Investors adds bond funds before rates fall

Investors are allocating assets to bond investments in anticipation of an impending decrease in interest rates. Investors are eagerly adopting bond funds in anticipation of an imminent decline in interest rates. During the first half of the year, fixed-income exchange-traded funds experienced record-breaking inflows of capital. While the stock market may be performing well, the year 2024 has been particularly favorable for bond funds on Wall Street.

Bonds are currently offering the most substantial returns in many years, and it is likely that interest rates will decrease. Simultaneously, an unprecedented number of individuals who have reached retirement age are seeking to reduce the level of uncertainty and potential loss in their investment portfolios. Investors are currently investing significant amounts of money into both indexed and actively managed funds due to their favorable combination. The financial district of Wall Street is experiencing a significant increase in financial gains.

Fixed-income exchange-traded funds listed on U.S. stock exchanges have attracted an impressive sum of around $150 billion by the end of July, setting a new record for this time of year. According to Morningstar, when considering mutual funds and ETFs collectively, taxable bond funds accounted for almost 90% of net U.S. fund inflows in the first half.

Following almost ten years of low bond yields, and only two years after experiencing the most unfavorable year for bonds in history, the current situation of elevated interest rates and decreasing inflation presents investors with a unique chance to generate investment income. Rick Rieder, the chief investment officer for fixed income at BlackRock, managing over $2 trillion, describes the present time as “the golden age of fixed income.”

Investors’ predictions for short-term interest rates have a vital role in influencing bond prices. Upon the initiation of rate cuts by the Federal Reserve in 2022, investors gravitated towards products with characteristics similar to cash. Currently, with Wall Street expressing confidence that interest rate reductions in the near future are quite likely, investors are shifting their focus to bonds. They are seeking higher yields, which are already beginning to decline as bond prices increase.

“We are observing a shift of individuals transitioning from holding cash to investing in bonds,” stated Rieder. “Cash has been generating significant returns, but there is now a belief that the Federal Reserve will begin reducing interest rates, eliminating this opportunity.”

Bond funds have provided a positive aspect for the money-management sector, which has faced challenges in dealing with the rise of passive investment and a significant decline in management costs. Although investors have mostly started to avoid actively managed stock funds, bond pickers are flourishing.

Out of the approximately 1,700 bond funds that were actively managed and monitored by Morningstar, 74% of them outperformed their benchmark indexes in the previous year. Bond exchange-traded funds (ETFs) that are now active have already reached a record level of yearly inflow, and this has been achieved with five months remaining in the year. Money managers are endeavoring to profit by introducing a variety of new active fund options. According to Morningstar, the average fees for ETFs, which have been decreasing over time, actually increased in 2023. This was due to the launch of more active funds with higher fees.

Investors of various sizes are purchasing a range of fund categories, some of which carry higher levels of risk compared to others. Wall Street traders have increasingly favored using index-tracking Treasury ETFs as a tool for making interest-rate wagers. In June, investors allocated $6 billion to long-term Treasury ETFs, which accounted for 7% of their total assets at the beginning of the month. This investment was driven by the expectation that bond prices would rise due to anticipated interest rate reduction.

Furthermore, actively managed funds that invest in low-rated corporate debt with good returns have also attracted significant capital. Janus Henderson’s AAA CLO ETF, which is the most widely favored active fixed-income ETF of the year, focuses on investing in collateralized loan obligations. These obligations are financial securities that consist of packages of low-rated corporate loans.

Additionally, numerous investors are purchasing straightforward investment funds that prioritize overall returns from the most highly-rated debt. They appreciate the fact that even the most secure returns now have a significant impact.

Todd McConachie, a 62-year-old retired corporate-risk analyst residing in Portland, Oregon, has strategically reallocated a significant amount of his retirement portfolio, which was previously heavily invested in stocks, into bond funds over the course of the past eighteen months.

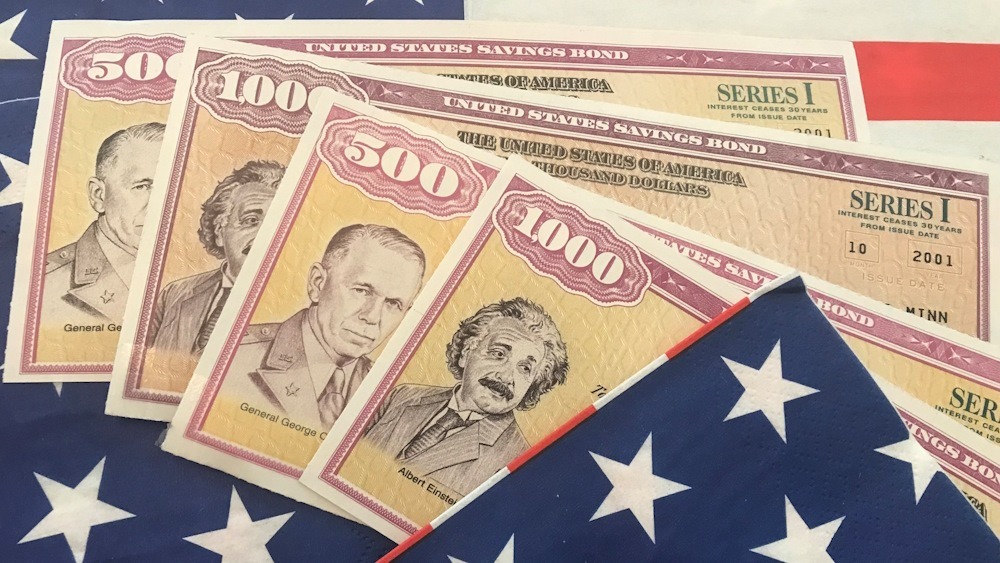

The individual currently possesses investment funds that acquire corporate bonds with strong credit ratings, as well as riskier junk bonds that offer greater yields. Additionally, they have directly purchased U.S. Treasuries using the government’s TreasuryDirect portal.

“During a period of low interest rates, I invested in total-bond-market index funds without closely monitoring them. I was content with receiving coupon payments and earning a 3% return,” stated McConachie. “Currently, I am amazed to discover that certain funds offer a 7.5% return on investment, which means I can potentially increase my cash flow by receiving interest payments that are twice the amount I initially invested.”

The current level of enthusiasm is a significant change compared to 2022. Bond funds were severely impacted by increasing interest rates, resulting in a significant decline of 13% in the Bloomberg U.S. Aggregate bond index, which is a record drop. Stocks also experienced a decline, causing disappointment for investors who had anticipated that bonds would provide some protection for their investment portfolio during periods of market volatility. The traditional portfolio allocation of 60% stocks and 40% bonds experienced its most challenging year since the Great Depression.

According to Wall Street, the current situation is considered resolved, and analysts suggest that it is now a good opportunity to reinvest before benchmark interest rates decrease again, resulting in lower bond payouts. Derivatives traders are currently factoring in a nearly certain probability of almost 100% that the Federal Reserve would reduce interest rates in September. Additionally, the benchmark 10-year Treasury yield has declined by over 0.75% since reaching its highest point of approximately 5% in October.

“The level of interest this year has been extensive across various areas,” stated Matthew Bartolini, the head of Americas research for State Street’s ETF division. “The volume of flows has been substantial and has encompassed a wide range of products.” The individuals participating in this activity are originating from various institutions, wealth managers, and retail traders.

One straightforward reason for the significant increase in bond-fund numbers this year is the strong bull market, which has resulted in substantial profits in individuals’ stock portfolios. As a result, investors have chosen to allocate some of their funds into bonds in order to mitigate their risks.

“Due to the prolonged outperformance of the stock market over bonds, individuals are now compelled to purchase additional bond funds in order to rebalance their portfolios,” stated Ryan Jackson, a senior manager research analyst at Morningstar.