Deutsche Bank Poses The Greatest Risk To The Global Financial System : IMF

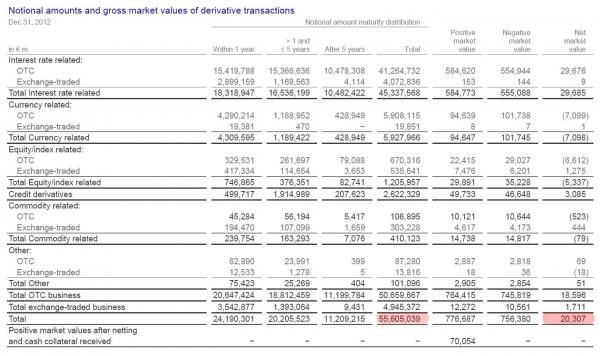

Over three years ago we wrote “At $ 72.8 Trillion, Presenting The Bank With The Biggest Derivative Exposure In The World” in which we introduced a bank few until then had imagined was the riskiest in the world.

As we explained then “the bank with the single largest derivative exposure is not located in the US at all, but in the heart of Europe, and its name, as some may have guessed by now, is Deutsche Bank. The amount in question? €55,605,039,000,000. Which, converted into USD at the current EURUSD exchange rate amounts to $ 72,842,601,090,000…. Or roughly $ 2 trillion more than JPMorgan’s.”

So here we are three years later, when not only did Deutsche Bank just flunk the Fed’s stress test for the second year in a row, but moments ago in a far more damning analysis, none other than the IMF disclosed that Deutsche Bank poses the greatest systemic risk to the global financial system, explicitly stating that the German bank “appears to be the most important net contributor to systemic risks.”

Yes, the same bank whose stock price hit a record low just two days ago.

Here is the key section in the report:

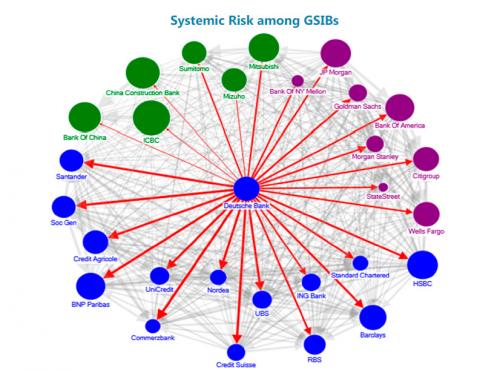

The IMF also said the German banking system poses a higher degree of possible outward contagion compared with the risks it poses internally. This means that in the global interconnected game of counterparty dominoes, if Deutsche Bank falls, everyone else will follow.

The IMF concluded that Germany needs to urgently examine whether its bank resolution, i.e., liquidation, plans are operable, including a timely valuation of assets to be transferred, continued access to financial market infrastructures, and whether authorities can ensure control over a bank if resolution actions take a few days, if needed, by imposing a moratorium:

Here is the IMF’s chart showing the key linkages of the world’s riskiest bank:

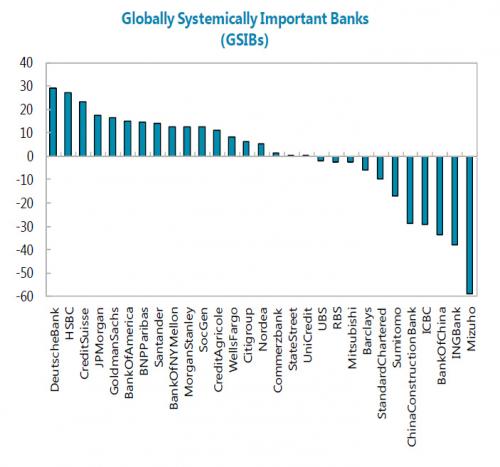

And while DB is number 1, here are the other banks whose collapse would likewise lead to global contagion.

Considering two of the three most “globally systemically important”, i.e., riskiest, banks just saw their stock price scrape all time lows earlier this week, we wonder just how nervous behind their calm facades are the executives at the ECB, the IMF, and the rest of the handful of people who realize just close to the edge of collapse this world’s most riskiest bank (whose market cap is less than the valuation of AirBnB) finds itself right now.