

Iraq: Consensus may be too pessimistic. Production has continued to surprise to the upside, with July production at 4.33 mmb/d. Iraq also relies heavily on crude oil and petroleum products for electricity generation, and demand has also been boosted by a summer heatwave.

Consensus expects Iraq to be flat or down in 2017, but increasingly it appears the country will grow. We currently expect production in the Gulf State to grow ~300 kb/d this year on avg, and we show only a slight ~60 kb/d increase next year. However, the recent announcement by Iraqi officials that agreements have been reached with major producers to restart previously stalled investments puts this at risk. Officials now believe that 2017 production could grow 250 – 350 kb/d. We have seen false signals from Iraq before, but this announcement should not be dismissed.

Libya: No increase yet. Despite a recent agreement between the national oil company, armed guards and the unity government to reopen three blockaded ports, oil exports will not increase until blockades at the field level are lifted. While elements of our production recovery scenario appear to be playing out, the political and security challenges remain acute and any production recovery could easily be derailed by yet another armed group.

For now, however, the squeeze continues and oil has suged out of the gates, adding to its weekly gains, now up 16% off last week’s lows, and almost back in a bull market.