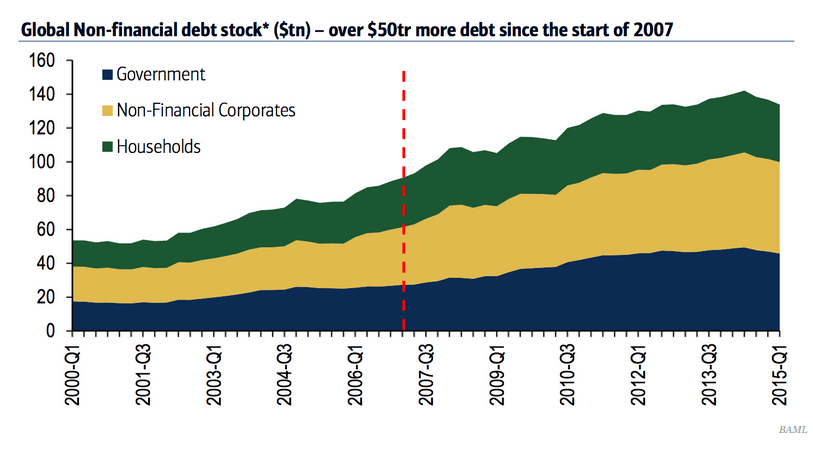

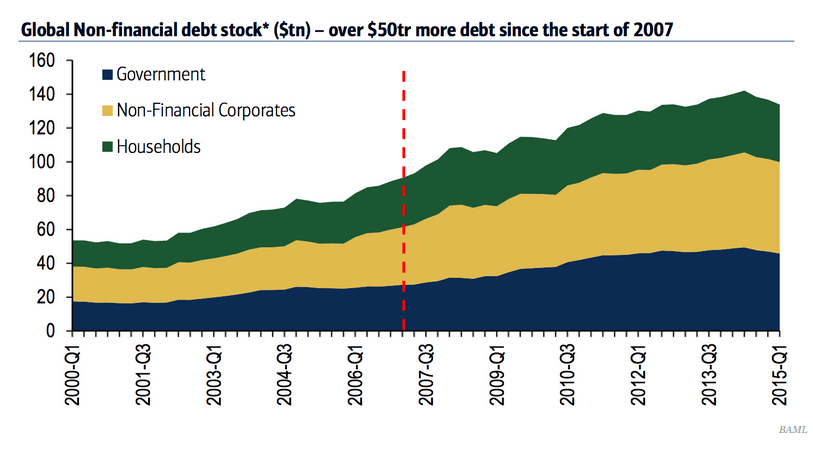

The World Is $50 Trillion MORE in Debt Since 2008 Financial Crisis

Check out this graph above from the Bank of America Merrill Lynch.

Global debt has apparently increased by $ 50 trillion since the beginning of 2007 going into the financial crisis of 2008.

That’s an increase of 50 percent.

Goldman Sachs recently announced we are in the “third wave” of the financial crisis. But how many “waves” are there exactly? An endless ocean?

This entire thing seems made up. The game has been played with Monopoly money for a really long time now. We keep hearing about the coming economic collapse. We’ve been hearing about it for a while.

Recently, Consumer Affairs asked Joel Naroff, of Naroff Economic Advisors, where he stood on the “coming economic collapse”.

Naroff, apparently quite the optimist, says there is no coming collapse, or at least, “the probability is very low” through 2016. He says domestic economic sluggishness is based around collapsing energy costs, but he also says its helping to drive more consumer spending.

Naroff doesn’t go into specifics there, but we all know why gas has been so cheap lately — it’s been a weapon of foreign policy in the renewed Cold War. With what’s happening with Russia in Syria right now, there’s no reason to optimistically rest our laurels on cheap energy prices as a given in the long-term.

Nevertheless, these huge amounts of debt looming over everyone’s shoulders cannot just be ignored indefinitely. There will be consequences brought upon those who can’t pay.

Cheery outlook or not, that graph is very telling. This kind of financial insanity cannot continue exponentially forever.