Guess Who Owns $1.1 Billion In Apple Stock

The Swiss National Bank had a rough quarter in Q1 as the decision to abandon the increasingly unsustainable EURCHF floor (an event which marked an implicit admission that central banks are not all-powerful after all) blew a $ 32 billion hole in the central bank’s euro reserves. That, however, wasn’t the most remarkable takeaway from the SNB’s quarterly report.

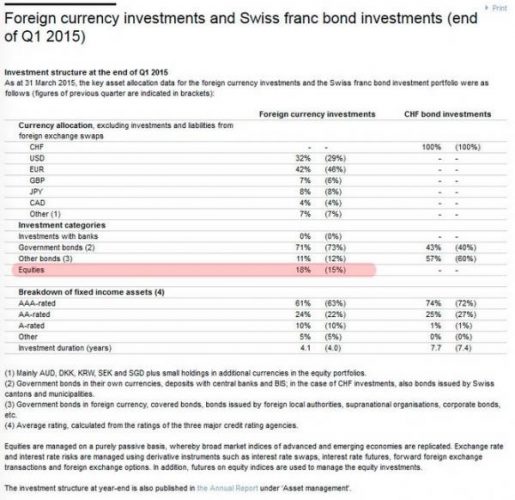

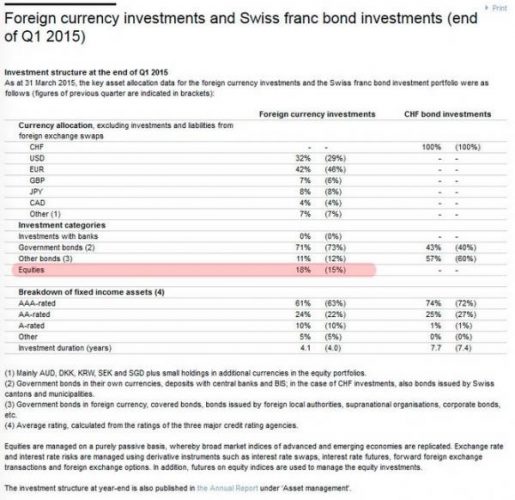

More interesting than the massive loss was the line item in the SNB’s balance sheet which shows that 18% of the bank’s assets are held in foreign stocks.

As we noted last week, that amounts to around $ 100 billion — 15% of Switzerland’s GDP — in equities. This prompted us to praise the bank for its sheer brazenness in owning up to its equity holdings in a world where all plunge-protection-providing central banks are buying stocks but in which no one dares to admit it.

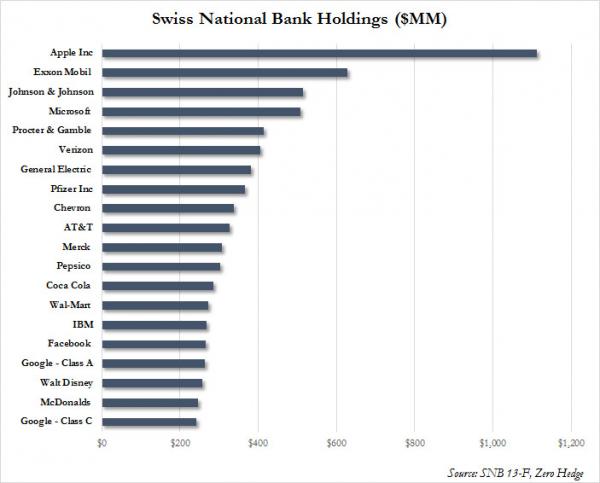

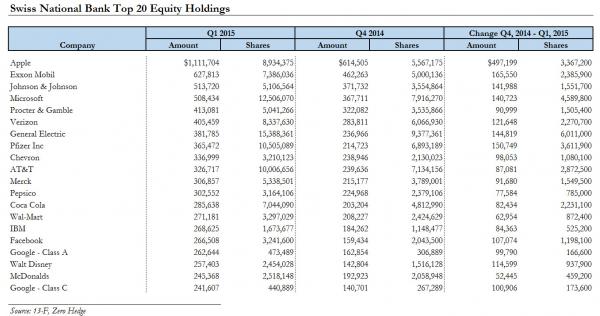

Just what does the SNB hold in its $ 100 billion stock portfolio? Quite a lot, and more than one-third of its holdings are in US equities. More specifically, the bank owns some $ 37 billion worth of shares in 2,548 US-listed companies, up an impressive 40% Q/Q. Here are the top 20 holdings:

And here’s a look at the Q/Q change (basically, they added to everything):

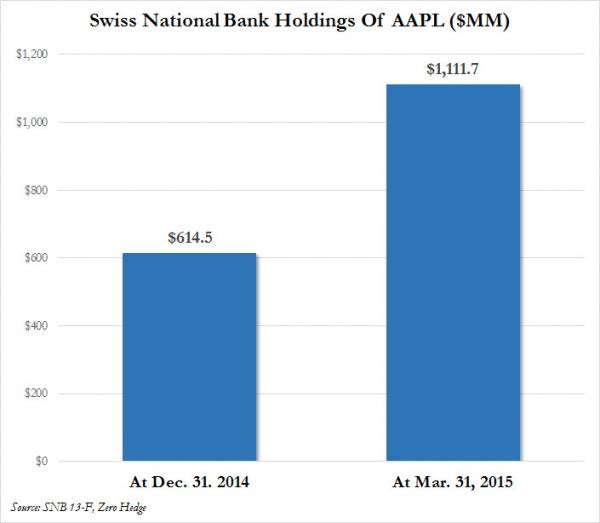

As you can see from the above, Apple is far and away the largest US position and indeed, the SNB bought some 3.4 million shares of the iPhone maker during the first three months of the year alone, while the value of the bank’s stake nearly doubled.

We would be remiss if we failed to point out the hilarious irony inherent in the fact that the SNB, whose abandonment of the EURCHF floor has hit Swiss watchmakers by reducing export comeptitiveness, spent the last three months accumulating a massive stake in the maker of the Apple Watch, a product that many traditional Swiss manufacturers have derided as a fad that’s unlikely to withstand the test of err.. time.

As for the SNB being one of the biggest buyers of AAPL, here is how one can explain it:

SNB buys AAPL stock and lowers interest rates to force yield-starved bond investors to give money to Apple, which uses the debt proceeds to buyback AAPL stock, which boosts the value of SNB’s AAPL stock.

Q.E… er… D.