Bank of America Throws In The Towel: “Clients Don’t Believe The Rally, Continue To Sell Stocks”

One week ago, as the bear market rally was about to hit its peak post-ECB crescendo, we reported that according to Bank of America data, “The “Smart Money” Is Quietly Getting Out Of Dodge: Sells For A Sixth Straight Week As Buybacks Soar.”

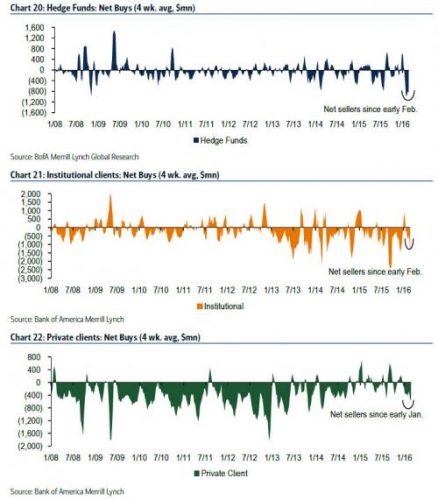

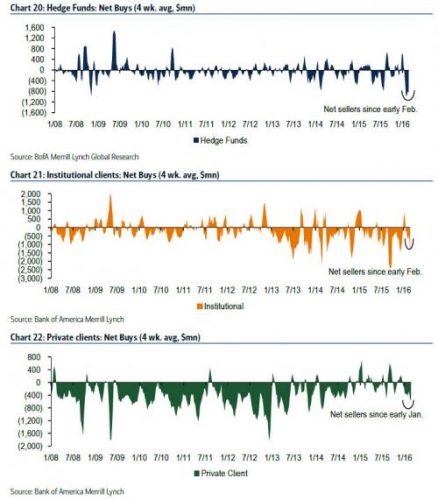

The writing was on the wall with the selling prevalent across every investor class: “similar to the prior week, hedge funds, institutional clients, and private clients (aka the “smart money”)were all net sellers, though sales last week were led by private clients (vs. hedge funds the week prior). Our hedge fund clients remain the biggest net sellers of US stocks year-to-date.”

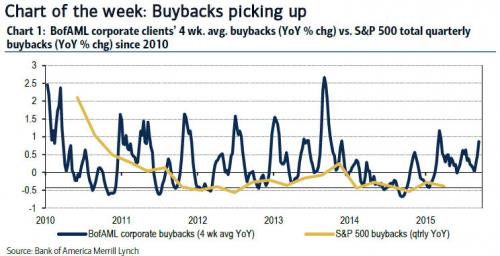

As for the ‘buyer’ no surprise there either: “buybacks by corporate clients accelerated last week to their highest level since August, and are tracking above levels we saw this time last year, though below levels we observed in 2014.”

In other words, the smart money sold to corporations buying back their stock, courtesy of bondholders who continue to eagerly fund this transfer of money, something even Bloomberg figured out yesterday with its report showing the “Only One Buyer Keeping The Bull Market Alive” (buybacks, for those who missed it).

Which brings us to the latest week, where in the latest BofA report on client flow trends, we find that Bank of America has largely thrown in the towel and reports that “Clients don’t believe the rally, continue to sell US stocks” and notes that the “smart money” has now sold stocks in the face of this bear market rally for a near record seven consecutive weeks.

The details:

The details:

- Hedge funds have been net sellers on a 4-week average basis since early Feb.

- Institutional clients have been net sellers on a 4-week average basis since early Feb.

- Private clients have been net sellers of US stocks on a 4-week average basis since early January.

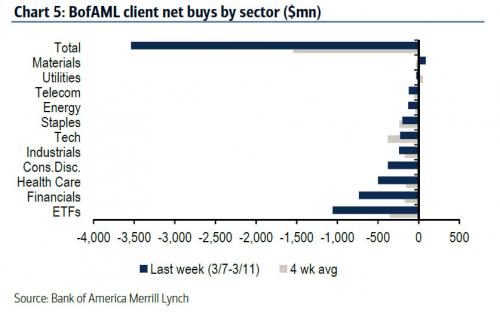

And if the smart money continues selling, means…that’s right, the corporations are buying their own stock:

It gets better: “Buybacks of Industrials stocks by our corporate clients last week were the largest in our data history, and Materials buybacks were also near record levels. These two sectors, along with Staples, have led the pick-up in overall buybacks in recent weeks.”

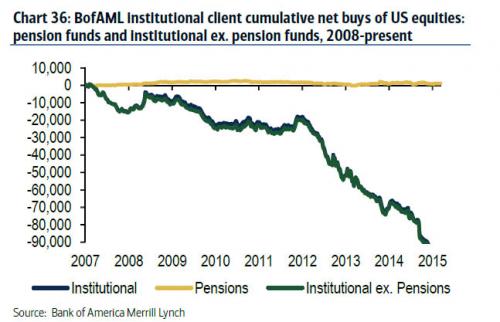

The stunning long-term chart which confirms that without buybacks, the S&P would be orders of magnitude lower:

Which brings us to BofA’s chart of the week: buybacks are picking up (in case someone was not aware).