.facebook{ font-size: 13px; border-radius: 2px; margin-right: 4px; background: #2d5f9a; position: relative; display: inline-block; cursor: pointer; height: 41px; width: 134px; color: #FFF; line-height:41px; background: url(http://www.thetradingreport.com/wp-content/plugins/big-social-share-buttons/facebook.png) no-repeat 10px 12px #2D5F9A; padding-left: 35px; } .bssb-buttons > .twitter{ font-size: 13px; border-radius: 2px; margin-right: 7px; background: #00c3f3; position: relative; display: inline-block; cursor: pointer; height: 41px; width: 116px; color: #FFF; line-height:41px; background: url(http://www.thetradingreport.com/wp-content/plugins/big-social-share-buttons/twitter.png) no-repeat 10px 14px #00c3f3; padding-left:37px; } .bssb-buttons > .google { font-size: 13px; border-radius: 2px; margin-right: 7px; background: #eb4026; position: relative; display: inline-block; cursor: pointer; height: 41px; width: 116px; color: #FFF; line-height:41px; background: url(http://www.thetradingreport.com/wp-content/plugins/big-social-share-buttons/google.png) no-repeat 10px 11px #eb4026; padding-left:37px; } ]]>

By definition, “pain trades” are those which could (and usually will) inflict the most pain on the largest number of speculators. They also tend to happen increasingly more often in a time when momentum ignition algos seek to punish the weakest hands who simply immitate the large money managers.

Add an illiquid, whipsawing market, and soon in addition to a short squeeze ETF there will be a “PAIN” ETF – one which takes positions counter to whatever is the prevailing conventional wisdom.

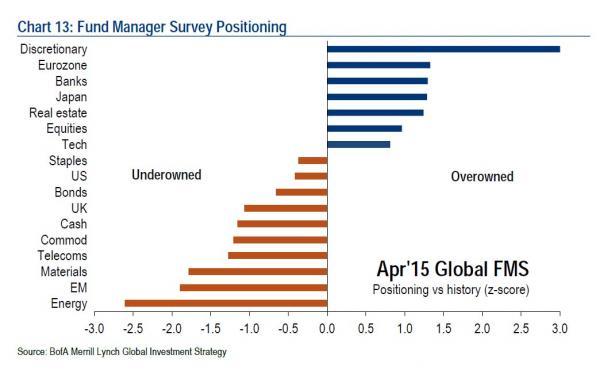

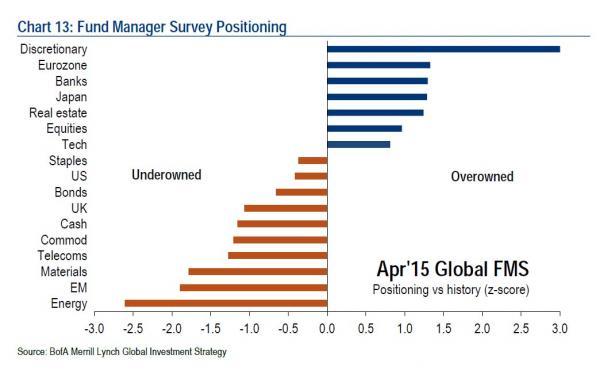

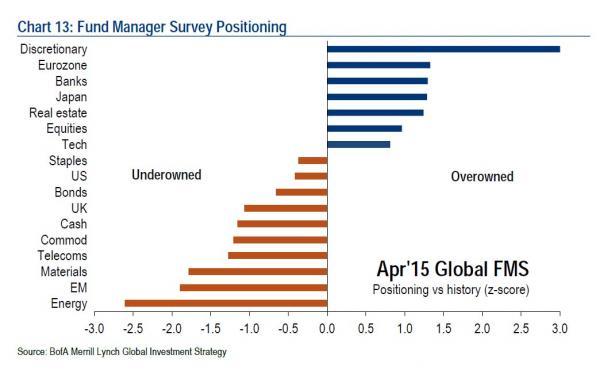

So what are the prevailing pain trades at this moment? According to BofA’s latest fund manager survey, investors are positioned for i) more asset reflation, ii) stronger US$ and iii) rising rates. “So weak US growth, a rise in EU rates & stronger Chinese production would be painful in coming weeks.”